Year-to-date, technology has led the charge in the market's recovery. Without the remarkable performance of a handful of industry, global leading names, the market would be near flat on the year.

The map below of the S&P 500 index categorizes performance by sectors and industries, with size representing the market capitalization of each company. Seven companies stand out for their performance and market capitalization in the above map, measuring performance YTD.

Interestingly, all seven companies are technology focused and at the forefront of innovative themes such as augmented reality, AI, cloud computing, electric vehicles, and more.

As a result, all seven companies are priority holdings of the Invesco QQQ NASDAQ: QQQ ETF.

YTD, the SPDR S&P 500 ETF Trust NYSE: SPY is up 14.3%, while the QQQ ETF is up 37.4%. With a remarkable outperformance stemming from a deep concentration on seven companies, is QQQ overbought and close to a pullback?

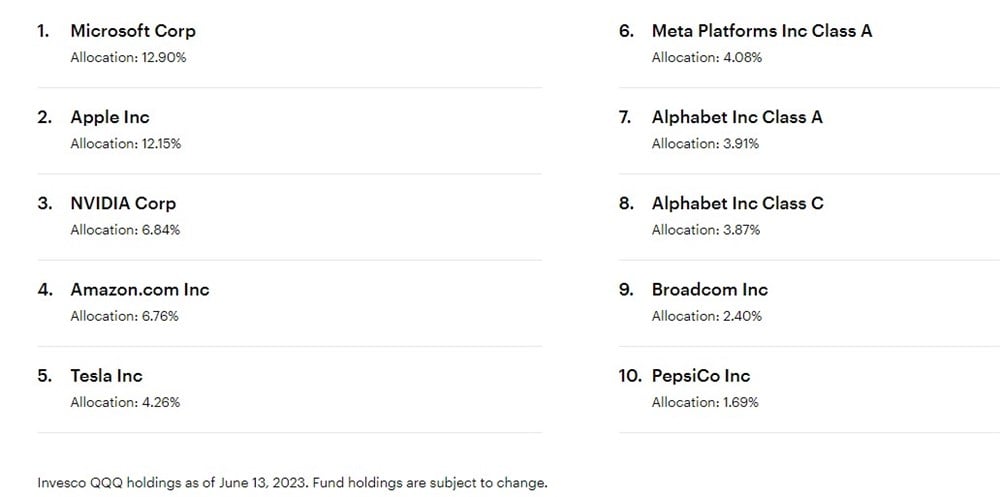

Seven Names Make Up Over 50% of QQQ Holdings

While the SPY ETF is diverse and includes companies across all sectors and industries, QQQ's is more focused, with 58% of the tech funds allocated to technology and 19% consumer discretionary. As a result, seven stocks dominate the fund's weighting and are all directly responsible for the QQQ's outperformance this year. However, if several of these individual stocks are overbought, in the short term, it might result in a sharp pullback due to a lack of diversification.

QQQ has a relative strength index (RSI) of 76.81, putting the ETF in overbought territory. Typically, an RSI above 70 indicates that a stock is becoming overbought.

From 1. To 8. In the image above, those seven companies contribute over 50% of the ETF's holding and exposure.

Microsoft NASDAQ: MSFT accounts for 12.90% allocation in the ETF. YTD, the stock is up 40% and closing in on its ATH of $349.67. The stock has an RSI of 66.58, approaching an overbought level.

Apple NASDAQ: AAPL, weighing 12.15% in the ETF, is up 41% YTD. AAPL has an RSI of 71, making the stock overbought and overvalued in the short term.

In third place, with an allocation of 6.84%, is Nvidia NASDAQ: NVDA. After trending higher all year, the stock soared on blowout Q1 earnings and guidance and is now up 194% YTD, with a market cap greater than $1 trillion. However, NVDA is in overbought territory with an RSI of 76.34.

Similar to Microsoft, Amazon (NASDAQ: AMZN) has an RSI of 66.04. The stock is nearing overbought territory but not quite there yet. YTD, the stock is up 50%.

Tesla NASDAQ: TSLA is in highly overbought territory with an RSI of 86.04. YTD, the stock is up over 100% and over 50% this month. With a significant weighting of 4.26% in the ETF, QQQ investors will want to watch the performance of TSLA closely, as a pullback will undoubtedly impact the ETFs performance.

Meta Platforms NASDAQ: META is up 127% YTD and significantly extended from its key moving averages, specifically the 200d SMA. META has an RSI of 74.28, indicating that the stock is overbought and overvalued in the short term and susceptible to a pullback.

Alphabet NASDAQ: GOOGL weighs 7.78% when combing class A and B holdings in the ETF. GOOGL is up 40% YTD. However, the stock has an RSI of 60.20, indicating it is not overbought or overvalued in the short term.

Should You Invest In QQQ?

As 4 out of the standout 7 top holdings of the ETF are currently overbought and overvalued, according to their RSI, now is the time for investors to be cautious and think about a retracement in the ETF.

The ETF has a highly overbought reading on its RSI and now finds itself vulnerable to its top-weighted names that are too in overbought territory. As such, investors should consider taking profits or some risk off the table and looking for a pullback to re-enter.

Before you consider SPDR S&P 500 ETF Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPDR S&P 500 ETF Trust wasn't on the list.

While SPDR S&P 500 ETF Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.