For the more active traders, technical analysis can be one of the quickest and easiest ways to spot near term opportunities. The multitude of indicators available means there are almost always some attractive setups worth looking at.

Here are four stocks that are on the verge of breaking out through resistance, having tested the lower end of their range recently, with a little bit of forward momentum from good earnings thrown in for good measure.

Marsh & McLennan Companies NYSE: MMC

Shares of global professional services firm, Marsh & McLennan Companies, are trading at all-time highs after an impressive 2019 performance. After a fairly flat 2018, shares got firmly back on track in January and have notched an impressive 30% gain so far this year.

Having flirted with the $103 level three times in July and once in September, the stock finally broke through at the end of last month on the back of Q3 earnings and looks to be setting up for its next leg higher.

Investors seeing it for the first time shouldn’t be too worried about meeting it when it’s overstretched. Since July there have been a number of shakeouts of more than 7% with the $95 level holding each time. This is now the first line of defense for anyone getting involved.

The stock’s RSI is at a bullish 63, MACD had a bullish crossover on October 17th and is firmly above the baseline as MMC looks to maintain its stunning momentum into blue skies territory.

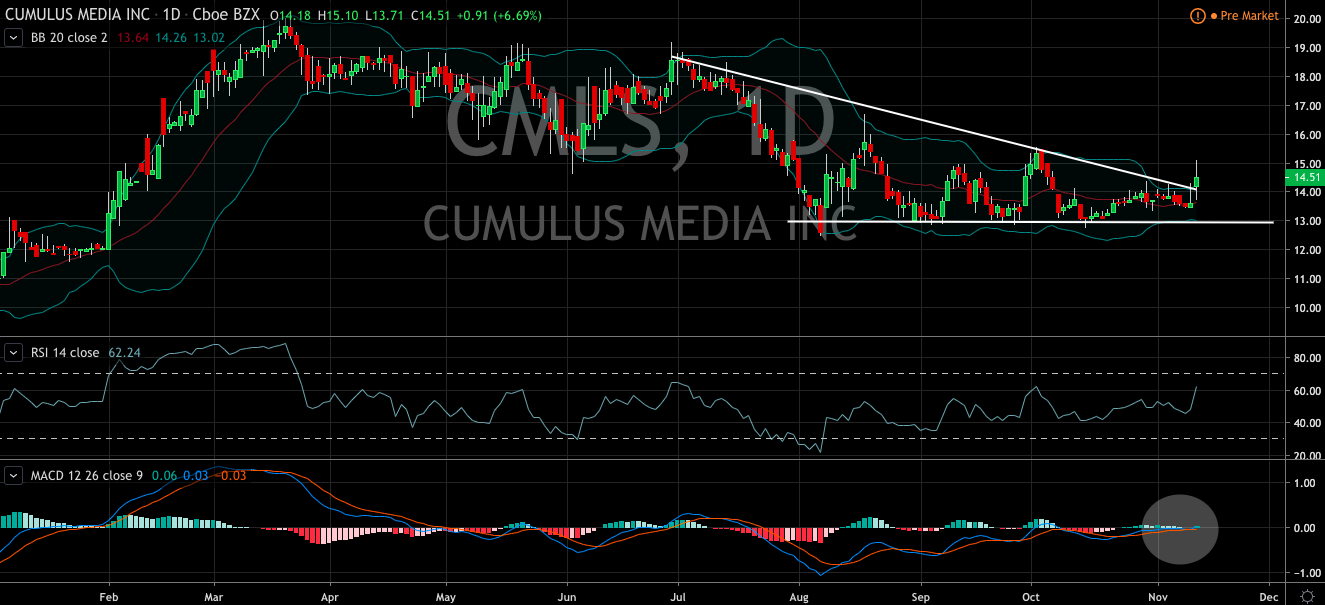

Cumulus Media NASDAQ: CMLS

After an end of summer selloff that sent shares tumbling almost 40% from June’s highs, shares of Cumulus Media have ranged between $13 and $16 since August.

There’s an attractive looking pennant in the making on the chart and as the Bollinger Bands have tightened, the potential for a near term breakout has increased. Given the stock has put in higher highs since October 16th, the odds are on a move to the upside.

On Monday the company announced a beat on their Q3 earnings which will provide a boost to momentum and MACD is just turning positive. While shares are still down considerably from summer highs, the current setup offers them the best chance they’ve had to head back up there.

Badger Meter NYSE: BMI

After jumping 10% on the back of positive earnings in October, shares of Badger Meter look set to test all-time highs up around $61.

The stock is up 25% in 2019 and 100% over the past 3 years; forward momentum is clearly on its side.

That said, if it doesn’t crack resistance in the next couple of sessions, there is a strong potential for shares to form a triple top and to turn back down. MACD is also on the very of a bearish crossover. In the grand scheme of things though, this could be a blessing in disguise for any investors on the sidelines.

Since 2012, any selloff has run out of steam at the Bollinger Band’s moving average on the monthly chart. Were shares to turn back from resistance in the near term, this would be a solid entry point to aim for and is currently around the $53 mark.

Great Southern Bancorporation NASDAQ: GSBC

Shares of Great Southern Bancorporation are up nearly 8% since stellar earnings last month. This puts them within pennies of their all-time high set back in July 2018 and with some volume and momentum they could easily push on through.

Between the previous earnings report in July and now shares came off about 10% twice but found support both times at $55. The latest run-up has seen the stock set higher and higher lows, suggesting it has enough of the right kind of momentum to break through to fresh levels. However it needs to do so in the next few sessions, otherwise, momentum will swing and there’ll likely be some profit-taking.

Some caution is advised in this regard as MACD is also starting to look a little tired and is on the verge of a negative crossover. Investors interested in the long thesis would do well to aim for an entry around the $55 mark if shares do indeed turn back.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.