Tesla Today

$357.93 +6.51 (+1.85%) (As of 06:03 PM ET)

- 52-Week Range

- $138.80

▼

$361.93 - P/E Ratio

- 98.06

- Price Target

- $243.75

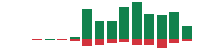

Shares of Tesla Inc NASDAQ: TSLA have been having a phenomenal second half of 2024. The electric vehicle (EV) stock is up an impressive 150% since April, putting it at its highest levels since 2022. Now, with shares less than 20% away from a record high, it’s easy to see why so many investors are feeling bullish, especially when you consider how little it would take for a tech giant like Tesla to close that gap.

The surge has been bolstered by an unexpected catalyst: founder and CEO Elon Musk’s close relationship with President-elect Trump - more on that below. For now, let’s just say there are several reasons investors should be getting excited about the Austin-based company, chief among them the likelihood that the stock will be ever closer to all-time highs by Christmas.

Tesla's Fundamental Performance: A Turnaround in the Making

To start with, let’s examine the company’s fundamental performance. Admittedly, Tesla’s financials have been mixed this year. The company missed analyst expectations across nearly every earnings report in 2024, contributing to the stock’s struggles early on. Falling demand and rising costs compounded the issue, leading to year-over-year revenue contractions and putting pressure on margins.

However, it’s starting to look like those challenges are now in the rearview mirror. The company smashed expectations for EPS with its latest earnings report in October while delivering a record revenue print. The turnaround potential is attractive heading into 2025, especially with a new administration likely to create favorable conditions for domestic manufacturing and renewable energy industries.

Bullish Analyst Updates Signal Strong Confidence in Tesla’s Growth

Tesla MarketRank™ Stock Analysis

- Overall MarketRank™

- 93rd Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 31.9% Downside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -0.51

- News Sentiment

- 0.47

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 39.20%

See Full AnalysisWith this in mind, several analysts are bullish on Tesla’s chances of maintaining its upward trajectory. In a note to clients, the team at Roth Mkm named Tesla a Strong Buy this week, citing “abundant positive catalysts.” Stifel Nicolaus and Royal Bank of Canada, which also recently issued bullish ratings and price targets, share their optimism.

Roth Mkm’s update highlighted Tesla’s growing appeal to historically EV-skeptical conservatives, thanks in large part to Elon Musk’s alignment with Trump’s pro-business agenda. This shift has opened up new demand channels for Tesla, bolstering its credibility and long-term growth potential.

The fresh price target is particularly compelling from where the stock closed on Tuesday. Stifel Nicolaus’s $411 implies nearly 20% upside from current levels, which would position Tesla squarely at its 2022 record highs. With excitement only likely to increase as we head towards Trump’s inauguration in January, there’s every reason to think this level is very much in play.

Risk-On Sentiment and S&P 500 Highs Provide Market Tailwinds for Tesla

Even with all the positive momentum, some analysts are sounding a note of caution. UBS Group reiterated its Sell rating last month, while Jefferies maintained its Hold stance at around the same time. These analysts point to Tesla’s meteoric rise over the past six months and note the absence of consistent, above-expectations earnings as a reason to be careful.

That said, Tesla has a history of its stock running ahead of fundamentals, and the broader market environment is undeniably supportive. The S&P 500 is hitting fresh all-time highs, and the Fed’s rate cuts are fostering a risk-on sentiment.

Getting Involved: Tesla Poised for a Strong Finish

Heading into the final few weeks of the year, there’s much more to like about Tesla than to dislike. Their fundamental performance has shown signs of trending back up, their CEO has a very warm relationship with the incoming president, and the broader macro setup is supportive of a growth stock like Tesla.

The fact that shares are steadily setting higher highs speaks volumes, while the high proportion of analysts calling the stock a screaming buy cannot be ignored. Investors should look for Tesla shares to continue gaining into the holidays, with a close above $365 confirming they’re ready to move to $411 and blue sky territory.

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.