Tesla NASDAQ: TSLA stock has been on a roller coaster ride recently, experiencing a notable decline of nearly 30% in one-year performance. While various factors contribute to this volatility, one key element driving uncertainty is the ongoing legal battle surrounding CEO Elon Musk's $56 billion pay package. Understanding this complex situation is crucial for investors seeking to capitalize on the complexities of Tesla's current trajectory.

Tesla's Stock Metrics

Tesla Today

$251.96 -0.44 (-0.18%) As of 04/11/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $138.80

▼

$488.54 - P/E Ratio

- 123.51

- Price Target

- $298.59

Tesla's current price-to-earnings (P/E) ratio is approximately 47.21, indicating that the stock trades at 47 times its current earnings. Tesla's P/E ratio is approximately three to four times higher than that of its automotive sector peers. This premium reflects investors' optimism in Tesla's potential for growth and technological advancements in the electric vehicle (EV) market. However, it is essential to note that this high valuation also signifies a higher risk for investors, as it reflects a significant degree of faith in Tesla's future performance. If the company fails to meet these high expectations, Tesla’s stock price could experience a considerable decline.

Tesla MarketRank™ Stock Analysis

- Overall MarketRank™

- 89th Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 18.5% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -0.51

- News Sentiment

- 0.20

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 32.42%

See Full AnalysisAdditionally, Tesla's price-to-sales (P/S) ratio stands at 6.07, meaning its market cap is six times its annual revenue. This high P/S ratio further suggests that Tesla's market valuation is elevated compared to its current revenue generation. However, it's crucial to consider that Tesla is still a relatively young company, and its sales growth potential is significant.

Tesla's debt-to-equity ratio is 0.04, indicating a relatively low level of debt compared to equity. This suggests that Tesla is financially healthy and has a lower risk of financial distress, which could support its growth initiatives. Nevertheless, investors should remain vigilant about Tesla's financial performance and ability to manage its debt levels while navigating the competitive EV landscape.

Tesla Shareholders Reaffirm Support for Musk's Pay Package

In 2018, Tesla shareholders approved a performance-based compensation package for Elon Musk that could reach $56 billion. However, the path to this massive payout faced a significant obstacle in January 2024 when a Delaware judge overturned the initial agreement. This decision stemmed from concerns about the Tesla board's independence and the lack of transparent disclosure of potential conflicts of interest related to Musk's influence. The judge argued that the board's close ties to Musk might have clouded their judgment when approving the compensation package.

Despite the legal setback, Tesla shareholders recently reaffirmed their support for the pay package in a June 2024 vote. Over 70% of shareholders, excluding Musk and his brother Kimbal, voted in favor of the package, suggesting confidence in Musk's leadership and Tesla's prospects. However, this shareholder vote does not automatically resolve the legal challenge.

Possible Scenarios in the Legal Battle Over Musk's Pay Package

The legal battle surrounding Musk's pay package remains ongoing, creating uncertainty for investors. Tesla argues that the recent shareholder vote validates the compensation agreement and seeks the judge to overturn the previous ruling. Opponents of the pay package contend that it is excessive and detrimental to shareholder interests, asserting that the board's decision was not truly independent.

Several scenarios could unfold in this legal battle. One possibility is that the court could order a third shareholder vote, allowing further scrutiny of the pay package and its potential implications. Alternatively, the judge could decide to reinstate the original 2018 agreement, potentially leading to Musk receiving his $56 billion payout. However, the judge could also uphold the previous ruling, effectively blocking Musk from receiving this significant compensation.

Ultimately, the outcome of the legal battle will depend on the court's interpretation of shareholder voting rights, its assessment of board independence, and its evaluation of the potential consequences of the pay package for Tesla and its shareholders.

Impact on Tesla Stock and the Company's Future

The pay package battle has undoubtedly contributed to Tesla's recent stock decline, creating uncertainty and volatility for investors. However, other factors also play a role in Tesla's stock performance. Tesla's recent financial performance has been impacted by a slowdown in sales, particularly in the highly competitive Chinese market, raising concerns about the company's growth trajectory.

Additionally, Musk's involvement in X / Twitter, SpaceX, StarLink, and other ventures outside of Tesla has distracted investors, raising questions about his commitment to Tesla's long-term strategy. This has led some investors to doubt Tesla's ability to maintain its rapid growth and navigate the competitive EV landscape.

The legal battle surrounding the pay package could further influence Musk's dedication to Tesla's future. If the legal challenge prevents Musk from receiving compensation, it could impact his commitment to the company. However, the possibility of a large payout might also incentivize Musk to focus on Tesla's growth and success.

Ultimately, the outcome of the pay package battle could significantly impact Tesla's business strategy and growth prospects. If the court rules against Musk and blocks the compensation package, it could lead to a shift in Tesla's management or a change in the company's direction. However, a positive resolution could provide Musk with financial security to focus on Tesla's long-term goals and position in the EV market.

Staying Informed: Essential Considerations for Tesla Investors

The Tesla stock situation presents significant challenges for investors seeking to navigate its complexities. Understanding the legal battle surrounding Musk's pay package and its potential impact on Tesla's financial performance, growth prospects, and future direction is crucial for informed decision-making. Investors should carefully evaluate Tesla's stock metrics, recent performance, and ongoing legal developments before making investment decisions. Staying informed about these critical elements by monitoring Tesla’s headlines will empower investors to make informed decisions about their investment strategy and position in Tesla.

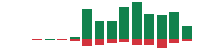

Tesla, Inc. (TSLA) Price Chart for Saturday, April, 12, 2025

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report