Tesla Today

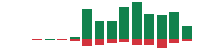

$251.96 -0.44 (-0.18%) As of 04/11/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $138.80

▼

$488.54 - P/E Ratio

- 123.51

- Price Target

- $298.59

Tesla NASDAQ: TSLA is closing in on the pivotal $400 mark, capping off a year of dramatic highs and lows. Earlier in 2024, Tesla shares were among the worst-performing S&P 500 stocks, down nearly 40% at their lowest point. However, the electric vehicle giant has experienced a remarkable reversal, now ranking as the 45th best-performing stock in the index on the year. Year-to-date, Tesla shares have climbed 57%, fueled by a 72% gain this quarter and a staggering 180% surge from their 52-week low. This comeback highlights Tesla’s ability to navigate challenges and regain investor confidence.

Early Struggles Set the Stage for a Comeback

Tesla faced significant obstacles earlier in the year. CEO Elon Musk announced a 10% global workforce reduction, aiming to enhance efficiency and control costs. This move, coupled with Tesla’s first annual delivery decline since 2020, highlighted the operational pressures on the company. Q1 deliveries were down 8.5% year-over-year, and production fell 12.5% sequentially. Additionally, the company dealt with the controversy surrounding Musk’s $56 billion pay package, which faced shareholder scrutiny and regulatory challenges.

Despite these setbacks, the tech giant found support at key technical levels. After reclaiming its 200-day SMA and the $200 support level, the stage was set for a turnaround. Anticipation grew as the market awaited Tesla’s Q3 earnings report, which ultimately catalyzed the stock’s resurgence.

Q3 Earnings Drive Optimism and Momentum

Tesla’s Q3 2024 earnings report delivered mixed results but underscored resilience and efficiency. Revenue fell slightly below expectations at $25.18 billion, up 8% year-over-year. However, earnings per share (EPS) of $0.72 beat analyst forecasts, showcasing operational strength. Key highlights included record-low costs per vehicle of $35,100 and a robust operating margin of 10.8%, reflecting the company’s ongoing cost-control efforts.

Tesla, Inc. (TSLA) Price Chart for Saturday, April, 12, 2025

Operational achievements further bolstered investor confidence. Tesla delivered 462,890 vehicles in Q3, a 6.4% year-over-year increase, while ramping up production of the highly anticipated Cybertruck. The company also celebrated the production of its seven millionth vehicle and expanded its Supercharger network by 20%. Notably, Tesla’s energy storage business grew 75% year-over-year, adding another layer to its growth narrative. Tesla also reaffirmed its vision for a sub-$30,000 EV, a move aimed at capturing a broader market segment and challenging competitors like BYD and Volkswagen.

Analyst Upgrades Signal Optimism as Tesla Nears $400

Tesla MarketRank™ Stock Analysis

- Overall MarketRank™

- 89th Percentile

- Analyst Rating

- Hold

- Upside/Downside

- 18.5% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- -0.51

- News Sentiment

- 0.20

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 32.42%

See Full AnalysisAs Tesla approaches its all-time high near $415, analysts have grown increasingly optimistic. Bank of America recently raised its price target to $400, citing Tesla’s robotics and artificial intelligence advancements as key long-term growth drivers. Stifel Nicolaus also boosted its target, setting a street-high estimate of $411 on December 2. These upgrades come on the heels of Tesla’s announcement of the Model Q, an affordable EV aimed at dominating the Chinese market.

The company’s consensus price target has risen nearly 20% over the past three months, from $209 to $248. While this still implies a potential downside, the momentum in revised price targets suggests that analysts may continue adjusting their outlooks as Tesla demonstrates sustained progress.

Looking Ahead

With Tesla shares surging and analyst sentiment improving, the company is poised to finish 2024 on a strong note. The stock’s recovery from one of the S&P 500’s worst performers to a leading name exemplifies its resilience and ability to innovate. As Tesla continues to expand its product lineup, streamline operations, and invest in groundbreaking technologies, the optimism surrounding its future trajectory remains well-founded. Whether Tesla will break through the $400 level and approach its all-time high remains a key focus for investors in the weeks ahead.

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.