Texas Roadhouse NASDAQ: TXRH, like many of its peers in the

restaurant industry, saw a significant slowdown in its business at the onset of the pandemic.

During its Q1 2020 earnings call, Texas Roadhouse announced that comparable sales decreased 29.7% yoy in March and 46.7% yoy in April.

But with huge growth in its To-Go business and dining rooms re-opening (under stringent requirements), Texas Roadhouse looks set to weather the storm. And with a sterling record of long-term growth, TXRH stock could prosper in 2021 and beyond.

First Dip in Comp-Sales in a Decade

In January and February, TXRH saw comps increase by 8% yoy and 4.2% yoy, respectively. The pandemic-caused slowdown in March caused Q1 comps to decrease 8.4%, though.

Prior to Q1 2020, TXRH had recorded 40 consecutive quarters of comparable sales growth.

Furthermore, in the Q4 2019 earnings call, Texas Roadhouse said it was targeting at least 30 company restaurant openings in 2020. That would equate to around 5% growth in restaurants over its more than 600 as of December 31, 2019.

While TXRH has put its new restaurant plans on hold, it still has plans for long-term expansion.

And looking back, revenue has had a double-digit CAGR over the past three years, five years, and ten years.

At around 25x projected 2021 earnings, Texas Roadhouse looks like a good value if it can return to long-term growth. But it will first have to navigate 2020.

A Lot of Uncertainty in 2020

Texas Roadhouse hasn’t had much to say on its Q2 performance ahead of its earnings report next week.

Here’s what we know:

- Even in the dog days of April, Texas Roadhouse was able to keep all but two of its domestic restaurants open.

- According to the US Census Bureau, eating and drinking places recorded seasonally adjusted sales of $47.4 billion in June. This was the second consecutive monthly sales gain, after the lows of $30 billion in April.

- Sales remain down $18 billion from January and February (pre-COVID).

While these numbers aren’t apples to apples, Texas Roadhouse saw comps decrease 46.7% in April yoy and the industry saw sales decrease around 54% from January/February levels to April on a seasonally adjusted basis. That outperformance provides some reason for optimism on May and June.

Additionally, a lot of restaurants have gone out of business or closed many of their locations. All of those are included in the data. Since Texas Roadhouse only closed two locations, there is one more reason to expect outperformance.

Huge Growth in the To-Go Business

Texas Roadhouse’s To-Go business offers several items including family-packs and ready-to-grill steaks.

The company was doing around $8,400 a week in business in January, but that number soared to over $56,000 by the last week of April, growth of nearly 600% in a few months. While even the $56,000 number represents a small percentage of overall sales, the strong growth bodes well for the future.

Enough Cash to Last

Even though the company paused its expansion plans and has cut costs where possible, cash flow is going to be a challenge for Texas Roadhouse this year.

However, even in early May, when business was near its worst, Texas Roadhouse was only seeing a cash burn of around $5 million per week. With approximately $200 million in cash on the balance sheet and an improving business environment, Texas Roadhouse should have no liquidity issues.

Shares Look Ready for a Leg-Up

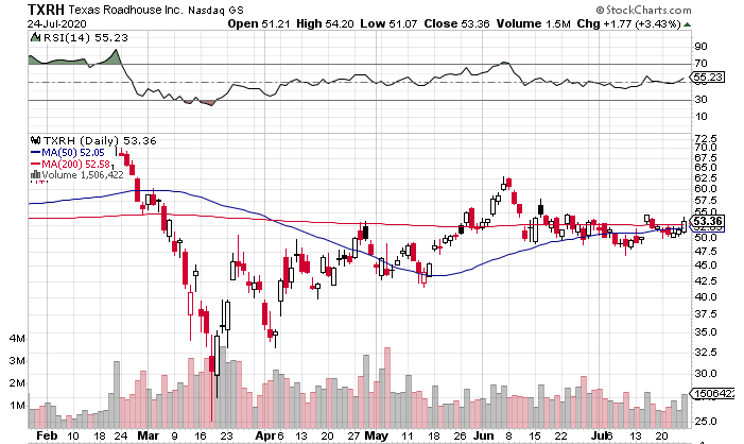

Between mid-February and mid-March, TXRH plummeted from around $71 a share to $25.

After quickly recovering, shares have spent most of the past six weeks in a tight range between $48 and $54. Volume has dried up considerably from March and April levels.

Shares are now sitting right around the 50-day and 200-day moving average.

You can look to get in on a decisive breakout above $55. Here are few reasons why that is a nice entry point:

- The 50-day / 200-day sit just $3 below $55 a share. You would have a clear line in the sand for a stop-order that would be less than 6% below your purchase price.

- If shares breakout, the 50-day would soon cross-over the 200-day, giving you a nice technical tailwind.

- The stock is not extended, and the RSI isn’t close to overbought territory.

The Final Word

Texas Roadhouse sports some of the most consistent comp-sales growth in the restaurant industry. Combine that with expansion plans that will resume when the economy stabilizes, and a reasonable valuation, and you have a potential winner.

2020 will be a tough year, even though the worst of it seems to be behind Texas Roadhouse. But this is the type of investment that can really pay off over a 2-3 year timeline.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here