Skincare company

The Beauty Health Company NASDAQ: SKIN stock has been on a tear recently as it continues to make new all-time highs on the

reopening theme. As consumers inevitably return to the

new normal, live engagement in the workplace or in social settings is a reality. With the

pandemic behind us (at least in the U.S.), the acceleration of

COVID vaccinations pushes this reality closer. Skincare and beauty products stocks have illustrated this with powerful uptrends across the board. The Company mainly offers experiential 30-minute facials and an assortment of

skincare products utilizing its patent Vortex-Fusion delivery system that exfoliates, extracts, and hydrates skin. Beauty Health is a recent IPO formed from the reverse merger between HydraFacial and

special purpose acquisition company (SPAC) Vesper Healthcare Acquisition, on May 5, 2021. Unlike most SPACs, this stock actually recovered and continues to grind higher on the reopening theme. However, it’s also crucial not to chase this one higher especially knowing it’s SPAC business combination. While much of its European partners are still under COVID-19 restrictions or closed, there is much runway for growth once the

reopening accelerates internationally. Prudent investors can patiently wait for opportunistic pullback levels to consider scaling into a position.

Q1 FY 2021 Earnings Release

On May 13, 2021, Beauty Company released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported a net loss of (-$3.3 million) compared to a net loss of (-$9.1 million) in the same year ago period. Adjusted EBITDA was $7 million compared to a loss of (-$2.1 million) in Q1 2020. Revenues for Q1 2021 were $47.5 million, up 46% and 37% year-over-year (YoY) from 2020 and 2019, respectively. Q1 delivery system sales were $25.6 million, compared to $14.1 million in 2020 and $17 million in 2019. Q1 consumable sales were $21.9 million compared to $18.5 million and $17.7 million in Q1 of 2020 and 2019, respectively. Gross margins rose to $66.8% compared to 58.2% gross margins YoY. Beauty Health CEO, Clint Carnell, stated, “We are pleased with out performance this quarter, which underscores the resilience of our business, as well as the changing consumer behavioral shifts in health and wellness. HydraFacial Nation, our community of passionate estheticians, is a compelling branding ecosystem and is an important driver of our continued strength. We achieved strong sales in our delivery systems and consumables globally, despite much of Europe remaining under COVID-19 restrictions and many of our partners are still closed. As a result of our strong performance, we are pleased to provide updated and increased top-line guidance for 2021 of approximately $200 million.”

Conference Call Takeaways

CEO Carnell set the tone, “Our flagship HydraFacial is a highly effective, non-invasive and approachable game-changing treatment. It is an accessible skin treatment that’s utilized in an innovative approach to cleanse, extract, and hydrate skin, offering an immediate outcome and an instantly gratifying glow. In three steps and 30-minutes, we simply deliver you the best skin of your life. We’re a platform business with the objective of building an enduring company of beauty health.” He went on to point out, “Our flagship brand HydraFacial ranked the highest across branded esthetician and medtech peers as score of 80 among estheticians and 40 among consumers.” He went on to detail the partnerships the Company creates with the community of estheticians and high influential providers by also providing clinical training, holistic business education and professional development through its program called HydraFacial CONNECT. The Company aspires to become the “world’s largest university and deployer of estheticians worldwide.” The Company offers its systems through a diversified channel mix including spas and medical offices. In 2022, Beauty Health plans to launch the 2.0 delivery system Syndeo and home device Project Casa in addition to a new serum per month to bolster consumer engagement.

SKIN Opportunistic Pullback Levels

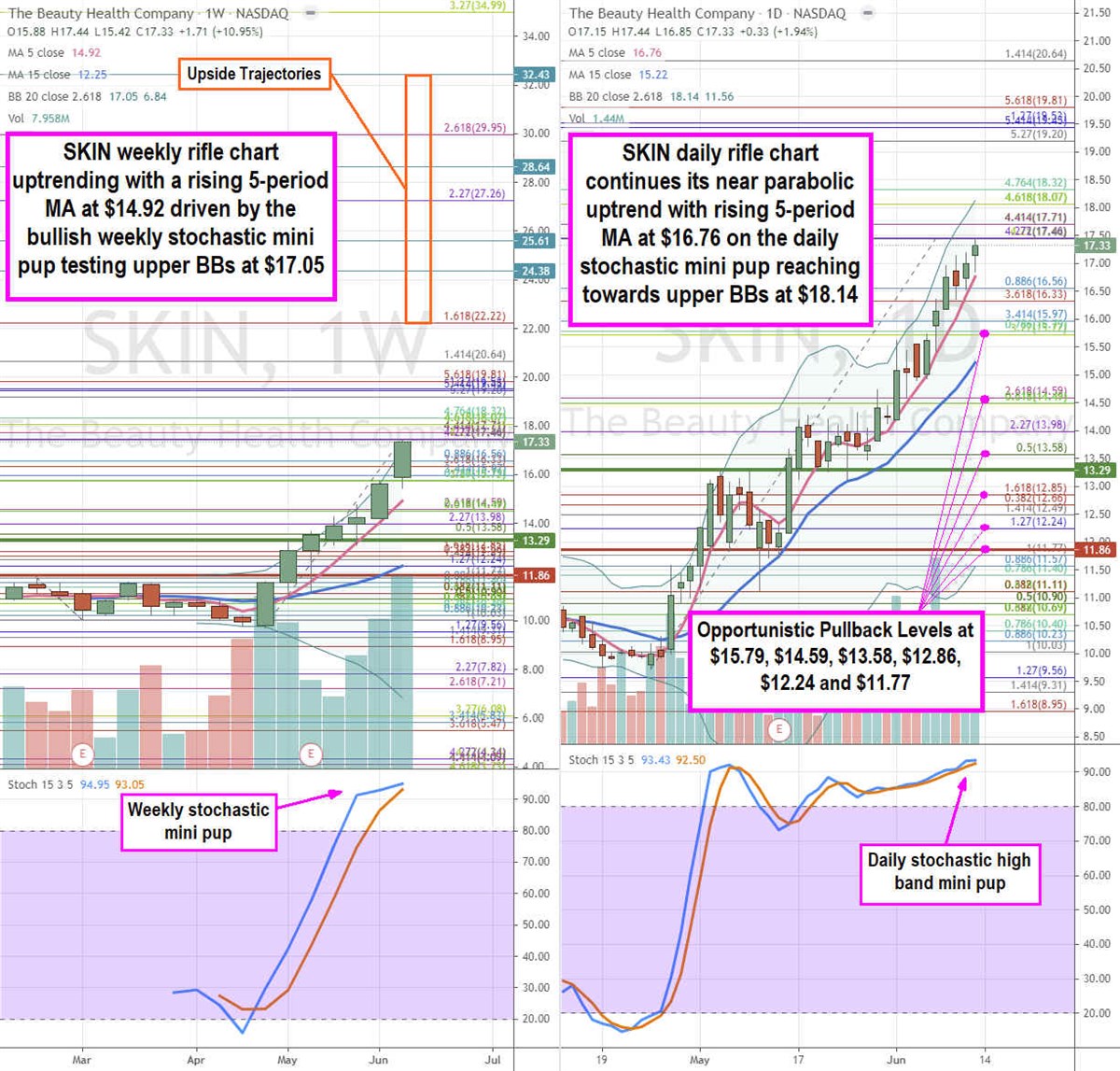

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for SKIN stock. The weekly rifle charts illustrate a powerful uptrend with a rising 5-period moving average (MA) support at $14.92 followed by the weekly 15-period MA support near the $12.24 Fibonacci (fib) level. Since this is a relatively newly publicly listed company, the fibs are sorted in clusters so it’s important to watch the gatekeeper fibs rather than individual bunched up fibs. Shares are already testing (and overshooting) the weekly upper Bollinger Bands (BBs) at $17.05. The weekly market structure low (MSL) buy triggered above $13.39 and hasn’t looked back. The daily rifle chart tested the $17.48 gatekeeper fib. The gatekeeper is the next set of fib clusters. The daily upper BBs sit just below the gatekeeper fib at $18.32 as the 5-period MA rises at $16.76 driven by the daily stochastic high band mini pup. It’s prudent not to chase shares but rather wait patiently for opportunistic pullback levels at the $15.79 gatekeeper fib, $14.59 fib, $13.58 fib, $12.86 fib, $12.24 fib, and the $11.77 fib. Upside trajectories range from the $22.22 fib up towards the $32.43 stinky 2.50s range.

Before you consider Beauty Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beauty Health wasn't on the list.

While Beauty Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.