Utility Was Not Immune To Viral Selling

One of the things that made this correction so scary was that traditional safe-haven assets were not immune. While the S&P 500 (SPY) sank upwards of 30% stocks in the real estate, consumer staples, and utility sectors fell right along with it.

Why did the market sell-off? Because of the impact of the coronavirus on the economy. With cities, counties, states, and nations shut down to slow the spreading illness it is certain earnings will fall for many industries. Why is the sell-off in safe havens like the Utility Sector (XLU) misplaced and overblown? Because the Utility sector will not experience the same economic slowdown as, say, the retailers, hospitality, and energy stocks. Far from it.

Steady Revenue, Stable Earnings, And A Safe Dividend

The reasons why the Utility Sector is a great safe haven play are numerous but boil down to its status as a Real Asset. Real Assets include things like real estate and natural resources but also infrastructure like a Utility.

Stocks in the Utility Sector share a combination of traits that make them solid if boring, long-term investments. Those include high barriers to entry (there is little competition among Utility operators), government-regulated income, income pegged to inflation, and consumer demand that transcends economic conditions (we all need the lights and heat on).

The Utility Sector just came off a stellar year of growth that will make the comps in 2020 a bit difficult. That said, the 11% YOY EPS growth posted in 2019 will be followed by 3.3% YOY growth in 2020 and that will accelerate to over 5% in 2021.

Earnings among Utility companies are paid out in dividends that tend to beat the broad market. The Utility Sector SPDR (XLU) pays a nice 3.5% at today’s prices compared to the S&P 500’s average of 2.25% and the Ten-Year Treasury’s sub-1%.

The difference, aside from yield, is that many dividends within the broad market are in danger of cut or suspension where those within the Utility Sector are safe. The payout ratios run high, in the range of 65% to 85% for the top five holdings in the XLU, but industry, cash flow, and the earnings outlook mitigate the risk.

Utilities Are Raising Cash But Don’t Be Worried

Bloomberg reported last week the U.S. largest utilities have raised over $14 billion in new cash. Those not able to lock-in low rates through the bond market have been drawing on new and existing lines of credit. The moves to draw on credit are intended to shore up cash-balances and reduce short-term debt during this uncertain time and not for operational purposes. If that were different like in the retail or hospital sector (where high-profile names are already having trouble paying the rent) then it would be a reason to worry.

“We expect to continue to see utilities drawing on credit lines,” Shahriar Pourreza, an analyst at Guggenheim Securities LLC, wrote in a note to clients citing AEP’s (AEP) $1 billion credit agreement. “The move is a conservative stance to shore up funds, he said. “We do not see it in any way a sign of overall liquidity risk.”

The Technical Outlook: Shaking Off The Virus, A Bottom Is In

The Utility Sector certainly didn’t offer any safety when stocks were on the way down. The XLU fell just over 38% to outpace the S&P 500 at the low of the movement. Since then, the XLU has rebound more than 35% while the SPX has regained only 20% showing investors do see value in this sector.

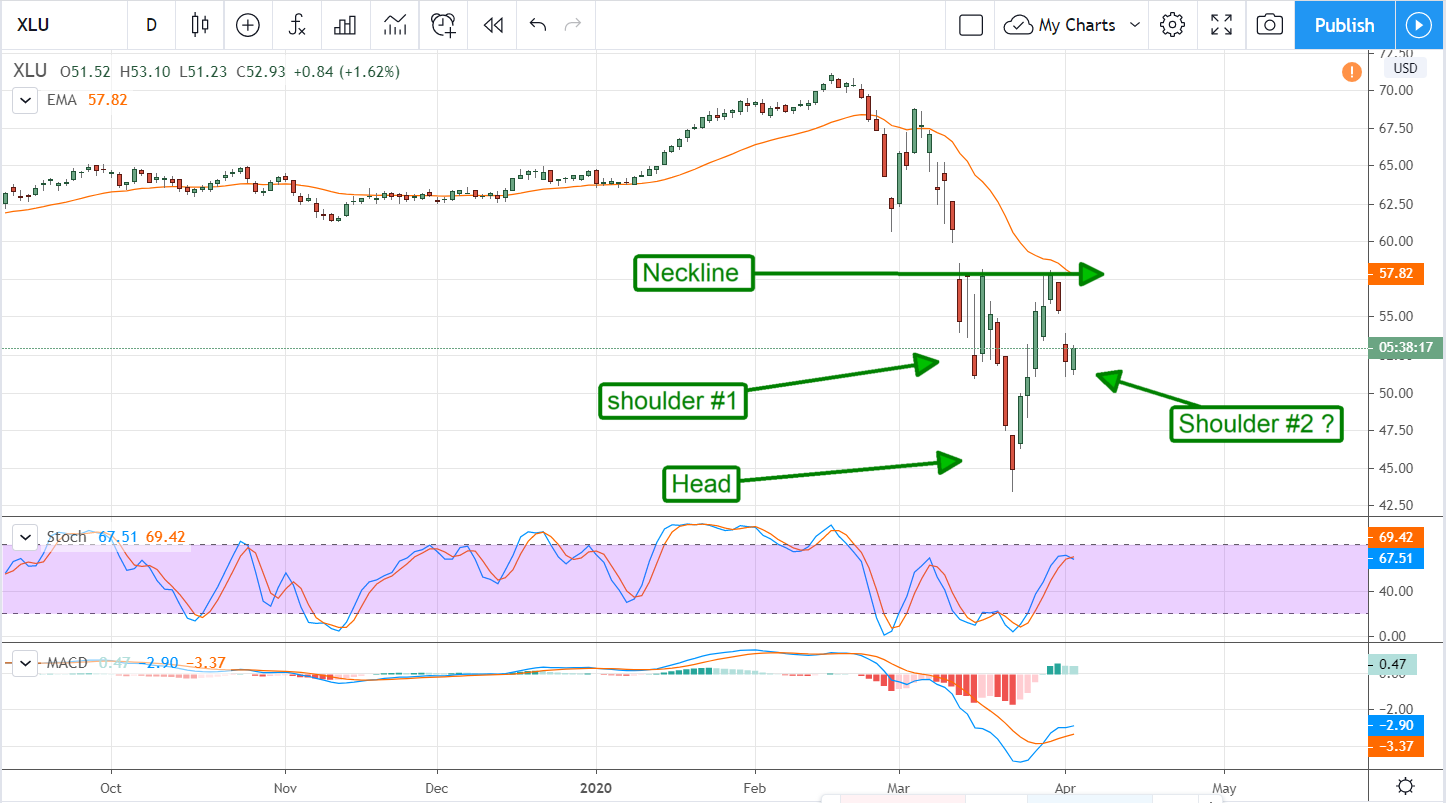

Technically speaking, the price action is also very promising. The price action over the past two weeks, including the lowest low of the sell-off, is forming a Head & Shoulders Reversal. The Head & Shoulders Reversal is a high probability price pattern and one that I have a lot of faith in, providing it confirms itself. This one is still in play but the signs are good a full reversal will be forthcoming.

Investors with more tolerance for risk may want to begin purchasing Utility stocks now but more cautious investors should wait. Price action is confirming support at the bottom of the right shoulder but it’s too early to call the pattern complete. Price action needs to move up to retest and surpass resistance at the neckline of the pattern before an all-clear can be given. The neckline is near the $57.80 region, a move above there would be strongly bullish.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.