Supply Chain No Issue For Walmart

Price action in Walmart NYSE: WMT trended strongly higher in the wake of the pandemic but hit a top last year that resulted in reversal. This reversal, as so many are, altered the trend from up to sideways putting the stock in a firm trading range. Now, more than a year later, the stock is still range-bound with one noteworthy point we would like to make. The stock is range-bound but trading at the bottom of the range with a positive outlook for growth.

Walmart may not break out to new highs but we see upside risk in the outlook for share prices if not the company’s operations. Not only is the company still growing, but it’s planning to buy back shares, pay and grow its dividend and that means profits for investors. Profits for investors usually attracts new money and that’s what we think will ultimately drive Walmart to new highs.

Walmart Beats Consensus Despite Divestitures

Walmart had a good quarter underpinned by strength in the U.S. Divestitures in the International segment resulted in a 22% decline in segment revenue that was offset by the 5.6% U.S. comp and strength in Mexico and China. The company reported $152.87 billion in net revenue to set a company record, grow 0.5% over last year, and beat the Marketbeat.com consensus by 170 basis points. Comps in the U.S. were driven by a 3.1% increase in tickets compounded by a 2.4% increase in ticket average. Sales at Sam’s Club helped as well, growing by 10.4% on a comp basis including a 9.1% increase in membership income. eCommerce, a pillar of the company’s growth strategy, grew by 1% YOY but is up 70% in the two-year stack.

Moving down to the earnings, the company reported a flat margin on a YOY basis which is about as good as could be asked for. The company has not been leaning on price increases to offset inflation which is part of why it is still attracting volume growth. Regardless, the $1.28 in GAAP earnings reverses a loss posted in the previous year while the adjusted $1.53 is up from last year’s $1.39 and beat by $0.03.

Walmart provided positive guidance as well, with revenue expected to grow by 3.0% in fiscal 2023 and for margins to hold steady. The company is also planning to buy back at least $10 billion in shares this year, a move that will help drive EPS growth to the mid-single digits.

The Analysts Are Bullish On Walmart

The analysts have been silent in the wake of Walmart’s Q4 results but they are overwhelmingly bullish. The consensus of 24 analysts is a firm Buy with a price target that implies 24% of upside for the stock. The most recent commentary includes some price target downgrades but no rating changes and that is before the Q4 results were released. The high price target of $196 adds another 18% to the consensus and is one we think easily reached, assuming the stock can break out of its range.

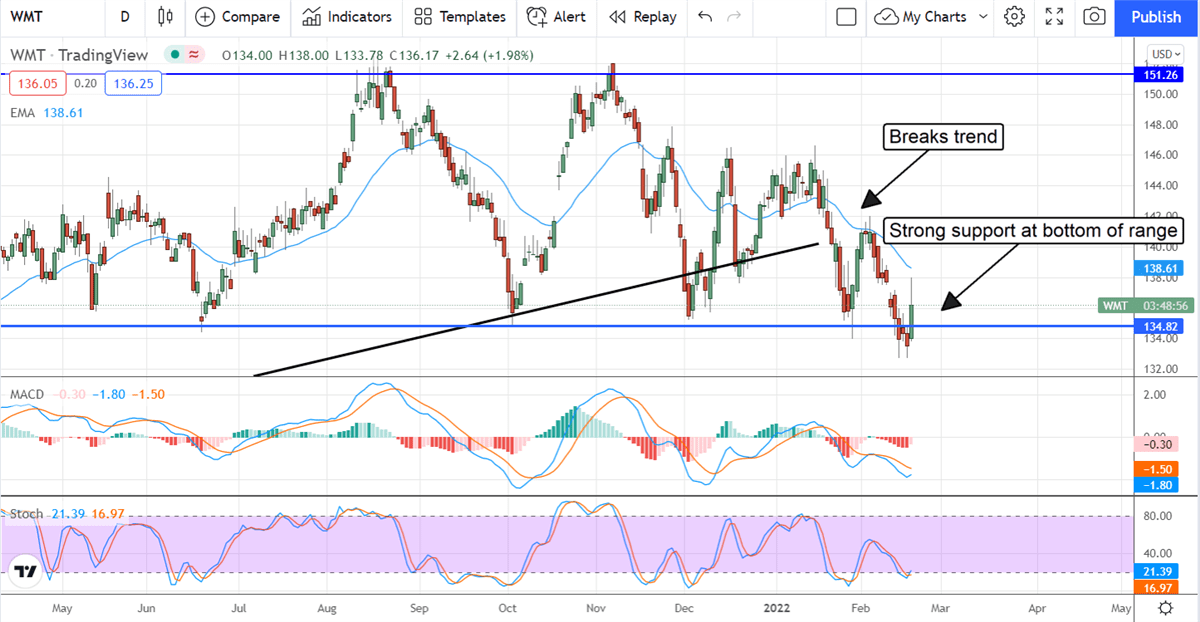

The Technical Outlook: Walmart Confirms Support

The Walmart chart may not be overly bullish but no one is trying to sell mad amounts of the stock either. The post-earnings release action shows strong support at the bottom of the trading range, near the $134 level, and the indicators are consistent with a move higher. The risk now is at the short-term moving average which may cap gains but we don’t think so. Assuming the stock is able to move above the EMA we see it trending higher within the range and hitting possible resistance at the $142 and $146 levels.

Before you consider Walmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walmart wasn't on the list.

While Walmart currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.