Clothing and apparel retailer The Gap NYSE: GPS stock has been selling off despite a blowout Q2 2021 earnings report and raised guidance for full-year 2022. Consumer apparel retailers were an epicenter casualty during the pandemic which led to digital transformation enabling them to adjust and reap gains from the post-pandemic reopening. Gap has seen an impressive rebound beyond the pre-COVID 2019 levels which is a testament to their adaptability and digital innovation. The Company has emerged from the pandemic a more agile and flexible organization capitalizing on the omnichannel. E-commerce comprised of 33% of total sales in Q2 2021. Prudent investors looking for a value play in the retail apparel recovery can watch for opportunistic pullbacks in shares of the Gap Stores.

Q2 fiscal 2021 Earnings Release

On Aug. 26, 2021, The Gap released its second-quarter fiscal 2021 results for the quarter ending July 2021. The Company reported earnings-per-share (EPS) of $0.70 excluding non-recurring items versus consensus analyst estimates for $0.46, a $0.24 per share beat. Revenues rose 29% year-over-year (YoY) to $4.2 billion, beating consensus analyst estimates for $4.12 billion. Topline revenues grew to the highest second quarter is over a decade up 5% compared to 2019. Comparable same-store-sales (SSS) rose 12% versus 2019 (pre-pandemic). Gross margins were 43.3%, up 440 basis points. Old Navy's global net sales rose 21% versus 2019, maintaining its number two apparel brand in the U.S. Global Gap sales fell (-10%) versus 2019 and the Global Banana Republic sales fell (-15%) versus 2019. Athleta net sales rose 35% compared to 2019 and comparable sales grew 13% YoY and 27% versus 2019. Online sales rose 65% compared 2019 representing 33% of total revenues.

CEO Comments

The Gap CEO Sonia Syngal commented, "Our talented teams delivered our highest second quarter net sales in over a decade. Our strategy is driving growth as evidenced by continued strength at Old Navy and Athleta, Gap Brand’s second consecutive quarter of positive 2-year comparable sales in North America, and momentum gaining at Banana Republic. Stepped-up marketing investments, improved brand management, and technology enhancements are paying off as our brand power cuts through. I look forward to our Integrated Loyalty Program and Old Navy's inclusive shopping experience, BODEQUALITY, taking hold in the back half, both key components of our Power Plan 2023, and important drivers of long-term sustainable growth.”

Full-Year 2022 Upside Guidance

The Gap Stores raised its guidance for full-year 2022 for EPS in the range of $2.10 to $2.25 versus $1.79 consensus analyst estimates. Full-year 2022 revenues are expected to grow 30% equating to a range between $17.94 billion versus $17.14 billion consensus analyst estimates.

Conference Call Takeaways

CEO Syngal set the tone, “Back to brand power. It is also essential that our strong brand created is as effective as possible and showing up in the right places and that sort of science comes in. We've updated our media mix. We've balanced investments between conversions with existing customers and the top of the funnel to build awareness, ground laws, and reach new audiences. And those coupled with rigorous marketing effectiveness and a fully maximized third-party data set, we've seen this payoff.” In terms of Old Navy, “Old Navy delivered record sales with 18% comparable sales growth versus 2019. Strong story-telling, trend by product, and strategic discounting are bringing a new and more valuable customer in driving the higher spend and margin dollars. Moving forward, the team is leveraging data science to allocate inventory to specific stores with great precision. Further, improving profitability. Old Navy will scale this capability in the back half, and we look forward to deploying it across the rest of our brands in 2022. And just last week, Old Navy brought the democracy styles service together with their women's inclusive styles sizing launch product quality. We now offer women's styles in every size with no price difference, fully integrated with both stores and online. No other top 20 mass retailer does that. This is the largest integrated launch in the brand's history and an important growth driver for the business for years to come. The average woman in the U.S. was a size 16 to 18. So, with very few competitors in the plus-size based, Old Navy is positioned to take a significant share of a $120 billion women's market. Moving to GAP. GAP is restoring relevance as an iconic American brand. And the North American business has reached a major inflection point with 12% comparable sales growth versus 2019.”

Digital Growth and Loyalty Program

CEO Syngal commented, “We've created the digital community faster and more efficiently because of our scale and our tech, and we're able to leverage this technology across all brands as we explore new ways to connect with customers. This quarter, we maintained our digital dominance of online delivering sales growth of 65% on a 2-year basis. Because of those growths, we're making investments across our distribution network to accommodate additional capacity and a new two to three days shipping comments for top-tier loyalty members. And meanwhile, our sourcing optimization efforts are ramping up as we look to reduce cost for packages and simultaneously increased units per package. And finally, the power of our portfolio. In July, we unveiled our new integrated loyalty program, featuring a new value proposition anchored by faster shipping promise, a new tier structure, on-demand point redemption, and the ability to do good to points donation. We know we build loyalty with our more than 65 million active customers by connecting deeply with them. This program allows us to engage personally with non-credit card customers to experience, not just discounting, to build lifetime value by migrating them up the value chain.”

GPS Opportunistic Pullback Price Levels

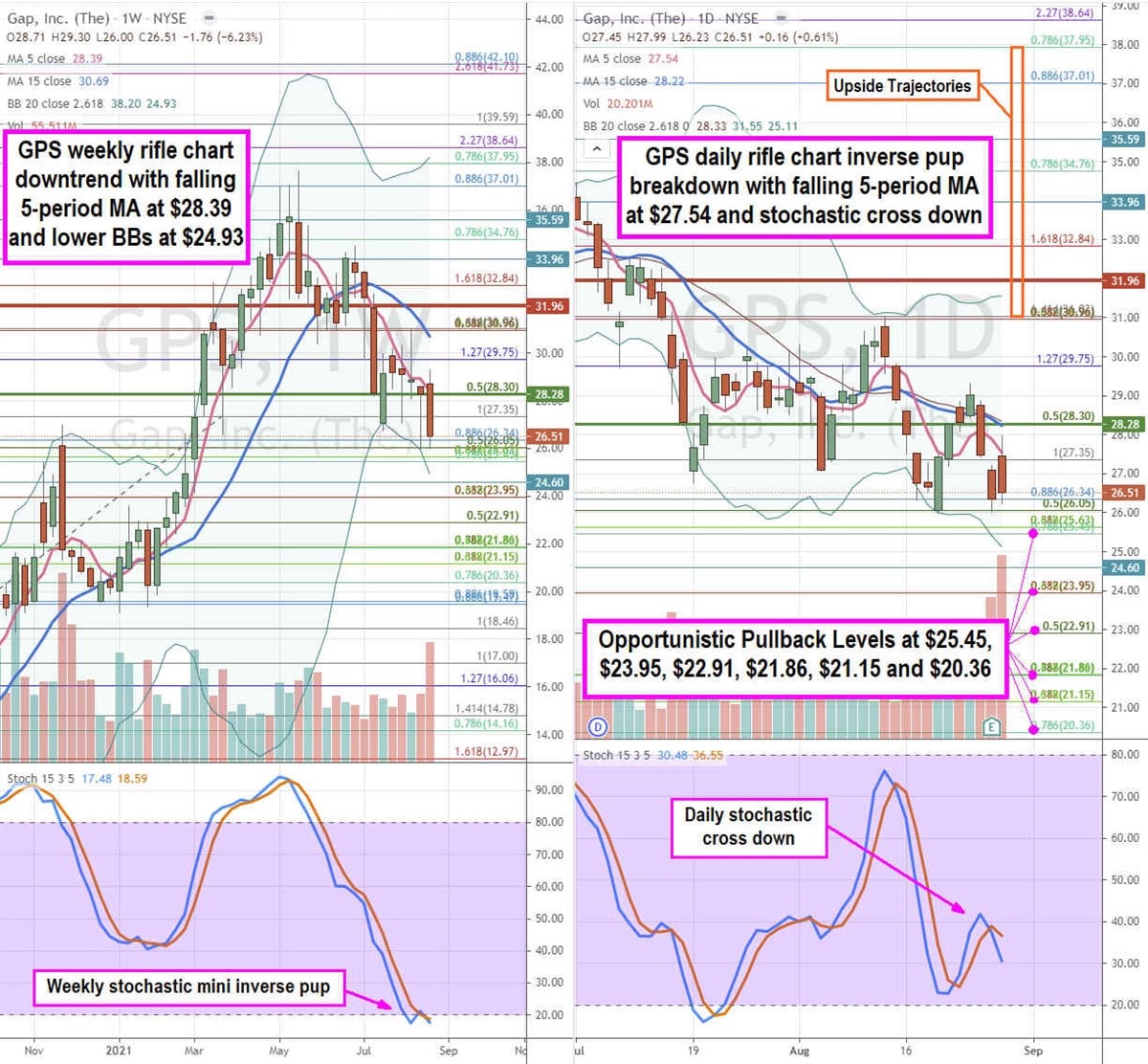

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for GPS stock. The weekly rifle chart has an inverse pup downtrend that rejected hard off the $30.96 Fibonacci (fib) level. The weekly 5-period moving average (MA) is falling at $28.39 with lower Bollinger Bands (BBs) at $24.93. The weekly market structure high (MSH) sell triggered on the breakdown below $31.96. The weekly stochastic formed a mini inverse pup lean down through the 20-band. The daily rifle chart formed an inverse pup breakdown with the falling 5-period MAA at $27.54 with lower BBs at $25.11. The daily market structure low (MSL) buy triggers on a breakout above the $28.28 level. The daily stochastic cross down confirms the daily inverse pup breakdown. GPS stock was in a downtrend heading into the blowout earnings report. Prudent investors can watch for opportunistic pullback levels at the $ 25.45 fib, $23.95 fib, $22.91 fib, $21.86 fib, $21.15 fib, and the $20.36 fib. Upside trajectories range from the $30.96 fib to the $37.95 fib.

Before you consider GAP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GAP wasn't on the list.

While GAP currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.