The nation’s largest arts, crafts and seasonal products retailer

The Michaels Companies, Inc. NYSE: MIK stock has benefitted from the stay-at-home mandates issued at the height of the pandemic. It’s allowed brand awareness to emanate amongst the Millennials and Generation Z demographic. As a third surge of COVID-19 cases race against the FDA approval of COVID

vaccines, shares of Michaels is both a

pandemic benefactor on lockdowns as well as an economic recovery play in the same vein as a

Pinterest NASDAQ: PINS has been able to transform itself from a

hobby to ecommerce platform. Rather than influencers, Michaels is targeting “Makers”. With shares currently underperforming the benchmark

S&P 500 index NYSEARCA: SPY, there is room for upside on this unique retailing play that has adopted digital transformation to broaden its omnichannel distribution and engagement models. Prudent investors can watch for opportunistic pullback levels to gain exposure on a potential sell-the-news reaction on earnings.

Q2 FY 2020 Earnings Release

On Sept. 3, 2020, Michaels released its fiscal second-quarter 2020 results for the quarter ending July 2020. The Company reported an earnings-per-share (EPS) profit of $0.30 excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.08), a $0.38 beat. Revenues grew 11.1% year-over-year (YoY) to $1.15 billion versus analyst estimates of $1.01 billion. The sales increase includes the additional opening of 13 stores in the quarter and 12% increase in comparable same-store-sales (SSS) partially offset by the closure of the wholesale business. The Company ended the quarter with overall liquidity of $1.3 billion after repaying down the $300 million outstanding balance on the revolver.

Conference Call Takeaways

Michaels CEO, Ashley Buchanan, presided over the conference call and highlighted the quarters achievements. All stores were open since July 2020 with COVID provide strong tailwinds for the business. Buchanan stated, “We believe that COVID-19 is providing some strong tailwinds for our business resulting in lifestyle changes such as more time at home and the need for creative outlets.” The Company improved its digital and omnichannel capabilities to give Makers a more seamless shopping experience. Michaels enhanced curbside pickups, introduced product bundling for ecommerce orders. The Michaels app was “beefed” up to bolster contactless in-store shopping that prioritizes convenience and safety. Buchanan plans to open the nearly 40 acquired A.C. Moore stores in 2021 under the Michaels banner. Alleviating friction points for a frictionless and seamless customer experience was heavily promoted. New customer additions grew 15% YoY. The Company expects long-term average annual top-line growth to range between 1.5% to 2.5% over the next five years leading to low double-digit EPS growth in fiscal 2022 and beyond. Cumulative cash flow is expected around $2 billion between FY2020 and FY2024.

Michael’s Makers Strategy

The pandemic has enabled Michaels to gain more insights into a segment of consumers deemed “Makers”. The Company sees them as a key driver for long-term growth. The Company plans to target Makers by modernizing the omnichannel experience and re-establishing itself as the expert brand for Makers. Michaels introduced a marketing campaign “Made By You” featuring real Makers and their creative works that has been well received by its customers. The Company is harnessing Makers with a “significant” offering of virtual classes and interactive content and even providing online kids camps featuring 21 native free crafting from many of the Makers. Within four months of launch, the program has already grown to over 200,000 signups for online classes. They also relaunched a revamped Michaels Rewards loyalty program. Ecommerce grew 353% which is inclusive in the 12% SSS comp. With Q3 earnings expected to be release in the first week of December, investors will be expecting a strong holiday Q4 season outlook, which is historically the most significant period. Prudent investors can wait for the reaction to watch for opportunistic pullback levels

MIK Opportunistic Pullback Levels

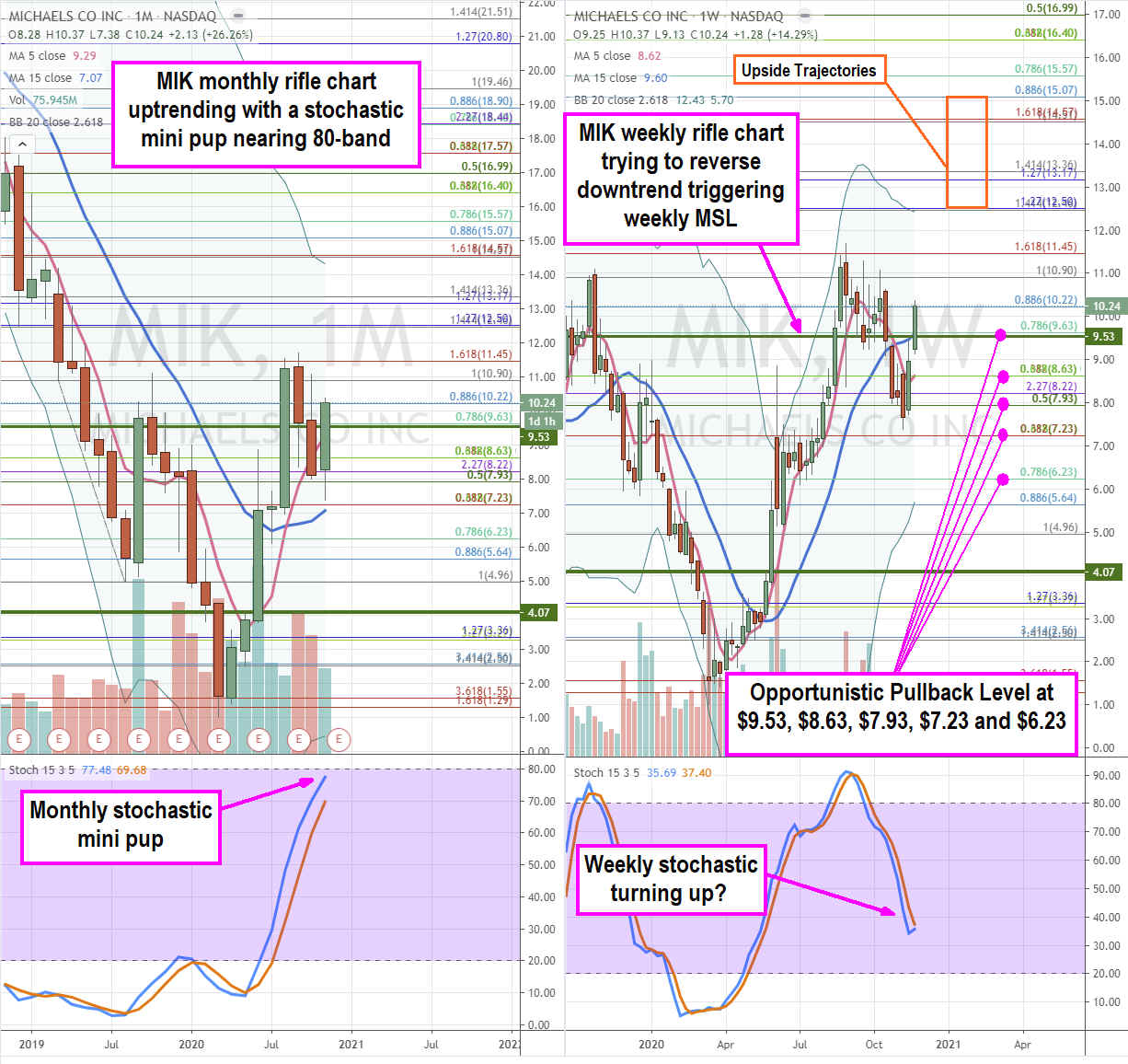

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field. The monthly rifle chart has an active uptrend above the 5-period moving average (MA) support at $9.29 with upper Bollinger Bands (BBs) near the $14.57 Fibonacci (fib) level. The monthly rifle chart triggered a market structure low (MSL) buy above $4.07, but the weekly MSL trigger formed above $9.53 heading into earnings. The weekly stochastic has been falling since shares peaked off the $11.45 fib level but are attempting to coil up sharply heading into earnings. Last quarter, MIK shares ran up into earnings only to trigger a sell-the-news reaction. The question of muscle memory will be answered on the reaction. Prudent investors can stay ready for exposure at opportunistic pullback levels at the $9.63 fib, $8.63 fib, $7.93 fib, $7.23 fib and the $6.23 fib. The upside trajectories range from the $12.58 fib up to the $15.07 fib in case shares rally after earnings.

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.