The

S&P 500 (NYSEARCA: SPY) is the most widely accepted benchmark index representing the U.S. stock market. It is the headwinds and a compass for anyone who owns or trades stocks. The SPY reached an all-time high at $339.08 on Feb. 19, 2020 preceding the coronavirus

black swan plunged shares by (-34%) to $218.26 on Mar. 18, 2020. This was the fastest transition from an all-time high to a bear market in history. Since then, the SPY has managed to rally nearly 62% from the lows peaking at the $295.68

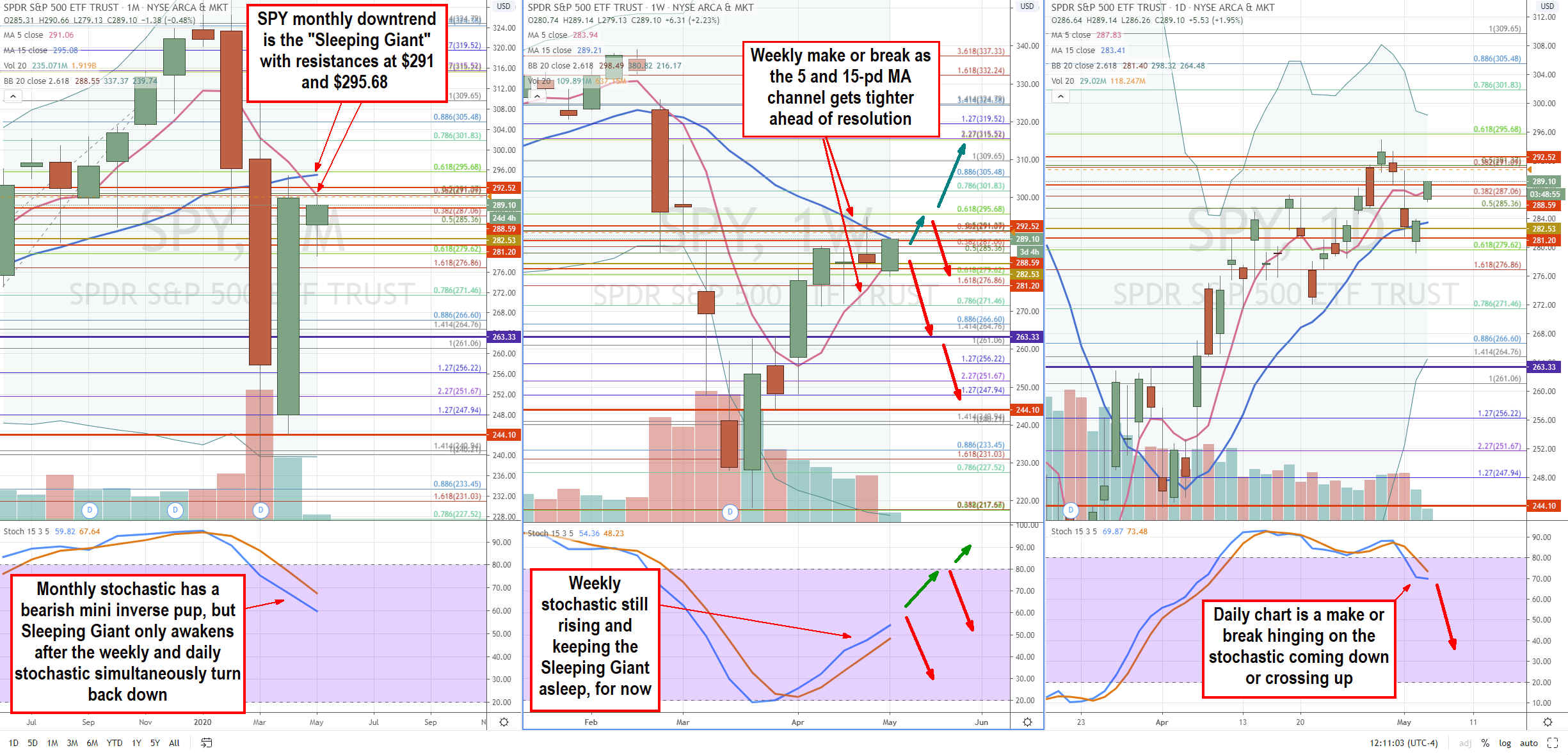

Fibonacci (fib) level before a rapid plunge back to $278.69 in two-trading days. The significance of this (-17 point) drop may easily go unnoticed in light of this year’s volatility, but it would be a mistake to do so. This was a mere nudge from the sleeping giant that is the monthly 5-period moving average (MA) downtrend powered by a bearish stochastic mini inverse pup. Here’s a lay of the land through a different “lens” so investors and traders can be aware of what lurks ahead for the SPY.

Square Peg into Round Hole

Everyday financial media attempts to explain the reasoning behind the stock market’s move, especially when it’s a large point move. However, listening to financial news networks can be very misleading as price action often precedes the ‘reason’. It’s very much like trying to fit a square peg into a round hole as the narrative shapes sentiment which shapes price until an extreme price move reshapes the narrative. Price often precedes the news so it’s best to also utilize price action interpretation methods known as technical analysis. This is what we employ to truly learn the message of the markets.

The Sleeping Giant Lurks

The SPY rallied up to the $295.68 fib and the monthly 5-period MA post-market on April 29th. The monthly 5-pd MA resistance rejected the break attempt as the SPY began its two-day descent causing a (-17 point) sell-off to $278.69. This caused the daily stochastic to cross down through the 80-band as bears pounced on the downdraft embracing the “Sell in May and Go Away” maxim suppressing the 60-minute stochastic under the 20-band for two-straight days in the weekly close on May 1st. On the following Monday and Tuesday, May 4th and 5th, the “experts” on the financial networks were very bearish in their tone talking up the extended recession and vanilla safe comments. The SPY spent all day on Monday consolidation at the $280 range and exploded through the $288.59 daily market structure low (MSL) to squeeze back up to the weekly 15-pd MA at $289.10 setting up for a potential showdown again with the “Sleeping Giant” monthly downtrend at the 5-pd MA at $291 and 15-pd MA at $295.68 fib.

Bulls Versus the Sleeping Giant

Using the rifle charts on monthly, weekly and daily time frames, we lay out the playing field suitable for swing traders and investors. The monthly rifle chart is bearish with the major resistance at the 5-period MA currently at $291. The bulls have managed to push through all resistances up to that level. Ultimately the showdown will happen to determine the next follow through the direction of the SPY and the U.S. stock markets. The bulls have to break through the monthly 5-pd MA at $291 and then grind through the 15-pd MA overlapping the $295.68 fib. If they can hold above this level into the month-end close, then a melt-up north of $300 is possible

The Bear’s Game Plan

The sleeping giant is the monthly downtrend composed for the 5 and 15-pd MA. The bears will use those monthly 5 and 15-pd MAs to deflect the breakout attempts long enough to exhaust the bulls back down to the rising weekly 5-pd MA at the $283.83 area. If the weekly 5-pd MA breaks down causing the weekly stochastic to cross down in combination with the daily stochastic cross down, it will awaken the sleeping giant since the monthly stochastic is already falling with a bearish mini inverse pup. The combination of three simultaneous wider time frame falling stochastic trigger a “perfect storm” breakdown that could collapse the SPY back down to re-test the $263.33 weekly MSL trigger. A breakdown through that area could result is a fast collapse towards the $244.10 daily MSL trigger level.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.