Shares of The Trade Desk

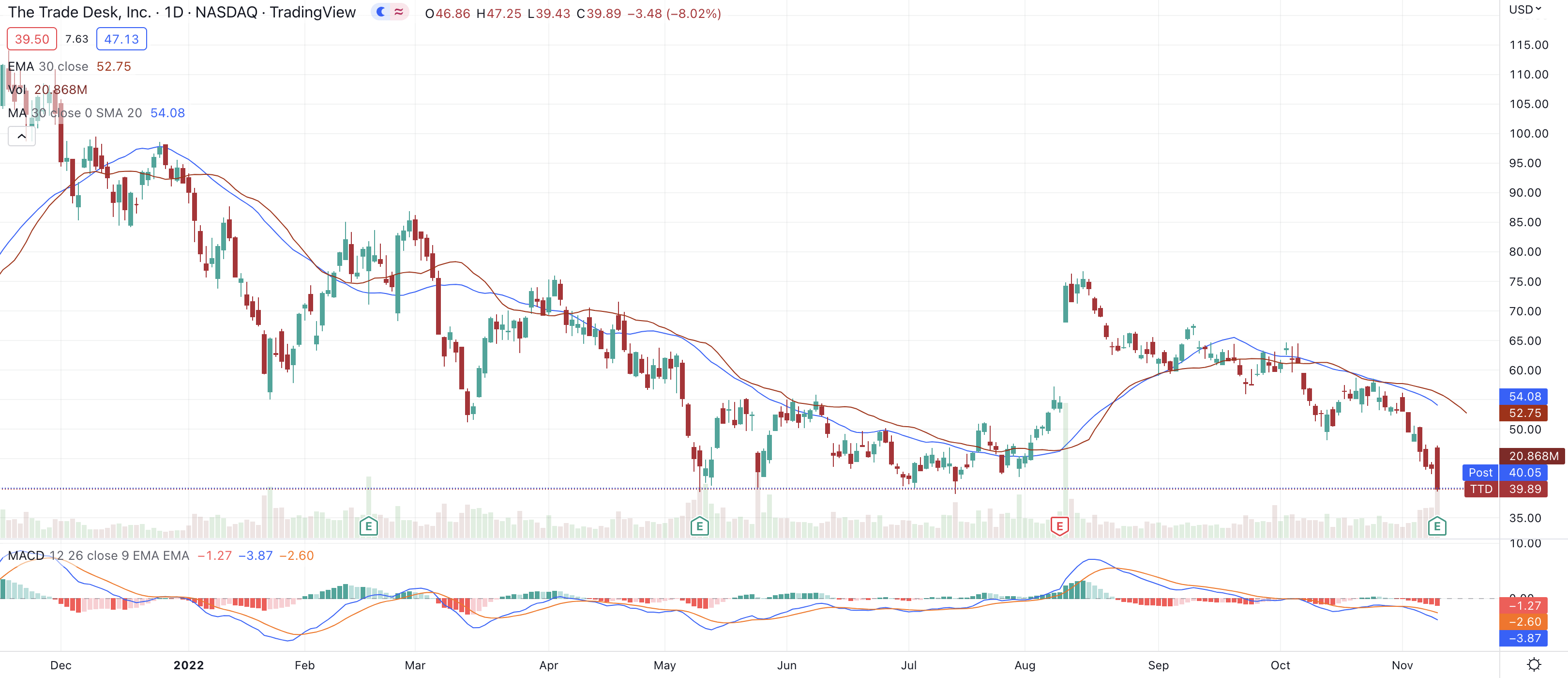

NASDAQ: TTD notched fresh all-time highs during Monday’s session as the stock completed a stunning recovery to the previous highs it had set last August. Even though the company had been doing everything right back then and had given Wall Street a stellar Q2 report that beat analyst expectations, some fairly heavy profit-taking set in and shares were down 35% by the start of October.

However, many an astute investor would have seen this pullback as a perfect buying opportunity for a company that’s been nothing but a dream to hold since they IPO’d back in 2016. Indeed, RBC were out with an upgrade around this time, highlighting the buying opportunity that the seemingly inefficient pullback had created and investors were listening. Shares started finding buyers around the same support line that they’d bounced off of in May. They trading sideways and consolidated for a few weeks and then turned north.

By the close of Monday’s session, they’d retaken the previous highs after a 60% run in less than four months and the future is bright for one of the world’s most popular digital advertising platforms.

Internal Momentum

Their Q2 report in August showed revenue increasing 42% year on year while management also raised guidance. Q3’s report came out in November and told a similar story. EPS and revenue both comfortably beat analyst expectations again even after management had raised guidance going into it, while the latter number registered 38% jump year over year. Net income rose 20% and management was confident enough to raise forward guidance yet again.

The company has shown investors that they’re able to continuously adapt to and innovate in what’s still a fairly young industry. As CEO and founder, Jeff Green remarked, “the world’s leading brands and agencies are increasingly using our platform to apply data-driven strategies to drive precision and value across their campaigns. More data-driven choices by advertisers led to record revenue of $164.2 million and a net income of $19.4 million in Q3. Connected TV, audio and mobile-led our channel growth. As more broadcasters make their content available via streaming services, we are better positioned than anyone to take advantage of this significant shift.”

With these kinds of numbers still being pumped out and this level of forward-looking confidence from their founder even as their market cap surpasses the $13 billion mark, is it any wonder that shares are up almost 1000% in a little over three years?

Competition From Amazon

Going forward, they’ll have to contend with Amazon as a potential competitor in the near future as the e-commerce behemoth begins to move into the ad selling space. Amazon seems intent on having some skin in the game in multiple industries and considering they’ve already pushed into cloud computing, digital streaming and artificial intelligence, this latest move should come as no surprise. If anything it confirms how ripe the digital ad market is. However, Rosenblatt is confident that this is more of a potential long term worry for The Trade Desk versus a short term concern and streaming companies like Roku NASDAQ: ROKU will be more nervous. Interestingly, Amazon’s previous VP of Finance for their International Consumer business recently became The Trade Desk’s CFO.

Looking Ahead

For now, at least, investors look to only have one thing on their mind and that’s being able to say they got in somewhere at least close to the ground floor. As the stock enters blue sky territory around the $290 mark, there are some sell-side price targets dangling as high as $340 in front of it. And given the stock’s ability to move hard and move fast, you wouldn’t bet against it justifying these figures in the coming months. To be fair, that’s less than a 20% move away from where shares closed on Monday.

With the MACD on the weekly chart still in a healthy bullish condition and the RSI only at 67, there’s plenty of room for The Trade Desk to stretch its legs into 2020.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.