Wedbush Doubles-Down On Secular Tech Winners

Last week, in a letter to shareholders, Wedbush doubled-down on big-tech names calling for another 20% to 30% upside for secular winners. The analysts say Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT) will be the biggest winners during the next phase of the market but they are not the only ones well-positioned in today’s market.

According to Wedbush, Apple is the best play for the coming 5G revolution while Microsoft will benefit from the push to work-from-home and cloud computing. The price target for both stocks was raised to near-Wall Street highs implying an 11% upside for Apple and 21% for Microsoft. Other names on the list include security/services like Docusign (NASDAQ: DOCU), Cyberark Software (NASDAQ; CYBR), and Fortinet (NASDAQ: FTNT).

While bold, I am not surprised by the note. Tech has been one of the biggest winners from the COVID-19 pandemic because of one thing; the pandemic has proven tech works. More importantly, it has proven that both businesses and consumers need tech in order to survive and accelerated a shift to digital that was already underway. On the one hand, there is a major push into work-from-home, why yes it is possible to work from home, while on the other there is social distancing. What better way to social distance than virtual?

Bank Of America Bullish On Chips

Bank Of America issued a similarly bullish statement on tech but confined the love to the chip-making industry. According to their research, the gaming industry is going to drive increasing demand (among other factors) in the second half of the year. With new consoles expected from both Sony and Microsoft, the analysts are expecting a major product upgrade cycle to begin.

Currently, less than 10% of the gaming market owns a console with chips on par to what will soon be the new standard. This means if gamers want to keep up with the latest games (and we know they do) they’re going to have to buy new machines. Of the chipmakers, Nvidia (NASDAQ: NVDA) and AMD (NASDAQ: AMD) are the best-positioned on the market. They see at least 10% upside on both stocks and maintain a buy rating for each.

Analog Devices (NASDAQ: ADI), coincidentally, just announced a major-merger and guidance upgrade that has shares of its stock on the move. The company is going to buy Maxim Integrated Products in an all-stock deal worth $68 billion. The move is intended to aid Analog Devices push into autonomous vehicles and 5G markets, markets that are both expected to boom in the current/upcoming year. At the same time, Analog Devices upped its full-year guidance underscoring both Wedbush’s and Bank Of American’s bullish stance.

The Earnings Outlook Is Good, Good, Good

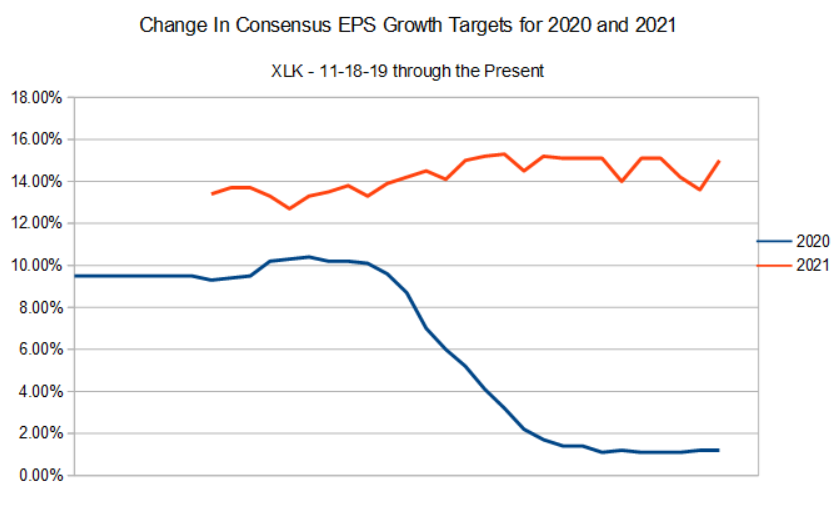

The tech sector is going to be impacted by the pandemic that is a fact. What is also a fact is that the impact will be small because tech is transcending the virus in a way that means today’s gains will be in effect for a long time to come. In terms of earnings, the S&P 500 Technology Sector (ARCA: XLK) is expected to see EPS decline by -1.3% in the 2nd quarter. The mitigating factors are that this bar will be easy to beat, signs are already in place that it will be beaten, and if so, EPS is likely to come in positive for the quarter.

Looking forward, the outlook for the next quarter (Q3) is not great, negative growth about -5.0%, but again there are mitigating factors. First is that the analyst’s consensus is probably too low, we’ll get more color on that as the Q2 season unfolds, and second is that full-year consensus is still positive. The current consensus is for full-year growth in 2020 is near 1.2% and likely to begin rising very soon. If there is one thing that can move a market to new highs its rising EPS estimates. Beyond that, EPS growth is expected to accelerate to the mid-teens next year.

The Technical Outlook: This Market Is Marching To New Highs

Some markets drift higher and some markets rocket higher but not the XLK. The XLK has been moving steadily higher at a decent but not excessive clip since hitting its post-pandemic bottom. Now trading at new all-time highs, the ETF looks set to continue moving higher over the mid to long term. In the near term, there is a chance prices could pull back to support at the $104 level but that is not a guarantee. If tech is something you think you want to get into now is the time before earnings, but slowly and with caution, always keeping some powder dry in case the market does offer a better buying opportunity.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.