The Market Corrected But Secular Trends Are Still Intact

To be a truly successful investor, one whose intent is the long-term growth and accumulation of wealth, you have to have a long-term perspective. While the coronavirus pandemic sparked a massive correction in the equities market the damage done to markets is debatable from the long-term perspective. In my view, the view of a long-term investor intent on capitalizing on market trends, the damage done is minimal, even expected, and will only lead to massive gains down the road.

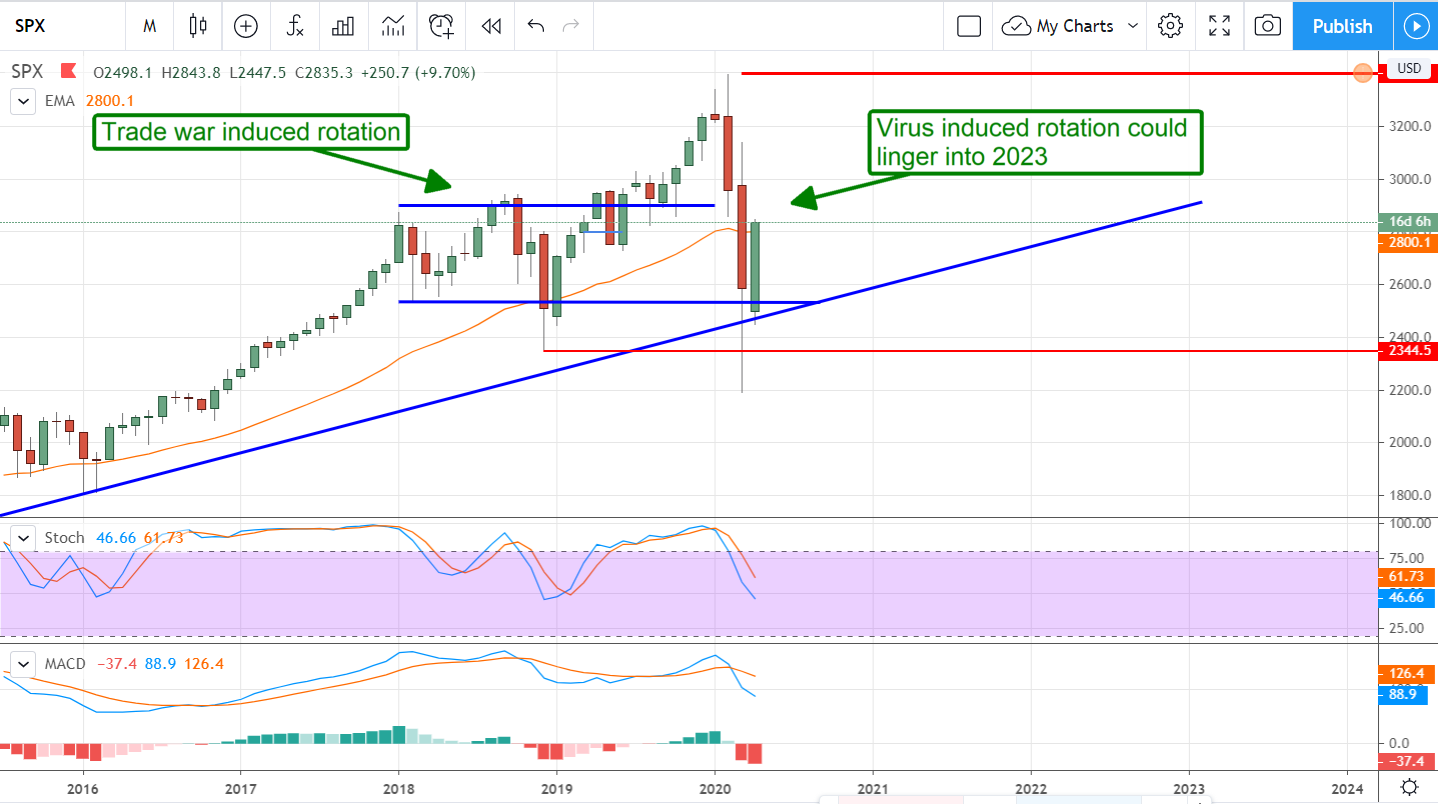

The trend that requires the most attention right now is the secular trend. The secular trend is the strongest trend a market can experience as it encompasses all participants. The current secular trend is bullish, a trend driven by demographics, and that trend is not broken. The coronavirus bear-market brought the S&P 500 (SPY) right down to its breaking point and then bounced. Why? Because the outlook for revenue and earnings growth is still present however dark the times may seem now.

What, Exactly, Is A Sector Rotation

The equities markets thrive on cycles, the cycle it loves most is the business cycle although there are others to be aware of. The business cycle is important to understand because it impacts which businesses will do better when. Because the business cycle can last many years not all stocks will perform the same at all points within the cycle. When investors move en masse from one sector to another chasing performance it's called Sector Rotation.

Early in the cycle industrial and materials stocks may do better as companies ramp their efforts. Later in the cycle, consumer stocks may do well because employment is high and consumer spending is well-supported. Other times, during business-cycle contractions, staples stocks and real assets like utilities perform best.

The point is that there are times when the market, at a fundamental and secular level, will begin to shun one type of stock or sector in favor of another. When that happens, equity markets tend to correct and enter periods of consolidation or sideways movement that will last until either buyers or sellers win the upper hand.

Stable Revenue, Growth, and Dividends Are What You Want To Own Now

The nature of this rotation is a bit different because it is driven in part by secular forces, in part by the business cycle and now by societal changes related to the coronavirus. Because of this, the rotation is less about sector although that is still important. The rotation now, in my opinion, is more about quality and the ability to deliver value in these new conditions. Basically, Investors are fleeing higher-risk equities and those with heavy viral exposure in favor of revenue stability and, more importantly, dividends.]

A look into the foodservice industry is a good example. Sit-down establishments like Cracker Barrel, The Cheesecake Factory, Ruth’s Chris, and Red Robin are in dire straits. They can’t, or haven’t yet, adapted to the new social-distancing paradigm and have lowered guidance, cut spending, ended buybacks and suspended their dividends. Other restaurants, restaurants like Dunkin Donuts, McDonald’s, and Chipotle Mexican Grill have staged massive rebounds because they’re proving their ability to adapt and succeed.

Rotation, Consolidation, And Continuation Are In My Forecast

Sector rotations often result in consolidation within a market as one group of investors exits and another enters. Consolidations often turn into continuation patterns and that is what I am seeing in the charts now. A consolidation pattern with the long-term secular bull market that will eventually become a continuation pattern.

What makes this the greatest sector rotation ever seen is its duration. If you look back over the chart of the S&P 500 monthly candles you can see this sector rotation began long-before the coronavirus pandemic set in. You might say it began with the Trade War but that was only a catalyst. Now, two years later, the coronavirus has triggered another rotation that could take another few years.

While we are expecting the pandemic to end within the next few months its impact will linger. Not only will earnings and economic activity be impacted the rest of this year, but the outlook for some business models is also bleak for the next several. Any business that relies on large groups of people congregating together is likely to see an impact on its revenues that could last indefinitely.

Because price action is confirming support at the secular trend line and growth is in the forecast for next year I expect this rotation/consolidation will become a continuation soon. The caveat is that soon, in the secular sense, could be as long as three years so patience is a must. Until then, focus on solid dividend-paying stocks and you will see your account outperform the broad market.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.