SMART Global Today

SGH

SMART Global

- Price Target

- $32.25

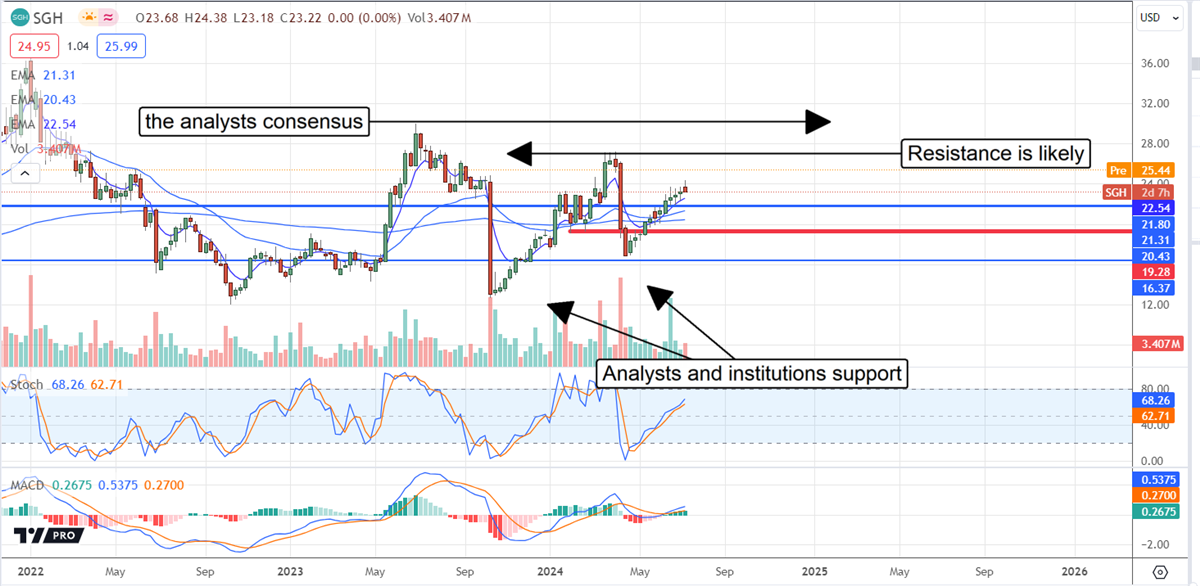

SMART Global Holdings' NASDAQ: SGH repositioning efforts have set it up to achieve record-high share prices soon. The company’s Q3 results aren’t perfect, but include critical details that will support the market over time. Among them are improved profitability and a return to growth supported by AI. The AI industry and the applications spawned by it need high-quality memory and LED components that SGH supplies. Although the guidance for Q4 was tepid compared to the analysts' consensus, the longer-term outlook is robust because AI is still in its earliest phases; the bulk of SGH opportunity lies ahead.

"Our customers are looking for a trusted deployment partner to help them solve the complexity of AI, and we feel we are well positioned with our portfolio of systems, software and managed services to enable their success," said Mark Adams, CEO of SMART Global.

SGH Returns to Growth: Builds Leverage With Wider Margins

SMART Global's Q3 was mixed. The company’s revenue is down 12.7% YoY and missed the consensus by a wide margin, but there is a repositioning effort to consider. The company exited its stake in Brazilian operations earlier in the year, which is a root cause for the weakness. Additionally, SMART Global’s analysts' coverage is light, so there is little conviction in the consensus estimate. The salient details are that sequential growth persisted for a 2nd quarter on strengthening in all segments. Memory Solutions led with a gain of 10%, followed by a 6.4% increase in LED Solutions and a 2.5% rise in Intelligent Platform Solutions.

Margin is another area of strength. The company widened its GAAP and adjusted gross and operating margins to deliver better-than-expected bottom-line results, reversing losses in the prior year. The gross margin widened by 80 bps on a GAAP and adjusted basis, while reduced spending and cost controls left the GAAP and adjusted EPS at $0.10 and $0.37, respectively.

Guidance is tepid compared to the analysts' consensus, aligning with the average outlook but favorable to investors. The company forecasts Q4 revenue in a range bracketing $325 million, which is good for sequential and YoY growth. The margin is also expected to widen and produce accelerated sequential and YoY growth.

The quarter was good for the SMART Global Holdings balance sheet. The company produced a cash-flow-positive quarter, aiding the cash build and debt reduction. The cash pile grew by roughly 25% while inventory held steady, increasing assets and total assets. Debt is down more than 10%, leaving leverage at 1.5x equity and 1.5x cash. Equity has risen nearly 100%.

Analyst Raises Price Target for SMART Global

SMART Global MarketRank™ Stock Analysis

- Overall MarketRank™

- 36th Percentile

- Analyst Rating

- Buy

- Upside/Downside

- ∞ Upside

- Short Interest Level

- N/A

- Dividend Strength

- N/A

- Environmental Score

- N/A

- News Sentiment

- N/A

- Insider Trading

- N/A

- Proj. Earnings Growth

- 94.29%

See Full AnalysisMarketBeat.com tracks five analysts covering SMART Global; all are bullish on this stock. The consensus target is down 10% to $30 compared to last year, but sentiment is firm at Buy, and the stock is a deep value in their eyes. Trading near $25, the stock is still 10% below the lowest analyst target, and the range is rising. The Q3 results spurred one analyst to revise its target: a $3 increase to $30, aligning with consensus.

Institutions provide another tailwind for this market. They bought on balance in 2024 and are increasing their holdings. They own nearly 98% of the stock, which may make it difficult for the short-sellers to cover. Short interest is near 10% and sufficient for a short-covering rally if not a squeeze.

SGH stock is up strongly in premarket trading and could move higher. The premarket gains have the market at a new high, but there is a risk of resistance at $27.50, the low end of the analysts' range. That target aligns with previous resistance and may cap gains. If so, SGH stock will remain range-bound until later in 2024 or early in 2025. If not, a move above $27.50 would indicate a shift in market sentiment that should get this market up to the $30 level.

Before you consider SMART Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SMART Global wasn't on the list.

While SMART Global currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.