The Labor Market Rebound Is Strong

There is still a lot of weakness in the labor market, don’t get me wrong, but the labor market is still strong and the rebound is on. Stocks in business with labor like Cintas (NYSE:CTAS) are in a clear position to survive the pandemic if not thrive in its wake. Total employment may be down but the need for labor is there and the costs related to their safety are increasing. It doesn’t matter what the position job or industry, today’s businesses need PPE measures for their clients and employees. Cintas isn’t the only company in business servicing those needs but it is the biggest; and the best.

1) The Non-Farm Payroll Report -

The non-farm payroll report was very encouraging. The number of net new-hires in August topped 1.4 million making the 4th month of gains above 1 million. This is the slowest month of job creation since the market bottomed in April but we need to keep this in perspective. August’s 1.4 million jobs is the slowest pace of job creation since April but far above any other month in recorded history. To date, we’ve recouped 47.75% of the total number of jobs lost and are on track to build on this figure during the 3rd and 4th quarters of the year.

And Seasonal hiring is another factor to consider. Amazon alone just announced another 100,000 new hires bringing its total close to 1 million for the year. Data from the services, manufacturing, and housing sectors also support the need for hiring. Other rays of light within the NFP is a rising participation rate, rising wages, and a near 2.0% decline in total unemployment.

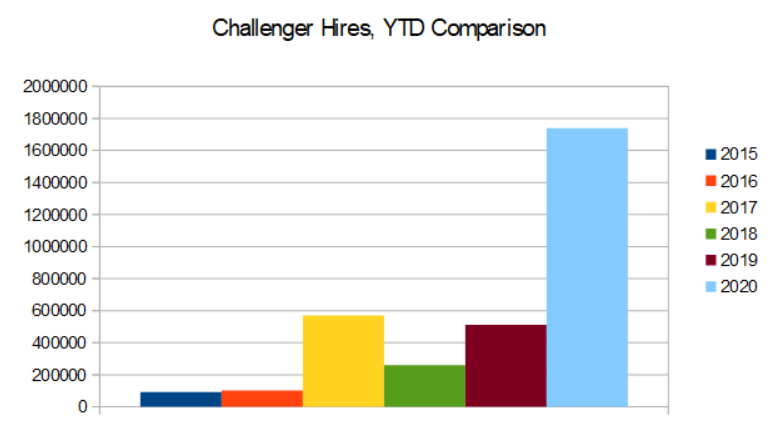

2) The Challenger, Gray & Christmas Report -

The Challenger report is one of my favorite pieces of labor data. The report details plans for layoffs and is a good leading indicator of the labor market. The total number of layoffs continues to rise, layoffs in 2020 have set an all-time record, but there are some mitigating data to consider. Way down at the bottom of the Challenger report, a data piece that virtually no MSM analysts will bring up, is the hiring intentions. While 2020 has been a big year for layoffs it has also been a big year for hiring.

As of August, the 2020 YTD total is already 44% above the previous FULL YEAR record and we’ve still got 33% of the year left to go. Looking forward, September and October are the two biggest hiring months. In, 2019 hiring in September and October was 650,524 or just over 50% of the FY total. So, layoffs are still strong but they’re more a sign of changing business conditions and labor turnover than one of labor market weakness.

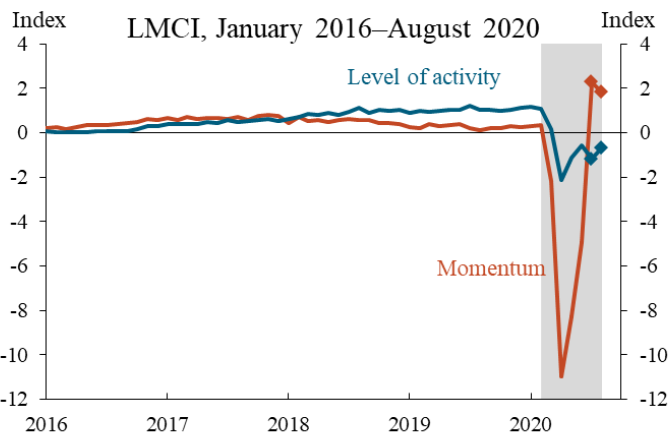

3)The Kansas City Fed’s Labor Market Conditions Index -

The KC Fed’s LMCI is an aggregate index of 24 labor market indicators. The indicators the Fed uses to gauge the labor market and ones that point to strength in the U.S economy. The activity index is down from earlier in the year and below zero and that is a concern. The two factors I am looking at are the 1) uptick in labor market activity and 2) the high level of momentum.

The labor market activity never fell as low as it did in 2008 so the market was never in that kind of condition. Since then, activity has made incrementally large gains that, from a chartists perspective, suggest a bottom and reversal is in play. We know that is true because the economy is reopening, the rebound is on. The Momentum Index is astonishing. Momentum within the labor market is trending at record highs and well above any past recorded high. Momentum is driven by the rebound in full and part-time hiring, hours worked, wages paid, and an expectation of job availability. Those are all signs of labor market health but the expectation of job availability stands out as a sign of employee/workforce optimism.

As I said, there are still pockets of weakness within the labor market but the general conditions are very bullish. Add in the recently strong manufacturing data and increasingly low inventories reported by S&P 500 companies and the stage is set for not only a continued rebound but an accelerating and self-sustaining rebound to boot. In that environment, labor-oriented stocks like Cintas and ADP (NASDAQ:ADP) can only do well.

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.