The Trend Is Your Friend, Trade With The Trend

Maximizing profits and minimizing losses, those are the two fundamental rules that drive all investment and trading strategies. No matter what, the goal, unless it’s to lose money, is to limit losses and capture the largest profits possible so that, over time, new wealth is created.

As far as rules go, it is also one of the hardest to follow and I can say that with authority. I know. The natural tendency is to take profits when you see them and let losers be in hopes they will at least return to break-even. They rarely do. What ends up happening is profits are taken too soon and losses grow beyond control.

Today I want to highlight three companies that are uniquely positioned in today’s market. They are at the nexus of convergent secular trends driving our economy and delivering value to their shareholders. It’s right to trim profits from your winners, even these if you own them, but don’t trim too much because they could still run higher. If you don’t own them, well, if you don’t there is still some room for these stock to run… and they all pay very safe dividends.

A Game-Changing Event For Tractor Supply Company

The coronavirus pandemic was a game-changing event for Tractor Supply Company (NASDAQ:TSCO). Already a growing, if obscure, brand the lock-downs and social-distancing sparked a shift to outdoor living and home-improvement that has yet to run its course. As a retailer servicing the more rural areas of America Tractor Supply is also without largescale competition in many areas which is boosting growth.

In the last year, the company hired a new CEO named Hal Lawton. Lawton’s pedigree includes time at Macy’s, eBay, and Home Depot giving him the experience to capitalize on the company’s strengths and bring it into the digital age. FYI, sales at Tractor Supply Company via eCommerce channels are up triple digits.

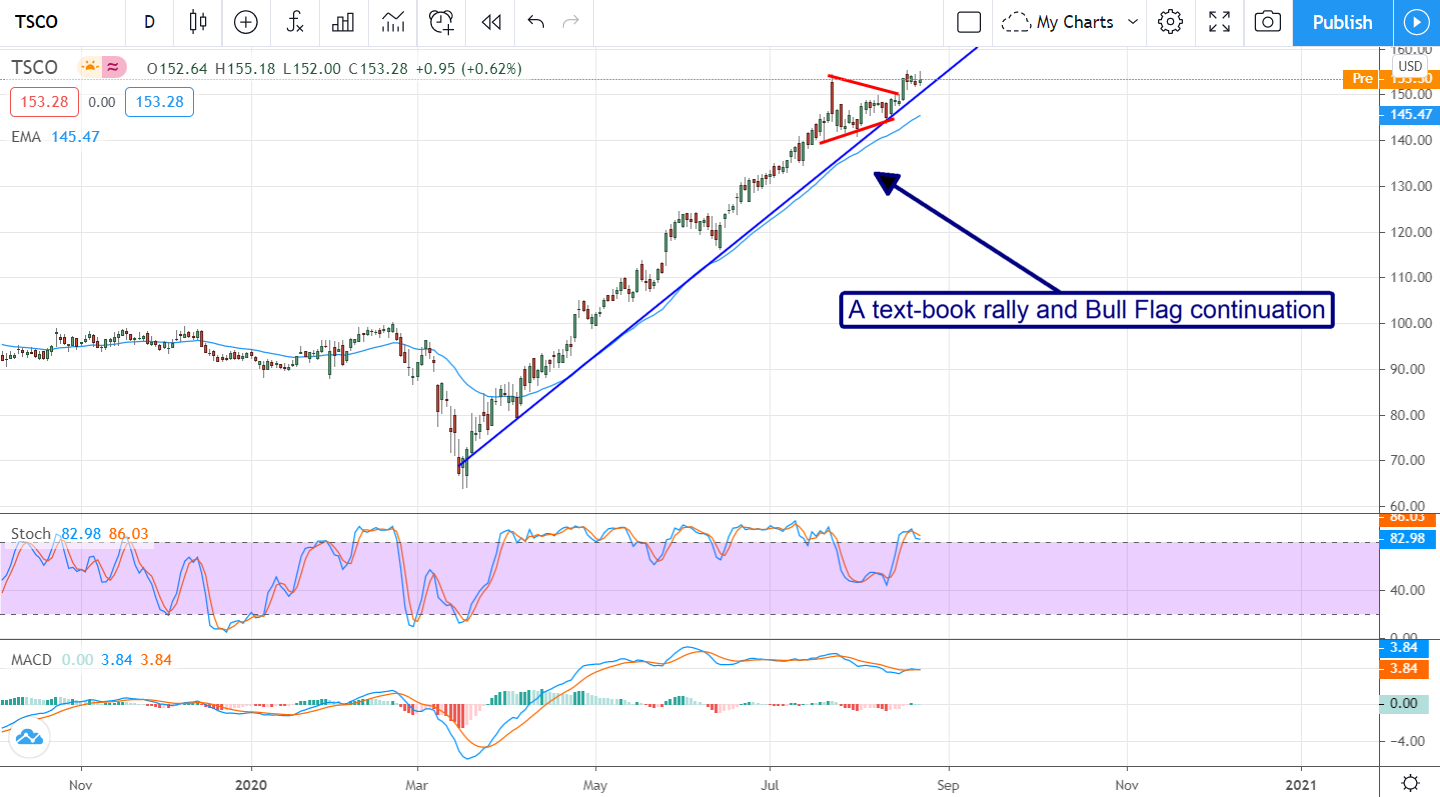

Looking at this chart gets me really excited because what I see is a text-book bull rally with a Bullish Flag consolidation pattern. The flag is a signal that this rally is only about half over, maybe less, and the confirmatory move is already in the bag. Last week, price action broke out of the Flag pattern to set new all-time highs. The indicators are still lagging a bit but are set up to fire a robust trend-following signal with a move above $155.

Economic Tailwinds For J.B. Hunt

J.B. Hunt (NASDAQ:JBHT) is North American’s largest intermodal trucking company and one with several tailwinds in place. To start, demand for trucking services has been on the rise since hitting its bottom earlier this year. That situation is merging with a decline in available drivers that has prices for services moving higher.

At the same time, growing backlogs among America’s manufacturers are leading to a manufacturing boom the likes of which we’ve not seen since WWII. Yes, I know that the Philly Fed MBOS and the Leading Indicators moderated from the last month but do you know that both are still well above levels seen in the 18 months before the pandemic? That’s a lot of activity and that points to a growing need for trucks, truckers, and trucking.

So that’s why shares of J.B. Hunt broke out to a new high last week. The indicators are still weak but I don’t expect that to last with the outlook for economic activity the way it is (the Atlanta Fed GDPNow tool is tracking at 28% for the 3rd quarter). Looking forward, this stock could easily move up to the $150 range in the near-term and higher over the long. It’s trading at nearly 30X this year’s earnings but only 24X next so a sustained uptrend could linger well into 2021.

Clorox Won’t Catch Up With Demand Until Next Year

Clorox (NYSE:CLX) may be the #1 winner from the pandemic. The company owns several key consumer brands including Kingsford, Glad, Freshstep, Hidden Valley, and of course Clorox bleach. When it comes to the pandemic, Clorox is the #1 choice for disinfecting yourself, your home and your business and it shows in the data. In terms of demand, the company reported a +500% increase in demand for some product lines including Clorox wipes. Company execs described the surge as something no supply chain can handle easily, news since then has them catching up sometime next year.

This chart is a little less bullish than the others but I’m chalking that up to profit-taking. The company reported earnings a week or so ago, beat on the top and bottom lines, reported double-digit growth across all segments, and a substantial increase in margins that points to increased earnings power in future quarters. Nothing to get bearish about there. With price action looking for support there is a chance of lower prices in the near-term, possibly as low as the $220 region. If so, I would expect to see buyers begin to step in and confirm the support level if not another move higher. The bottom line, a pullback in Clorox is your chance to buy.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.