The Analysts Are Leading The Market Higher

The analyst's upgrades keep rolling in and they are leading the market higher. The good news is that results continue to outpace the analyst's consensus estimates which means the upgrades will keep coming in. Among the latest news is warming sentiment in regards to three companies if for different reasons. In the case of Broadcom, the analysts are supporting a trend that has been in place since before the pandemic began. In the cases of Boeing and Lyft, we're seeing the first glimmers of a rebound that could result in high double-digit gains for investors.

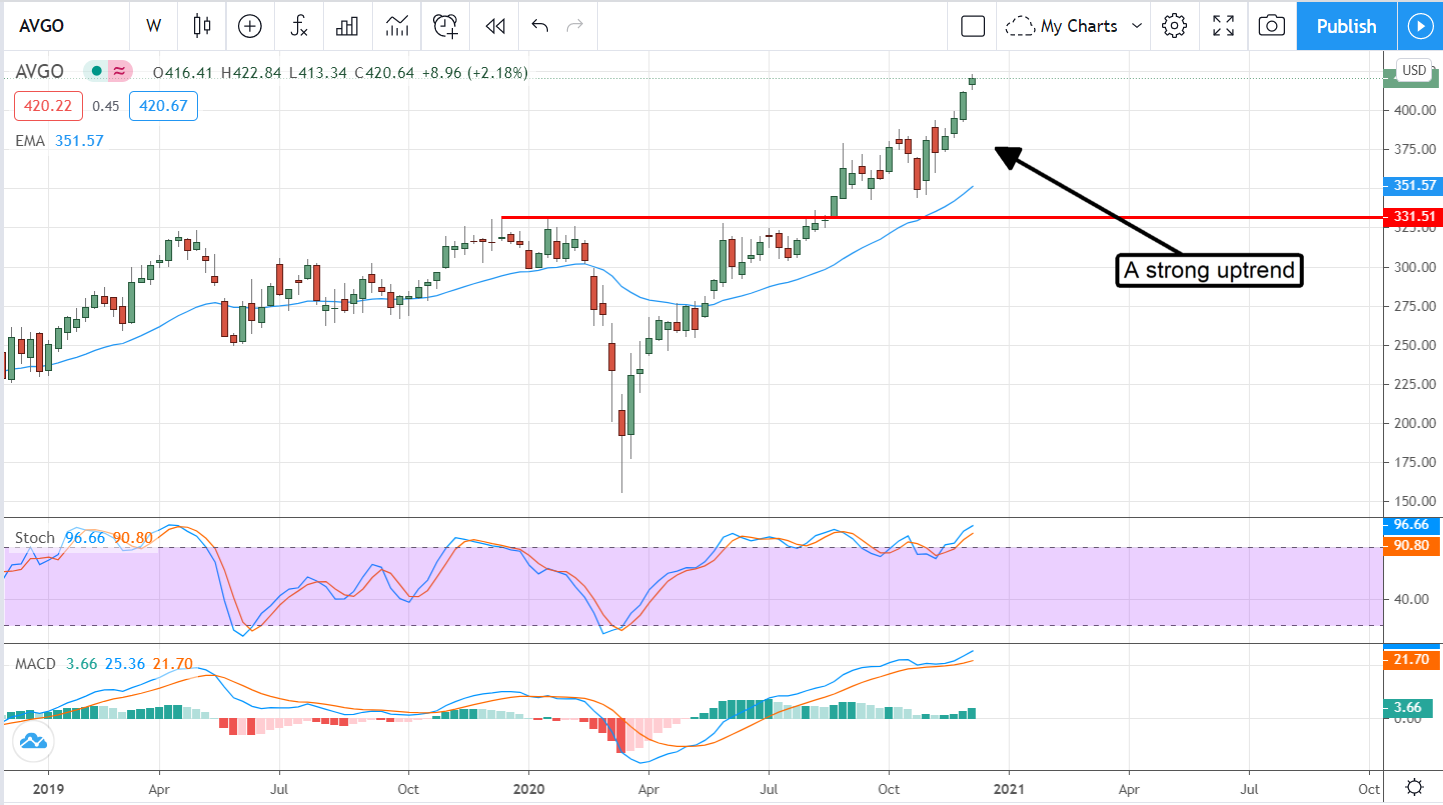

Broadcom (NASDAQ:AVGO) is slated to report earnings after the bell on December the 10th and the analysts can’t wait. Not one but three analysts came out on Monday with positive commentary and/or price-target upgrades that suggest more upside is coming for this stock. Bank Of America is perhaps the most notable after adding the stock to its US 1 List. The US 1 List is Bank Of America’s list of best investment ideas in the buy-rated US market.

Evercore ISI and Morgan Stanley both maintained their buy-ratings but upped the price target to a consensus of $445 or about 6% upside. Between them, they make a case for the coming 5G revolution and the Apple upgrade-cycle that will coincide with it. As for the Q3 earnings report? The company is expected to post over $6.40 billion in revenue for the quarter which is up 11% on a YOY basis with a slightly more-robust increase in earnings. Longer-term, revenue and EPS growth is expected to run in the low double-digits for the next couple of years.

On a valuation basis, the stock is trading about 18X this year’s earnings with a high expectation the company will outperform the consensus. Looking forward, the company’s valuation declines to about 15X earnings in 2022 which is quite reasonable for a growing company that yields more than 3.10%. The dividend is relatively safe, the company has a history of distribution increases and no red flags on the balance sheet to keep you up at night. Regarding the increases, Broadcom has been aggressively increasing the payout and that is expected to continue as well if at a lower rate than the 55% CAGR is currently boasts.

Boeing Is About To Explode Higher

Boeing (NYSE:BA) has not one but two tailwinds of gale-force strength about to lift its share prices to new highs. Not only is the 737-MAX been cleared for use by the FAA but there is a healthy dose of good vaccine news as well. The combination means that 1) the company’s top-selling jet is back on the market and 2) people are going to start flying again. So that’s why UBS decided to upgrade the stock.

UBS analyst Myles Walton says the cash flow estimates for Boeing have moved materially higher, as the company expects advances coming back faster with 50 or more per month of production on the 737 "in a supply-constrained world post-2021/22 as leisure, domestic and low-cost carrier-centric demand recovers the fastest and affords a continued path of production growth."

The average analyst’s estimate is a hold but the bias has shifted over the past 90 days. The shift is due to two neutrals turning bullish and two new ratings initiated at a buy. The consensus target is about even with recent price action but the high-price target implies about 26% upside.

Lyft Gets A Lift From Big Upgrade

The analysts at Piper Jaffray see a major opportunity developing in Lyft (NASDAQ:LYFT). They upped the ride-share app’s rating from Neutral to Overweight and gave it a price target of $61 or 30% upside from recent price action. They see the company’s cost-cutting efforts setting it up for a significant EBITDA boost as the company recovers from the pandemic. Lyft has been able to deliver improving EBITDA despite falling revenue providing a lever to earnings once revenue rebounds and growth resumes.

The average analyst rating is a buy but the consensus target is closer to $48 than it is to $61. Looking at the chart, $61 looks entirely possible but there is a hurdle in the way. The $50 level could keep prices in check as it has been a point of strong resistance in the past. MACD is in the bull’s favor, however, showing convergence with the recent rally and indicative of strength. This, coupled with the recently confirmed double-bottom reversal, suggest price action could be up near $80 before too long.

Before you consider Broadcom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadcom wasn't on the list.

While Broadcom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.