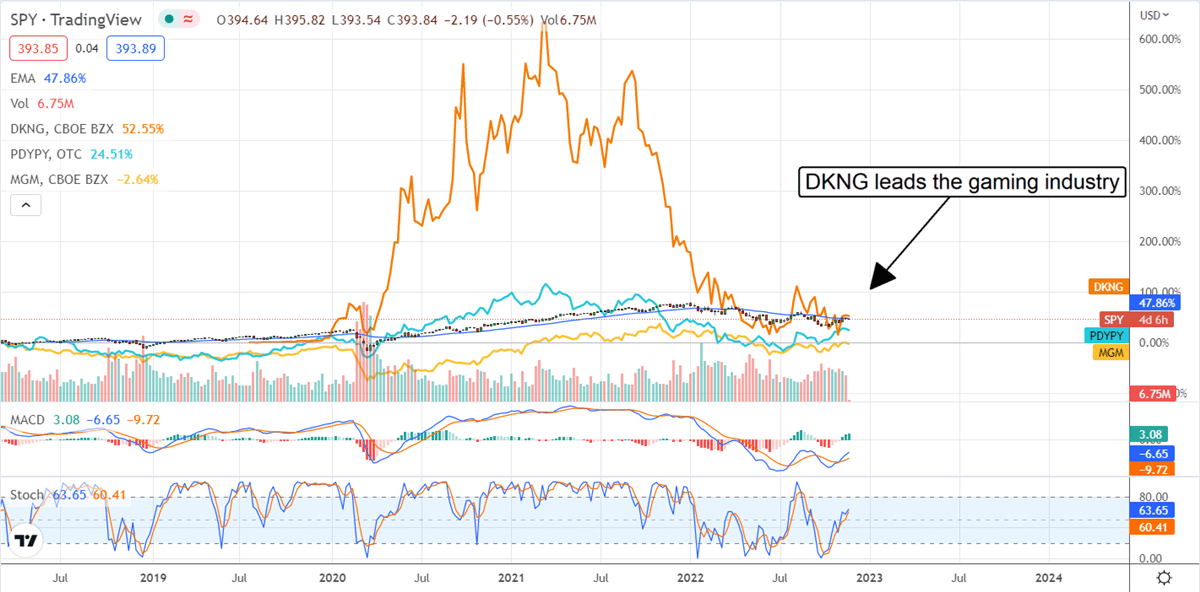

The online gambling industry is the 10th hottest industry in the US in 2022 and that is saying something. This industry is small at roughly $11 billion in value but growing rapidly and up 45% on a YOY basis as of late November. The industry is expected to continue to grow at a high-double-digit CAGR for at least the next 5 years as well, driven by expanding legalization and deepening penetration of existing and new markets. The real takeaway, however, is that this industry is expecting to see an increasing level of profitability as it grows due to leverage of scale and less need for promotional activities. What this means for investors is a chance to get into the industry leaders now, while their share prices are still at today’s lower prices.

Flutter Entertainment, The Market Leader Worldwide

Flutter Entertainment (OTCMKTS: PDYPY) is the largest digital gambling company that matters for U.S. investors. This UK-based company has operations in North America (Fanduel), the UK, Australia, and internationally where allowed and commands more than 42% of the US market share. The company is an integrated operator which means it provides platforms for gaming both for in-house operations and B2B services.

The company's platforms are end-to-end solutions for brands that want to add gaming to their offerings and include front and back-house operations. The only drawback to the stock is that US investors have to buy the stock on OTC Markets. There are 7 analysts rating the stock and they have it pegged at a Moderate Buy with no price target. Flutter Entertainment itself is predicting 5X growth for its Fanduel segment as the industry matures.

Draftkings, Taking The Market By Storm

Draftkings (NASDAQ: DKNG) is another integrated operator with its business centered in North America. Draftkings is the 2nd largest market share in the US and slowly creeping up on its larger competitor. This stock is listed on the NASDAQ Exchange so there is slightly less risk in that regard. As for the outlook, this company is growing by a high-double rate and it has been accelerating in 2022. The latest news is the launch of operations in Maryland which is expected to happen ahead of the Thanksgiving holiday. The analysts at Piper Jaffrey initiated coverage following the news with a rating of Outperform compared to the consensus of Moderate Buy. Their target is predicting at least 40% of upside from the $15 level and that is not the highest target out there. Some recently set targets add another 50% or more to the Piper Jaffrey target and that is following an analyst reset that occurred earlier in the year.

MGM Resorts Bets On Digital Gaming

MGM Resorts (NYSE: MGM) has thrown its hat into the ring by opening its own online gaming platform, BetMGM. The platform is the 3rd largest by market share in the US and commands a combined 39% alongside its slightly larger rival Draftkings. This gaming platform is available in 14 jurisdictions, less than DKNG, but that number is growing. As it is, BetMGM is about 10% of MGM Resorts' net annual revenue and a significant driver of growth and margin for the business. Current plans are to extend operations into New York and Japan which would boost growth in the segment by high double to triple digits.

Before you consider DraftKings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DraftKings wasn't on the list.

While DraftKings currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.