Fast-casual restaurant chain

Denny’s, Inc. NASDAQ: DENN stock has been in a steady downward spiral since peaking off it $19.99 post-pandemic peak. Restaurant stocks are facing the fear of more regional capacity and lockdowns on fears of the rapidly spreading Delta variant of the

COVID-19 virus despite the acceleration of

vaccinations. Capacity restrictions would be a death blow to many

restaurants as they are experiencing supply chain issues, rising food costs, and a labor shortage. Restaurants are the true epicenter of the pandemic and the resurgence of COVID fears has been causing a sector-wide sell-off for months. Shares are severely underperforming the

S&P 500 index NYSEARCA: SPY as it continues

making new highs. Denny’s is approaching value play levels again turning is

nasty sell-off into an opportunity for prudent investors seeking exposure in a recovery.

Q1 FY 2021 Earnings Release

On May 4, 2021, Denny’s reported its Q1 2021 earnings for the quarter ended in March 29, 2020. The Company reported earnings of $0.01 per share versus consensus analyst estimates of $0.02 per share, a (-$01) miss. Revenues fell (-16.6%) year-over-year (YoY) to $80.6 million versus $77.63 million analyst estimates. Domestic same-store-sales (SSS) fell (-20%) compared to 2019 and (-9.7%) compared to 2020. The Company opened three franchised restaurants including two international locations. Adjusted free cash flow was $5.2 million. Adjusted EBITDA was $11.8 million.

Denny’s CEO John Miller commented, “We entered 2021 confident in the resilience of Denny's given the strength of our franchisees and team that continues to persevere and deliver a great experience to our guests. Our initial optimism is now being supported by sequential sales improvements, as our dining rooms have reopened in various capacities with the increase of vaccine distributions. The easing of dine-in restrictions, coupled with fiscal stimulus and the rollout of our new virtual brands, have resulted in our same-store sales trending toward pre-pandemic levels."

Conference Call Takeaways

Denny’s CEO Miller set the tone, “We are simply delighted to see the return of guest charge dining rooms. We are still the place where people can come in, sit down and connect with one another of a great food, but also place with a continued focus on the health and safety of our guests, employees and suppliers.” Sales are returning to April 2019 pre-COVID levels. The Company is balancing labor shortage disruption. Denny’s is focused on safety, value, and comfort. He detailed the rollout of virtual brands, “Turning to virtual brands, I'm excited to say that, we substantially completed our rollout of The Burger Den in April. This concept allows us to focus on one of our strengths, great burgers, with new varieties using ingredients already in our pantry, and during testing we established the success criteria of a sales $650 per week per restaurant.” He elaborated, “And our second virtual concept called The Meltdown is a DoorDash exclusive brand that features handcrafted sandwich melts with fresh ingredients and unique flavor combinations. While this brand is able to utilize approximately 70% of the items currently in our pantry, our innovative culinary team has crafted new crave-able products with premium ingredients, such as slow-smoked brisket burnt ends. Test results have been similarly encouraging for The Meltdown and over half of our domestic locations will be launching during the second quarter. In fact, we've already launched over 175 locations and an additional 175 expected to launch this week. These brands provide opportunities not only dinner and late-night to leverage underutilized labor and kitchen space, but we are also seeing a meaningful number of transactions during the week versus the weekend.”

Denny’s Price Trajectories

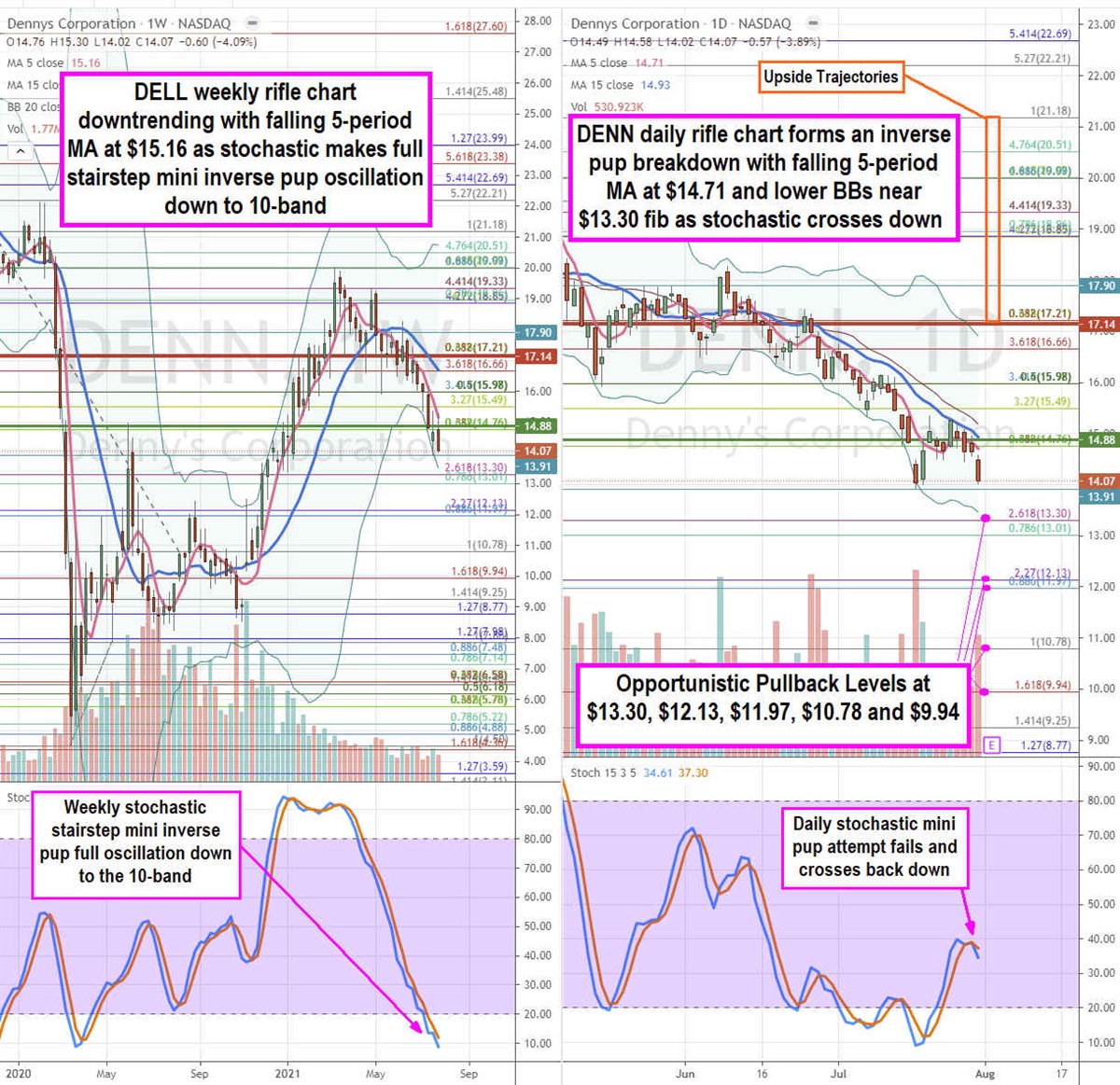

Using the rifle charts on the weekly and daily times frames enable a precision view on the price action for DENN stock. The weekly rifle chart is in an active downtrend after peaking off the $19.99 .93 Fibonacci (fib) level. It triggered a weekly market structure high (MSH) sell trigger on the breakdown through $17.14. The weekly 5-period moving average (MA) resistance is falling at $15.16 with lower Bollinger Bands (BBs) near the $13.30 fib. The weekly stochastic has formed a full oscillation down in a stairstep mini inverse pup towards the 10-band extreme oversold area. The daily rifle chart formed another pup breakdown with falling 5-period MA at $14.71. The stochastic failed its mini pup attempt and instead crossed back down. The daily market structure low (MSL) buy triggers on a breakout above $14.88. This is a very bearish chart which needs time to base as the whole restaurant sector is experiencing a sell-off. Prudent investors can watch for opportunistic pullback levels at the $13.30 fib, $12.13 fib, $11.97 fib, $10.78 fib, and the $9.94 fib. Upside trajectories range from the $17.21 fib to the $21.18 fib level.

Before you consider Denny's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Denny's wasn't on the list.

While Denny's currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.