Satellite radio provider

Sirius XM Holdings Inc. NASDAQ: SIRI stock has been a steady performer continued to grow top-line during the

pandemic but should see a boost from the

reopening trend. With over 40 million subscribers consisting of Sirius XM and Pandora subscribers, Sirius is the only publicly traded satellite radio company with no other satellite radio competitors. The Company has managed to grow top-line during the pandemic despite margins hurting. Growth has returned to the Company as the reopening gets underway and commuters are returning to offices as indicated by the 5% YoY growth in the Q1 2021 earnings. The Company should bolster growth from as the global chip shortage

relieves itself and

automobile sales continue to speed up. The

acceleration of

COVID vaccinations and return to the new normal are tailwinds to drive both top and bottom lines for the Company. Prudent investors wishing to take a position can watch for opportunistic pullback levels.

Q1 FY 2021 Earnings Release

On April 28, 2021, SiriusXM released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) profit of $0.07 excluding non-recurring items versus consensus analyst estimates for a profit of $0.05, a $0.01 beat. Revenues grew 5.4% year-over-year (YoY) to $2.06 billion, beating analyst estimates for $2 billion. Sirius Self-Pay net additions grew 83% YoY to 126,000. Q1 included a $220 million in non-cash impairment charge due to the failure of it’s SXM-7 satellite, not reflecting any potential insurance recoveries. The average revenue per user (ARPU) rose 7% to $14.30 per month.

CEO Comments

SiriusXM CEO Jennifer Wiz stated, “I am pleased to announce SiriusXM has started the year impressively. We added 126,000 self-pay net subscribers, an 83% increase as compared to the period a year ago, saw a first quarter record-low churn rate of 1.6%, and are reporting a new record-high quarterly adjusted EBITDA figure. These strong results reflect the value we bring to our listeners through the breadth and depth of our content. Our advertising revenue grew 24%, driven by robust monetization of both on- and off-platform opportunities, as well as the growing podcast market. While we are benefiting from the broader reopening of the economy and the acceleration of consumers' digital adoption, the meaningful long-term investments we've been making are also paying off. This includes creating and delivering compelling content, strengthening our digital product experiences, and scaling a full suite of end-to-end distribution and monetization solutions for content creators and publishers. We are extremely focused on achieving our 2021 goals and reinforcing our long-term position as North America's premier audio entertainment company,”

Reaffirms Full-Year 2021 Guidance

SiriusXM reaffirmed full-year 2021 revenues of $8.35 billion versus $8.41 consensus analyst estimates. The Company estimates full-year 2021 Self-Pay subscribers net additions around 800,000.

Conference Call Takeaways

SiriusXM CEO, Jennifer Wiz set the tone, “ Like many companies, we are benefiting from Americans getting back on the road, growing auto sales and consumer incomes bolstered by significant federal stimulus… SiriusXM is the premier audio entertainment company in North America. Across our properties, approximately 150 million users regularly listen to our content, much of it is premium, unique, and expertly curated, covering everything from music to talk, news, sports, comedy and podcast.” CEO Wiz pointed out that the Company experienced a record low churn of just 1.6% and revenue growth of 5% driven by the rebounding advertising market. The Company also achieved the highest quarterly EBITDA in Company history of $687 million, up 7%. Automotive SAAR was up 14% YoY led by 17.7 million in March. The only thing holding back is the global chip shortage affecting automakers. She noted the Sirius is no longer a one-way network, especially with 360L which is employed in over 2 million automobiles so far, “The 2-way functionality and advanced UI enabled by 360L opened up a host of engaging features for consumers and new capabilities for our business. We are also utilizing consumption data from 360L to help optimize our one-to-one marketing efforts to drive better conversion, retention and pricing.”

SIRI Opportunistic Pullback Levels

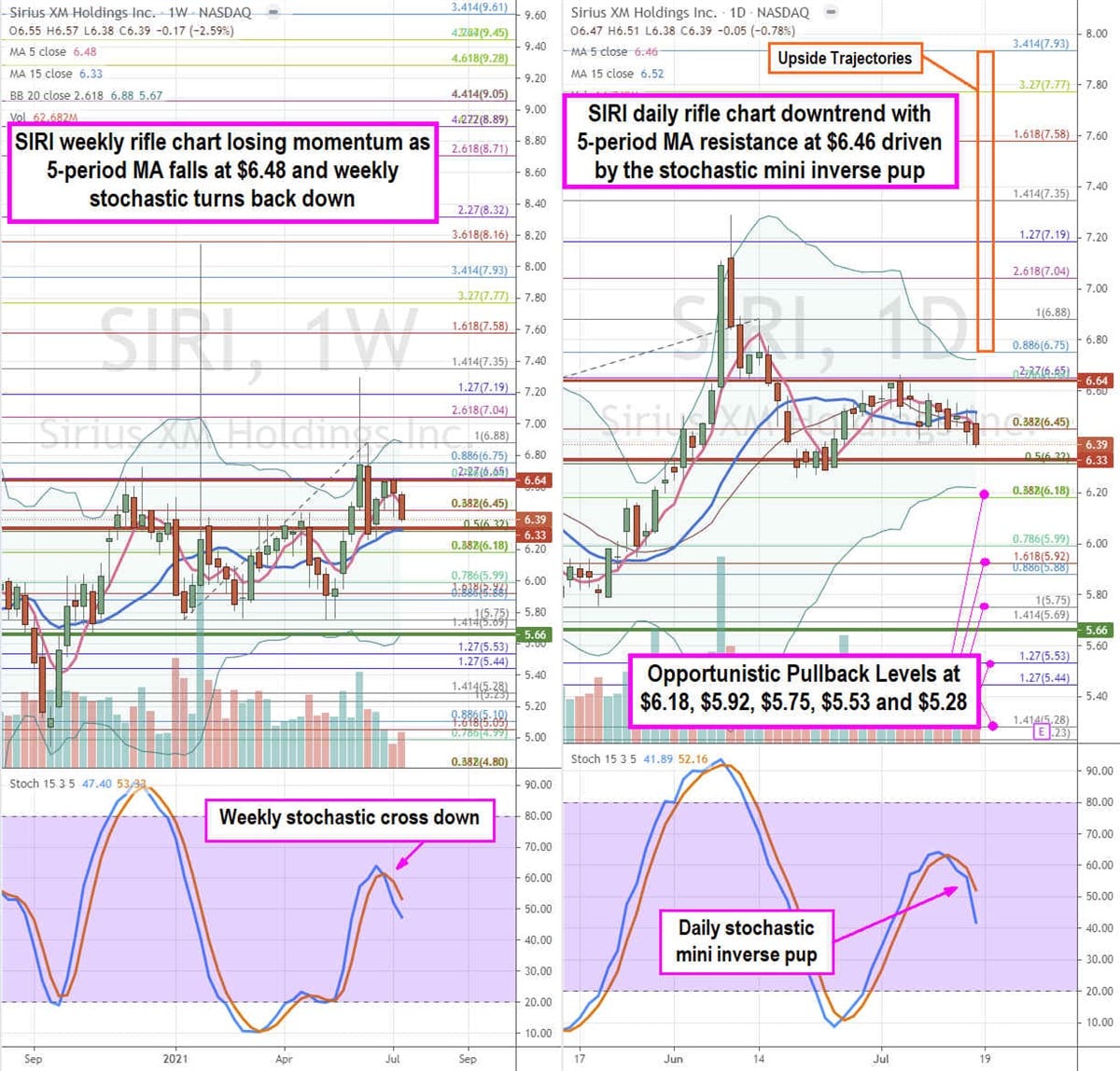

Using the rifle charts on the weekly and daily time frames enables a precision view of the playing field. The weekly rifle chart is losing momentum as the 5-period moving average (MA) support is now falling towards the 15-period MA at $6.33. The weekly market structure high (MSH) sell triggers under $6.39. The weekly stochastic has crossed back down off the 65-band. The weekly upper Bollinger Bands (BBs) rest near the $6.88 Fibonacci (fib) level. The weekly market structure low (MSL) buy triggered above $5.66, which makes it a line in the sand for bulls to defend. The daily rifle chart is in a downtrend with the falling 5-period MA resistance at $6.46. The stochastic mini inverse pup indicates potential downside to the daily lower BBs near the $6.18 fib. Prudent investors can monitor for opportunistic pullback levels at the $6.18 fib, $5.92 fib, $5.75 fib, $5.53 fib, and the $5.28 fib. Upside trajectories range from the $6.75 fib up towards the $7.93 fib.

Before you consider Sirius XM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sirius XM wasn't on the list.

While Sirius XM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.