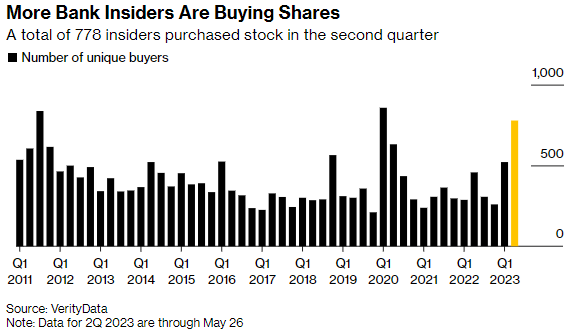

Executives at US banks are aggressively loading up on shares of their companies at the highest rate since the pandemic struck in 2020, a signal that the industry may be turning a corner following the collapse of large players like Silicon Valley Bank and First Republic Bank.

Despite lingering volatility in regional banks, as tracked by the SPDR S&P Regional Banking ETF NYSE: KRE, the significant insider buying suggests plenty of upside for those betting on a banking recovery.

According to Bloomberg and VerityData, the surge of bank insider buying recently is only rivaled by the COVID-19 pandemic in recent history.

Are Banks Recovering?

Corporate insiders tend to buy company shares when the stock price declines. It's a well-known pattern, so does it indicate an "all-clear" signal for banks, or are they just falling victim to anchoring bias?

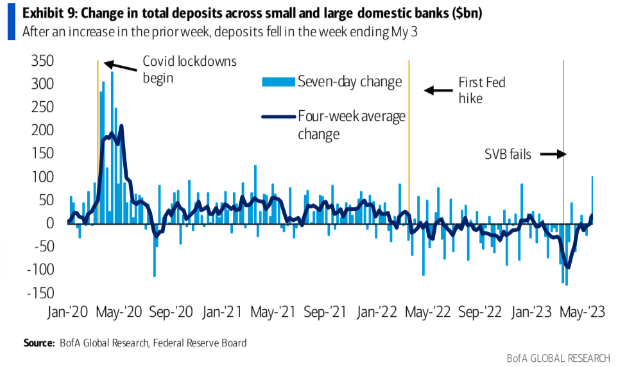

Bank assets and deposits rose for two consecutive weeks following two weeks of declines. Rapid deposit outflows caused the banking crisis in March, so deposit improvements are a very bullish signal.

And according to a recent Bank of America report, lending is largely unchanged, showing no sign of the credit contraction many investors feared as multiple banks failed.

But deposits are still under threat due to rising interest rates. High yields from money market funds, which are seeing strong inflows, are compelling banks to increase deposit interest rates to remain competitive. Wealthy depositors, in particular, are expected to continue migrating to better yields until the Federal Reserve halts its rate hike campaign.

In addition, US regulators are slated to propose new regulatory capital rules for larger banks, forcing them to increase capital requirements by roughly 20%. Then there’s also the iceberg that is commercial real estate exposure.

Overall, conditions are improving but are not "back to normal." However, with regional banks trading at the same levels as post-SVB, shares are beginning to look much more attractive as things stabilize. Most regional banks sell for less than tangible book value, leaving much room for error.

A (Potentially) Safe Play: Cullen Frost Bankers

Texas-based Cullen Frost Bankers NYSE: CFR is a cult favorite among the "compounder" crowd. The conservative management and sustained healthy return on equity has led the stock to trade at a hefty premium to its peers but for a good reason.

However, even a conservative bank like CFR couldn’t avoid contagion from the banking crisis, and its stock is down 20% since the start of March.

Since the start of the banking crisis on March 10, several executives and directors at CFR have made significant purchases, including the CEO's $1 million investment, as well as the Chief Credit Officer's recent $100,000 acquisition.

Frost is a straightforward recovery play on the banking sector. For those that think regional banks have gotten too beat up and want to play a bounce with a conservative stock, Cullen Frost Bankers NYSE: CFR is among the best choices.

Check out MarketBeat's MarketRank Forecast for Cullen Frost Bankers:

A Potential Double: Dime Community Bank

Dime Community Bank NASDAQ: DCOM is a New York-based microcap community bank with a $678 million market cap. It's the biggest community bank in Long Island, New York. It has the largest non-interest-bearing deposit base in the area as well.

Of course, having a large share of non-interest-bearing deposits is a great thing when there's no banking crisis afoot. Still, this fact explains the adverse performance of the stock, declining 44% since the start of March.

Dime lost about 11% of its non-interest-bearing deposits between Q4 2022 and the end of Q1 '23, or $397 million. However, its interest-bearing deposits went up $714 million during the same period. So while the bank's cost of capital indeed increased, deposit outflows have been a manageable problem for it.

The bank pays a 5.72% dividend while trading at just 0.74x tangible book value, representing a significant bargain.

Dime stock has been the subject of a cluster insider buy, with four members of the board of directors buying shares within the last three weeks. Relative to the company size, the insider buying activity in Dime Community Bank NASDAQ: DCOM is some of the strongest among all regional banks.

Check out MarketBeat's MarketRank Forecast for Dime Community Bank:

Before you consider Dime Community Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dime Community Bancshares wasn't on the list.

While Dime Community Bancshares currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report