Mobile social gaming platform

Zinga NASDAQ: ZNGA stock has been hitting record highs on the success of its gaming apps. The growth in both revenues and daily active users (DAU) can be attributed to the stay-at-home mandates triggered by COVID-19

pandemic in 2020 along with its acquisition strategy and partnerships with popular social media platforms like

Snapchat NASDAQ: SNAP and entertainment giant

Walt Disney NYSE: DIS. The momentum from eSports,

online sports betting and

iGaming has been a boon to stocks like

DraftKings NASDAQ: DKNG,

Activision Blizzard NASDAQ: ATVI and

Penn National Gaming NASDAQ: PENN larger expansion. However, the climate for mobile sportsbooks and iGaming has completely changed as cash strapped states leave no stone unturned for tapping potential tax revenues streams. While the Company has not mentioned any intent to pursue iGaming, the potential to do so adds an extra premium not yet factored into the shares. Prudent investors seeking an untapped iGaming player with an established distribution base may consider monitoring shares of Zynga for opportunistic pullback levels for exposure.

Q3 FY 2020 Earnings Release

On Nov. 4, 2020, Zynga released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) loss of (-$0.11) excluding non-recurring items versus consensus analyst estimates of $0.09, a (-$0.20) miss. Revenues rose 45.8% year-over-year (YoY) to $503.33 million smashing analyst estimates for $453.67 million. The Company expected Q4 2020 EPS loss of (-$0.09) and upside revenues of $570 million versus $521.43 million consensus estimates and full year revenues of $1.92 billion versus $1.84 billion consensus estimates.

Conference Call Takeaways

Zynga CEO, Frank Gibeau, set the tone, “In Q3, we delivered strong results ahead of our guidance across all key financial measures, including our highest ever quarterly revenue and bookings with revenues of $503 million, up 46% YoY and bookings of $628 million, up 59% YoY. We also delivered our best Q4 operating cash flow of $113 million, up 65% YoY.” The social slots portfolio marked its best quarter in Q3, with Hit it Rich! Slot and Game of Thrones Slots Casino as well as record performance from Words With Friends, CSR 2 and Casual Cards portfolio and Empires & Puzzles. At the end of the quarter, Zynga launched Harry Potter: Puzzles & Spells worldwide and expects it be to a “meaningful growth” driver in 2021 and beyond. The Company grew international revenues and bookings by 44% and 49% YoY. Gibeau summed it up, “The global proliferation of high-end smart devices is shifting the entertainment landscape towards mobile games. Players across genders, geographies and generations are drawn by the ever increasing opportunities to socialize with friends and make new connections anywhere and anytime.” The Company integrated the Rollic acquisition on October 1, 2020. Rollic accommodates the hyper casual gaming segment releasing up to 12 titles a month. The Company hit a record breaking 31 million mobile daily active users (DAU) and 83 million monthly active users (MAU) in Q3 2020.

iGaming Legalization Trend

Online gambling is becoming a reality with more states joining the trend. The new term of online gambling is iGaming, sounds more innocent. On Jan. 29, 2021, the state of Michigan became the third state in the U.S. to approve iGaming, behind New Jersey and Pennsylvania. The casino games are legal and regulated by the respective state gaming control boards currently available for the residents. However, interstate shared liquidity pools are being worked on by various venders enabling approved iGaming states to connect jackpots and participation. The catalyst of the spread of legalization of digital sportsbooks and iGaming may provide additional tailwinds in case the Company decides to pick up where it left off in 2013. Zynga had originally planned to get gambling licenses in Nevada in 2013 to transform its dominant free online poker gaming platform into a real money gambling but threw in the towel after efforts failed.

<><> insert ZNGA-chart1-labelled graphic <><>

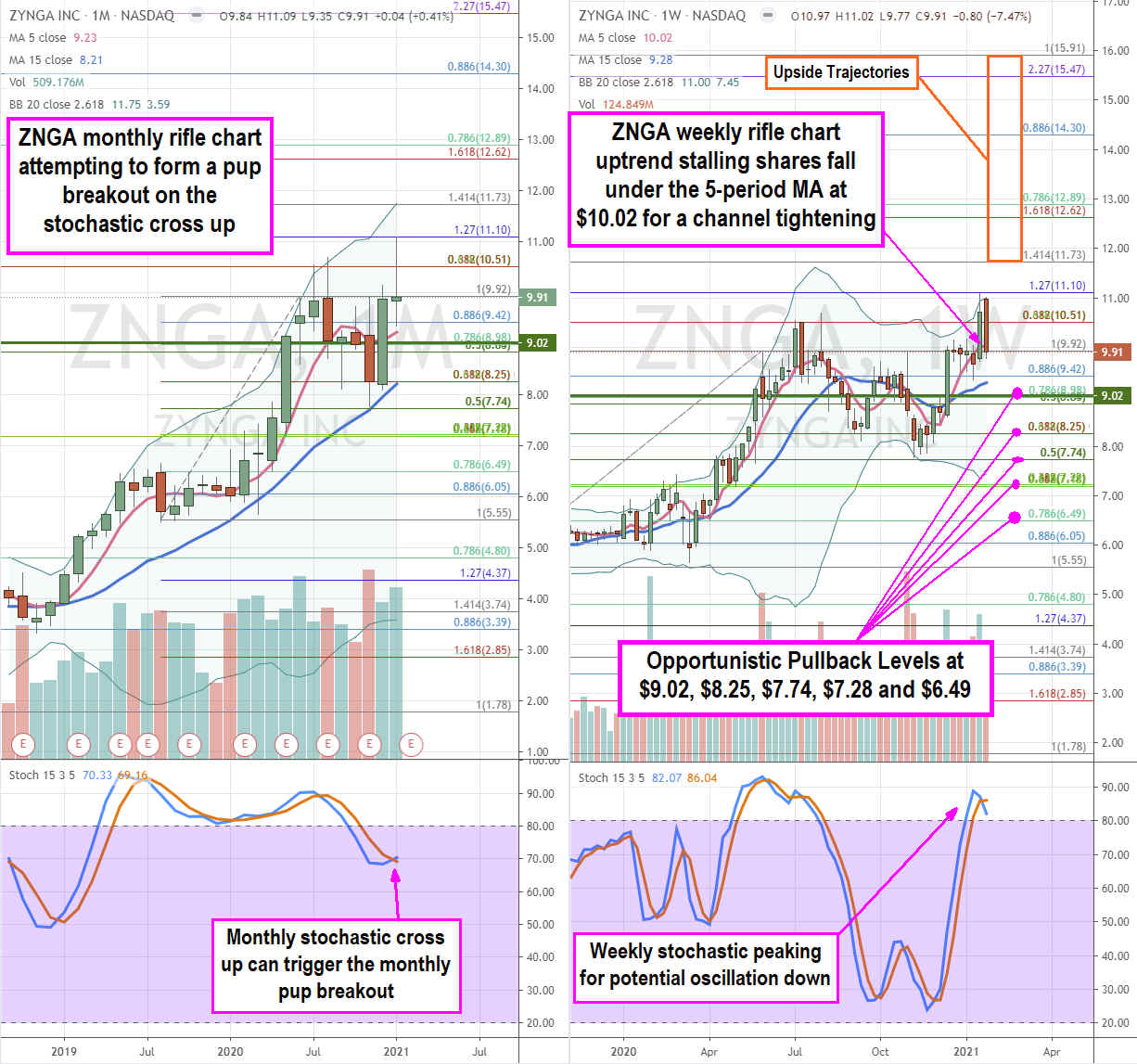

ZNGA Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field for ZNGA shares. The monthly rifle chart has a potential powerful pup breakout upon confirmation of the monthly stochastic crossover up as the monthly 5-period moving average (MA) attempts to hold at $9.23. The monthly 15-period MA overlaps the $8.25 Fibonacci (fib) level. The monthly upper Bollinger Bands overlap the $11.73 fib setting the initial upside target on the monthly pup breakout. However, the weekly rifle chart stalling out as the stochastic peaked above the 80-band. The weekly 5-period MA support sits at $10.02 with 15-period MA support at $9.28. The weekly rifle chart triggered a market structure low (MSL) buy signal above $9.02. A weekly stochastic crossover back down under the 20-band can present opportunistic pullback levels at the $9.02 weekly MSL trigger, $8.25 fib, $7.74 fib, $7.29 fib, and the $6.49 fib. The upside trajectories range from the $11.73 monthly upper BB/fib up towards the $15.91 fib level.

Before you consider Zynga, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zynga wasn't on the list.

While Zynga currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.