Chinese electric vehicle (EV) maker

NIO NYSE: NIO stock has fallen (-25%) year-to-date (YTD) as the

Nasdaq sell-off combined with

semiconductor chip shortage and China tensions mount a perfect storm of negative sentiment. Shares reached all-time highs of $66.99 on Jan. 11, 2021, as the height of the

EV momentum surge. However, a reckoning has hit

EV makers as markets reprice these companies closer to reality amid the hype and speculation of future potential. With the exception of

Tesla NASDAQ: TSLA and the major

U.S. automakers General Motors NYSE: GM and

Ford NYSE: F, most start-up

U.S. EV makers have yet to go into full scale production. Sentiment turned bearish and markets await with a ‘show me’ attitude. Selling also hit its peers

Xpeng NYSE: XPEV and

Li Auto NYSE: LI shares. Risk tolerant investors looking for a recovery Chinese EVs can monitor opportunistic pullback levels on NIO shares to cautiously scale in exposure.

Q4 2020 Earnings Release

On March 1, 2021, NIO released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported revenues of $1.018 billion, up 132% year-over-year (YoY). Gross profits were $175 million and gross margins were 17.2%, up from (-8.9%) YoY. Adjusted net loss was (-$0.14) or (-$203.2 million). The Company ended the quarter with $6.5 billion in cash, cash equivalents, restricted cash, and short-term investments. Vehicle deliveries for January and February 2021 were 7,225 (up 352% YoY) and 5,578 (up 689% YoY), respectively. Total vehicles delivered reached 88,444.

Conference Call Takeaways

NIO CEO, William Li, expounded on Battery-as-a-Service (BaaS), “NIO is devoted to building an innovative model of battery vehicles operation and battery subscription with chargeable, swappable, upgradeable batteries as well as providing holistic power solutions to users… In February 2021, the take rate of BaaS among NIO orders has reached 65%. We believe BaaS and NIO’s holistic charging and swapping service system can accelerate the conversion from ICEs to the EV.” He noted that production capacity reached 7,500 units in January and further capacity expansion is underway at the Hefei plant with partner JAC. The Company plans to expand annual production capacity to 150,000 units under a single shift and 300,000 units under two shifts. The Company also entered into a collaboration agreement with the Hefei government to jointly plan and construct the, “Xinqiao Smart Electric Vehicle Industrial Park, including R&D and manufacturing, pilots demonstration, and industrial supporting services, and build a world-class smart electric vehicle industry cluster with full-fledged industry value chain.” NIO has grown its sale and service network to 23 NIO Houses and 303 NIO Spaces in 121 cities in China with plans to add 20 new NIO Houses and 120 new NIO Spaces in 2021. The Company built 191 battery swap stations in 76 cities and plans to deploy the Power Swap Station 2.0 in Q2 2021 to ramp-up to 500 stations in 2021. The super charging network currently has 127 power charging stations and over 1,700 chargers which it plans to expand to 600 charting stations and 15,000 chargers by year’s end 2021. NIO has 31 new service stations and 158 authorized service centers, which it plans to expand as well.

Semiconductor Shortage

On March 26, 2021, NIO announced a production halt and cut its vehicle delivery figures due to the global chip shortage. The Company will temporarily suspend vehicle production in the JAC-NIO manufacturing play in Hefei for five working days starting March 29, 2021. This prompted NIO to cut its vehicle delivery estimates for Q1 2021 to approximately 19,500 vehicles, down from 20,000 to 20,500 vehicles as previously estimated. The Company confirmed it had enough supplies to meet Q1 2021 demand, but further concerns regarding supply chain disruptions for Q2 2021 continue to linger making investors nervous. The EV stock sell-off presents opportunistic pullback levels for risk-tolerant investors to cautiously gain exposure in NIO shares.

NIO Opportunistic Pullback Levels

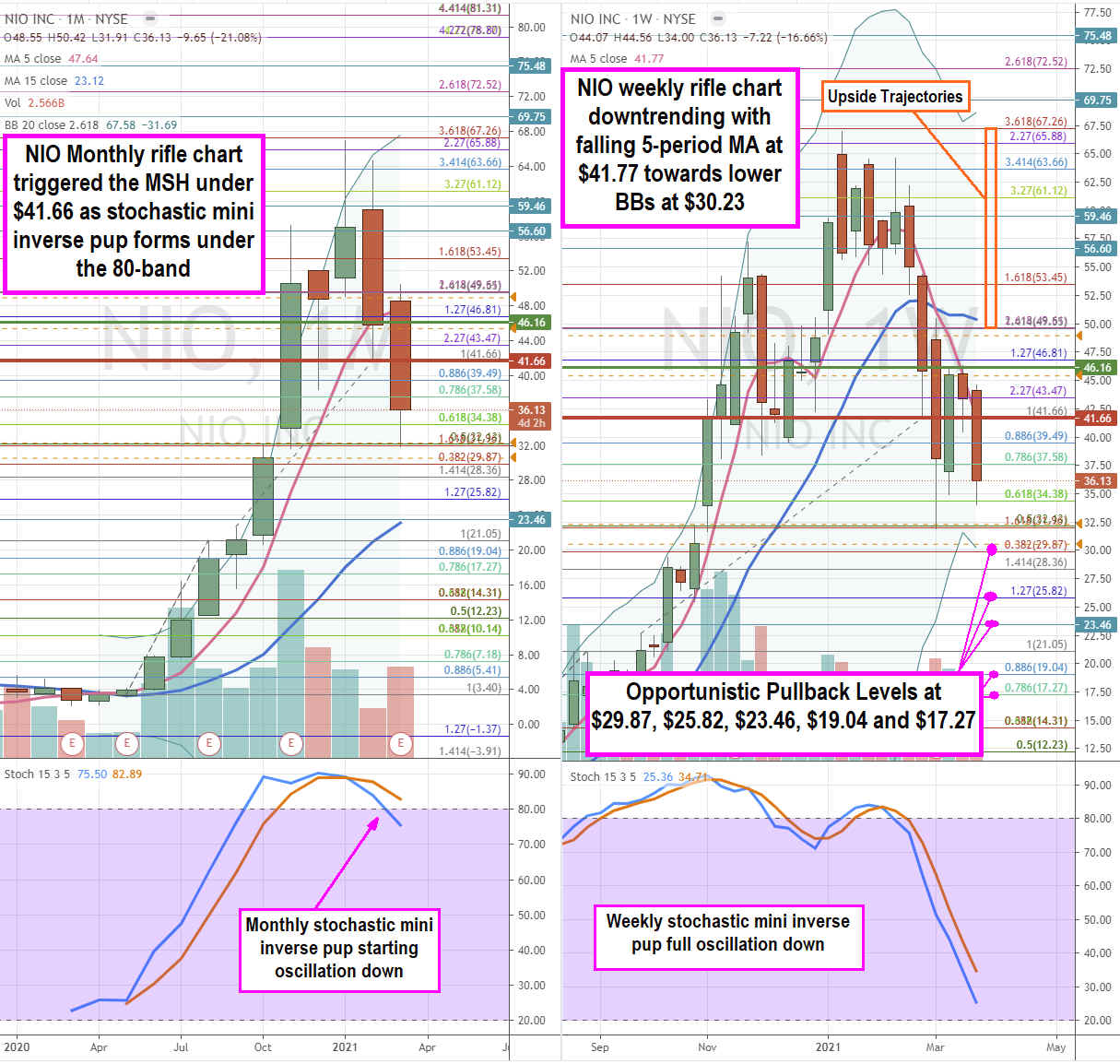

Using

the rifle charts on the monthly and weekly frame provides a broad view of the landscape for NIO stock. The monthly rifle chart uptrend peaked near the $67.26

Fibonacci (fib) level. As shares fell sharply to the $32.46 fib, the monthly 5-period moving average (MA) has stalled at $47.64 driving the monthly stochastic to mini inverse pup down through the 80-band. The weekly

market structure low (MSL) buy triggers above the $46.16, but the monthly market structure high (MSH) triggered under the break of $41.66. The weekly rifle chart has been in a downtrend with a falling 5-period MA at $41.77 powered by the weekly mini inverse pup oscillation down that targets the weekly lower Bollinger Bands at $30.23. Prudent traders can monitor

opportunistic pullback levels at the $29.87 fib, $25.82 fib, $23.46 fib, $19.04 fib, and the $17.27 fib. Keep an eye on Chinese EV peers XPEV and LI as they move together. Upside trajectories range from the $49.65 fib up towards the $67.2Before you consider NIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIO wasn't on the list.

While NIO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.