Big three U.S. automaker General Motors NYSE: GM stock is rebounding despite concerns of the global chip shortage. The behemoth is also further migrating towards electric vehicles (EV) and electric charging solutions as evidenced by the recent post-earnings conference call. The Company missed top-line estimates largely due to global semiconductor shortage and supply chain issues affecting supply despite extraordinary demand. General Motors is transforming itself from automaker to a platform innovator according to its CEO Mary Barra. Its Orient assembly and factory 0 plants have been transformed from building gas-powered autos to EVs. It’s developing level 4 autonomous driving with a portfolio of 20 startup businesses. Its recruited talent with heavy experience in digital transformation and deep experience in IT, e-commerce, cybersecurity, software development, and venture capital. The Company is outfitting electrification of its most popular models including Hummer, Cadillac, and Silverado EVs. Prudent investors looking for exposure in the future of mainstream EVs can look for a pullback in General Motors shares.

Q3 FY 2021 Earnings Release

On Oct. 27, 2021, General Motors released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $1.52 excluding non-recurring items versus consensus analyst estimates for $0.98, a $0.54 beat. Revenues fell (-24.5%) year-over-year (YoY) to $26.78 billion missing consensus analyst estimates for $27.8 billion. Margin was 10.9%. The top-line miss was largely due to the global chip shortage impacting supply, not demand. The Company guided in-line as it see full-year fiscal 2021 EPS between $5.70 to $6.70 versus $6.22 consensus analyst estimates. The Company believes it will reach the high end of its guidance with adjusted EBIT in the range of $11.5 billion to $13.5 billion, above the $10 billion to $11 billion estimate from February 2021.

Conference Call Takeaways

General Motors CEO, Mary Barra set the tone. “After spending time with our leaders and subject matter experts, I hope it's clear to you that we have assembled the right technology to have the right platforms and we have the right talent to achieve our long-term goals, including doubling our annual revenue and expanding our margins. Our confidence comes from the fact that we are already making significant progress in transforming GM, from a traditional automaker to really a platform innovator. You can see it in the conversion of the Orient assembly and factory 0 plants as they have gone from building gas-powered cars to EVs, the construction of our Ultium Cell JV plants, the rapid expansion of Super Cruise, the development of level 2 plus autonomy with Ultra Cruise, the lead Cruise has in level 4 autonomous driving and our portfolio of 20 startup businesses. You can also experience it in the software and services that will enhance our customers lives and drive growth. And you can see it in our talent and expertise. This includes the new digital business team that we formed to establish digital market leadership for GM and our expanded board of directors who have deep experience in IT, E-commerce, software development, venture capital, cybersecurity, and more. As one of you observed, the real magic happens in our vehicles at the intersection of the Ultium and Ultifi platforms. Ultium enables us to efficiently deliver the industry's broadest portfolio of EVs, including a diverse portfolio of truck entries. And the beauty of Ultifi is the way it will allow us to deploy new software and services rapidly and securely across our entire fleet. This includes Super Cruise upgrades and services we'll create in the future. And seeing is believing.”

EV Growth

CEO Barra continued to underscore the migration to EVs, “We've established and announced 4 major supply chain initiatives recently, and we expect to add more soon to support our growth, our performance, and our cost reduction plans. And our goal is to eliminate supply chain risks that control -- and control our own destiny as we rapidly scale our EV volumes. A common thread that runs through these and our recent announcement is a clear commitment to U.S. leadership in EVs. For example, we will add 2 more battery plants in the U.S. by mid-decade. We also have plans to build EV motors and another EV truck facility here in the U.S. We look forward to sharing the details very soon, but keep in mind, this is just the beginning. As Gerald said at Investor Day, we forecast that North American EV assembly capacity will reach 20 % by 2025 and climbed to 50 % by 2030. We're also bringing Ultium to China starting with the Lyriq, which is launching in early 2022, and GM China also recently announced it's doubling the size of its advanced design center to support EV development.” She continued with EV charging, “Cruise is the second opportunity that I want to highlight. As you know, we have always gated the progress of Cruise by safety. As we speak, Cruise is just one state level approval away from full regulatory approval to charge customers for rides in San Francisco. And it is still the only Company with a permit to provide full driverless ride-hailed service in the city. As Cruise CEO, Dan Ammann, said, complementary skills of GM and Cruise have brought it to the cusp of commercialization.”

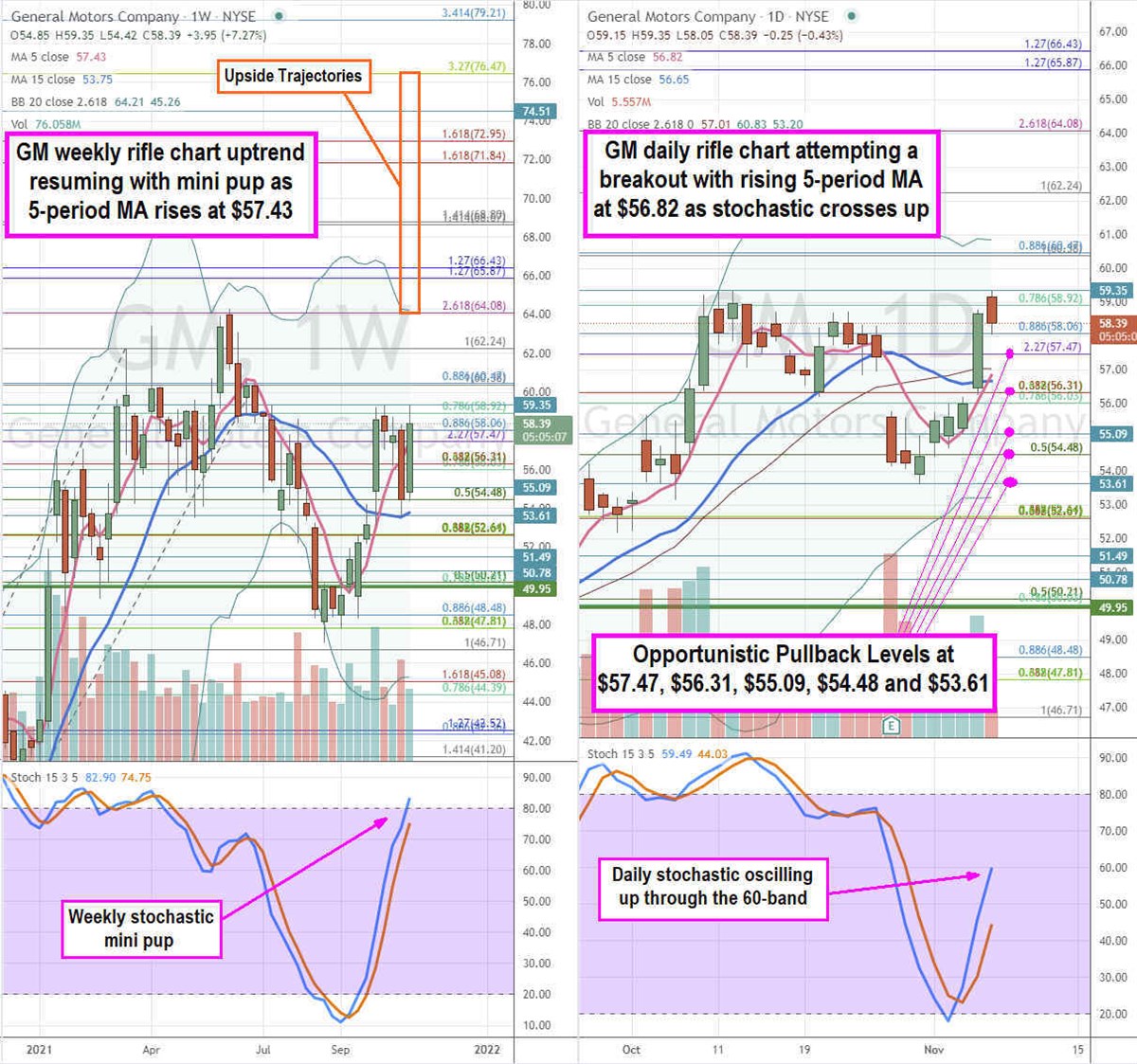

GM Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for GM stock. The weekly rifle chart peaked of the $64.08 Fibonacci (fib) level before selling off down towards the $47.50s. The weekly market structure low (MSL) buy triggered on the bounce up through $49.95. The weekly uptrend resumed on the rising 5-period moving average (MA) at $57.43 and 15-period MA support rising at $53.85. The weekly stochastic formed a mini pup through the 80-band with upper Bollinger Bands (BBs) at $64.21. The daily rifle chart is attempting to uptrend as the 5-period MA at $56.82 crosses up through the 15-period MA at $56.65. The daily upper BBs sit at $60.83. Prudent investors can watch for opportunistic pullback levels at the $57.47 fib, $56.31 fib, $55.09, $54.48 fib, and the $53.61 level. Upside trajectories range from the $64.08 fib up towards the $76.47 fib level.

Before you consider General Motors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Motors wasn't on the list.

While General Motors currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.