The COVID-19 pandemic triggered the fastest market plunge from a bull market to bear market in history. The

S&P 500 (NYSEARCA: SPY) collapsed (-34%) from its all-time highs of $339.08 reached on Feb. 19, 2020, to low of $218. 26 on Mar. 23, 2020, in five-weeks. The isolation and stay-at-home mandates bolstered the remote work, learning and medicine theme lifting up stocks that fit benefit the theme. Since the lows, the SPY rallied through the 0.618

Fibonacci (fib) level before peaking out at $295.68 as markets embrace the economic restart narrative and jurisdictions phase-in the reopening of businesses and communities. Investors may want to re-evaluate these three stocks moving forward and ask the same question that

Netflix (NASDAQ: NFLX) earnings reaction sell-off addressed, “Is this the best it gets?”. The answer is a resounding, “yes”.

Zoom Video Communications

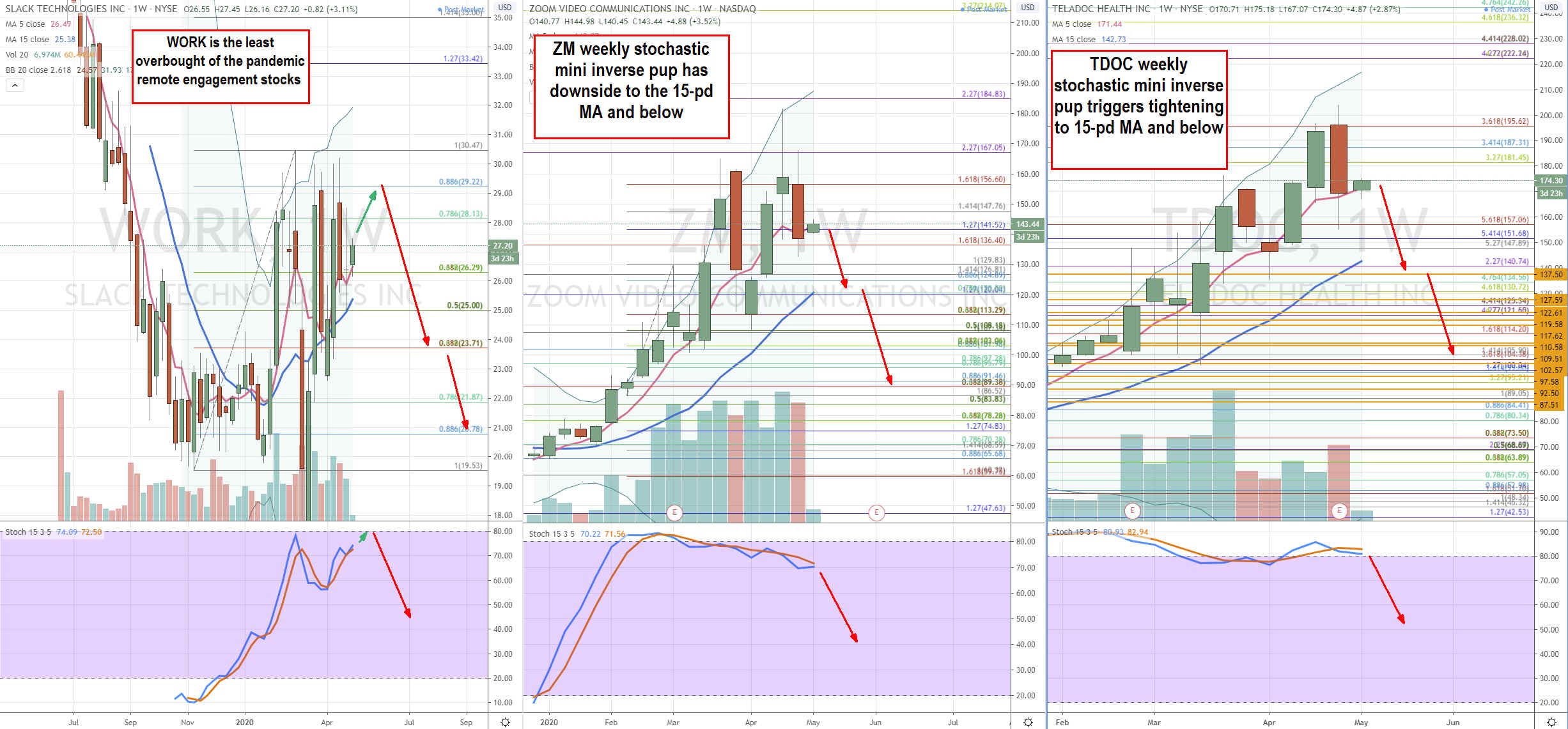

This disarmingly easy-to-use video conferencing platform has been the poster child for remote video engagement during the COVID-19 pandemic. Zoom Video Communications (NASDAQ: ZM) saw video meeting participants climb over 300 million. Zoom experienced blowback stepping from security and privacy issues that caused various companies and even governments (IE: Taiwan) banning its use by employees. Competitor Alphabet (NASDAQ: GOOGL) banned Google employees from using Zoom software on their computers. Pressure is also growing from competitors in the video conferencing space including Microsoft (NASDAQ: MSFT) , LogMeIn (NASDAQ: LOGM) , Citrix Systems (NASDAQ: CTXS) , Adobe Systems (NASDAQ: ADBE) and notably Facebook (NASDAQ: FB) with its “Messenger Rooms” (also called Rooms) platform that enables group video chats for up to 50 participants. Facebook plans to integrate Rooms platform into WhatsApp and Instagram Direct messengers. Zoom trades at over 50X earnings with only 2.2 million monthly active users in February 2020 compared to over 300 million for Microsoft’s Skype. Overvaluation, heavy competition, and demand drop should bring these shares back down to earth under $100-per share.

Slack Technologies

With the same premises for contraction as Zoom, Slack Technologies (NYSE: WORK) has been a popular business technology platform that includes video conferencing along with enterprise workflow management tools and applications. It faces the same stiff competition from all of Zoom’s competitors including Zoom. Shares collapsed after the Q4 2019 earnings results with in-line Q1 2020 guidance at (-$0.06 to -$0.07) EPS versus (-$0.07) EPS consensus analyst estimates and revenues of $185 to $188 million compared to $188 million estimates. These pre-COVID-19 results triggered a collapse to all-time lows of $15.10 before rallying on the work-at-home narrative. The company reported a spike of 7,000 new paid customers from Feb. 1 through Mar. 18, 2020, up from 5,000 new customers year-over-year (YoY). This piece of news enabled Slack to upsize an offering of $750 million if 0.50% convertible senior notes. The rivalry with Microsoft is comical as numbers still pale in comparison to Skype which reported 40 million daily active users (DAU) and 44 million daily users for Teams on a company blog on Mar. 30, 2020. These shares haven’t necessarily exploded but business wasn’t great to begin with and should contract again as workers head back into offices.

Teladoc

Remote contactless medical visits are a win-win during pandemics and Teladoc (NASDAQ: TDOC) stock shares have skyrocketed on that narrative. The company reported a 91% spike in medical visits in Q1 2020. The spike related directly from coronavirus fears. Incidentally, the revenue growth didn’t parallel the spike in visits at 41% due to the extra expenses associated with adding new physicians to its network. This is a first half 2020 story as stay-at-home mandates get lifted. The company is still losing money and shares trade at over 160 times EDITDA estimates. While the Q1 2020 growth was impressive, it’s just not sustainable as investors should reassess the upside moving forward by once again asking the question, “Is this the best it gets?”. The answer is a resounding “yes”. TDOC is the loftiest valued stock of the group and needs to maintain a blowout every quarter moving forward to maintain the momentum. The reality is that the fundamentals are secondary to the narrative which impacts sentiment. As the narrative shifts to restarting economies and relieving isolation mandates, these pandemic plays lose steam as hedges get taken off.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.