Online real estate platform

Zillow Group, Inc. NYSE: ZG shares have vastly outperformed the benchmark

S&P 500 index NYSEARCA: SPY as it surged past its pre-COVID highs in July 2020. The pandemic and low mortgage rates fueled outsized demand in home sales as

consumers leave heavily populated cities to migrate into the suburbs. While shares have been white-hot, they may have gotten too overextended as wider time frame charts indicate a deeper sell-off awaits. The question is whether ZG can keep the pace of growth alive even as the restart narrative accelerates past the pandemic effects. The downside guidance suggests not. Investors should be aware of the pullback trajectories to determine if it’s time to take profits off the table at key price reversion levels.

Q2 FY 2020 Earnings Release

On Aug. 6, 2020, Zillow released its second-quarter fiscal 2020 results for the quarter ending Jun 2020. The Company reported an earnings-per-share (EPS) loss of (-$0.17) excluding non-recurring items beating consensus analyst estimates for a loss of (-$0.48), beating estimates by $0.31. Revenues grew 28.1% year-over-year (YoY) to $768.35 million versus $615.9 million consensus analyst estimates. The Company put a freeze on Zillow Offers home buying activity during the peak of the COVID-19 pandemic in Q2. The effects of this precautionary measure will reverberate in Q3.

Lowered Guidance for Q3 2020

Zillow Group lowered Q3 2020 guidance to $543 million to $581 million in top line versus $783.16 million consensus estimates. This was primarily due to the self-initiated freeze triggering supply constraints rather than demand, which remains robust. The big winner was Home segment revenues which grew by 82% YoY to $454.25 million besting its prior guidance of $325 million to $350 million. However, the Company guided Q3 Home segment revenues down to $140 million to $160 million. The Mortgage segment grew 25% YoY to $33.76 million and Q3 guidance set between $34 million to $37 million. IMT segment revenues fell 13% YoY to $280.34 million and Q3 revenue estimates raised to $369 million to $384 million. Premier Agent segment revenues dropped 17% YoY to $192 million but guidance raised to $272 million to $282 million for Q3.

Real Estate Bubble?

As economic restarts accelerate, new and existing home sales continue to rebound. In fact, existing home supply has dropped to four-year lows indicating a sharp contraction in supply which is spurring even more demand as bidders compete with each other. The result is rapidly accelerating home prices combined with tightening lending standard as banks try to navigate the economic recovery while simultaneously trying to avoid another real estate bubble. These tailwinds would bolster bullish sentiment for Zillow Group, if the shares weren’t already overextended indicating the best-case scenarios may already have been priced in. With the U.S. unemployment rate still at an elevated 8.4% as of Sept. 4, 2020, it’s hard to believe there’s a real estate bubble that could be forming but the spike could be overshadowed by the accompanying drop as the Fed Balance sheet shot up through $7 trillion in record time nearly doubling in less than a year. Prudent investors may want to ring the register on Zillow Group while the market is still hot at opportunistic price reversion levels to unwind into strength, not panic on weakness.

ZG Price Trajectory Levels

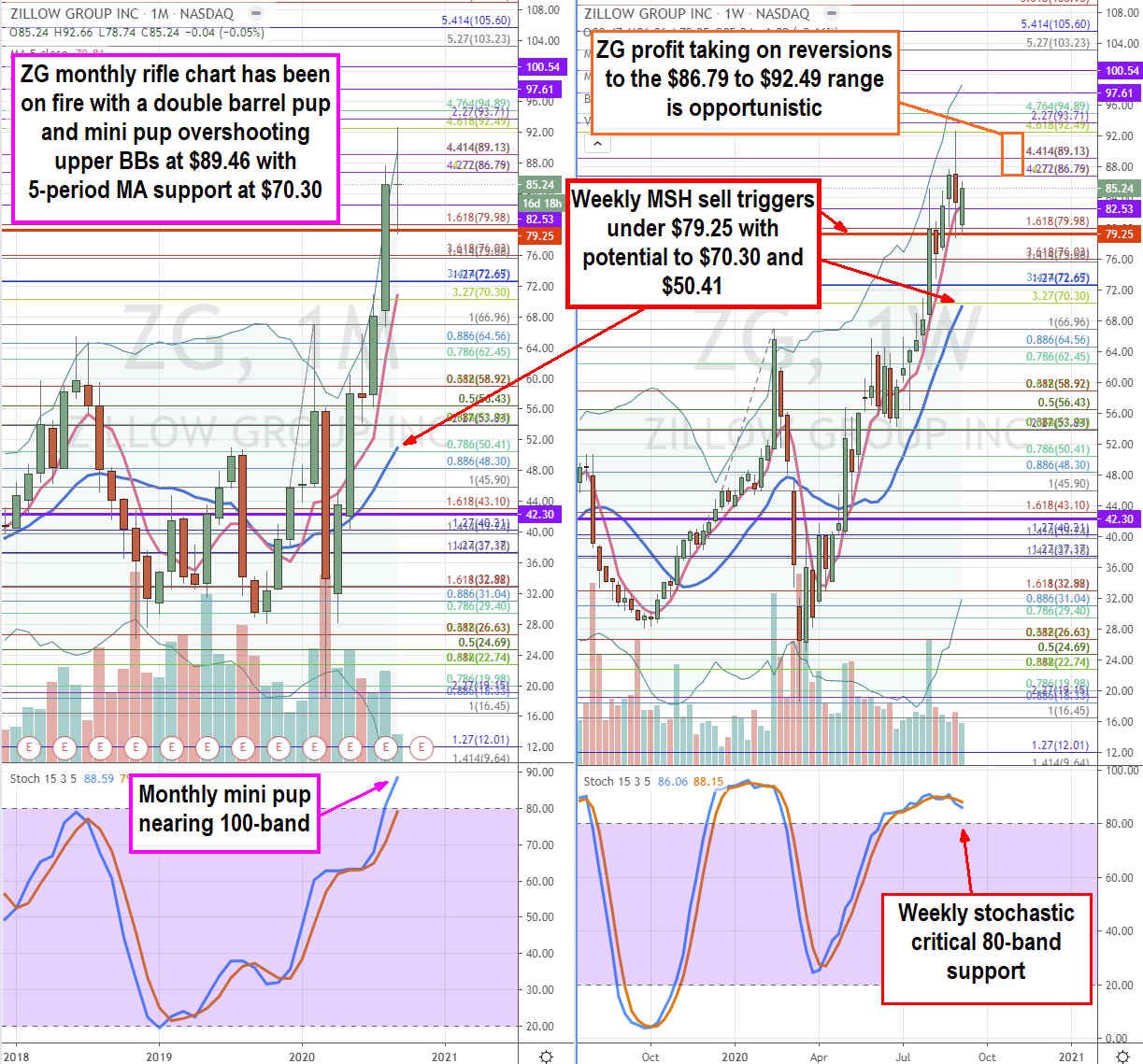

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for ZG stock. The monthly rifle chart has a double barrel pup which is composed of the moving average pup breakout combined with the stochastic mini pup which triggered a market structure low (MSL) buy above $42.30. The powerful bullish pattern skyrocketed shares through its monthly upper Bollinger Bands at $89.45 to peak out at the $92.49 Fibonacci (fib) level. The weekly stochastic peaked and formed a market structure high (MSH) sell trigger under a break of $79.25 (stop-loss). A nominal reversion coil back towards the $86.78 to $92.48 fib is an opportunistic profit taking range. However, investors should be aware that a breakdown through the weekly MSH trigger at $79.25 accompanied by an 80-band weekly stochastic slip can accelerate shares down to the $70.30 overlapping monthly 5-period moving average (MA) and weekly 15-period MA and fib support. This is where shares can form another reversion back to the weekly 5-period MA. If that reversion fades and a weekly 5 and 15-period MA crossover occurs, then the next channel tightening targets the 15-period moving average (MA) near the $50.41 fib.

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.