Natural gas is one of the world's most reliable energy sources due to its low prices and lower environmental impact, especially when compared with other nonrenewable energy sources like oil and coal.

It has become a key pillar of modern economies worldwide because it also serves as a cleaner alternative ecologically, producing nearly 30% less carbon dioxide than oil and 50% less than coal. Natural gas is often the solution where people can't get renewable energy.

What is the best natural gas stock to buy? We'll help you discover the top 10 best natural gas stocks worth your time and money.

Natural Gas: An Overview

Why should you even consider finding the best natural gas companies stock? With countries transitioning to cleaner energy sources, natural gas may play a huge role in meeting future energy demands. The European Union's determination to stop importing gas from Russia due to the country's invasion of Ukraine has caused an imbalance in the market and a short-term scarcity of supply.

Nevertheless, due to its distinct qualities, demand for natural gas is still expected to increase by 5% yearly between 2021 and 2030. From 2030-2050, natural gas demand is still likely to remain steady. That means a consistent demand for natural gas stocks in the long run, making natural gas a sound choice. And companies in the oil and gas sector often pay dividends, which allows you to earn regular income on returns.

Features to Look for in Natural Gas Stocks

As you look for the best gas companies to invest in, you should consider a few features. Knowing what these features are and how they'll affect your decision can make it easier to know the best natural gas stock to buy and invest confidently.

Production Volume

The production volume is key because it determines the amount of natural gas a company produces and can often indicate how profitable it will be. Higher production volumes mean more profit potential and increased revenue.

Capital Expenditure

Capital expenditure (or capex) is the money companies spend acquiring or maintaining assets. These assets usually include drilling rigs, pipelines, facilities and equipment used to extract natural gas. Companies with higher capex may have better-developed infrastructure, leading to more efficient operations and greater profits in the long run. On the other hand, companies with lower capex tend to have fewer resources available for exploration and development of new projects.

Dividend Yield

Dividend yield measures how much of a return company shareholders will receive from dividends per share compared to its share price. A high dividend yield indicates you'll get higher returns from dividend payments than in other stocks. Conversely, a low dividend yield suggests you'll see smaller returns from dividends per share than if you'd invested elsewhere.

Reserves

Reserves are the amount of natural gas a company has in storage, waiting to be sold. Companies with larger reserves will have a steady supply of natural gas to sell and won't be as impacted by any temporary market instability that pops up.

Profitability

Profit is a must to consider when choosing the best natural gas stocks. A profitable company is more likely to pay dividends, which provide you with regular income. Profit can also indicate future growth potential, which can increase the value of your investment over time.

10 Best Natural Gas Stocks

What are the best natural gas stocks? Take a look at our top 10 natural gas stocks to buy now.

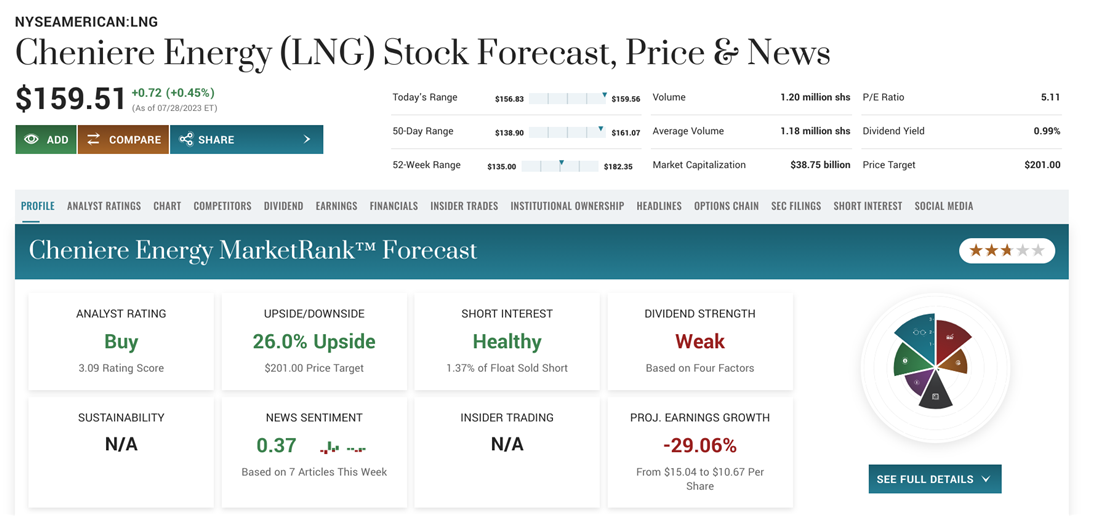

1. Cheniere Energy Inc.

Cheniere Energy Inc. NYSEAMERICAN: LNG is one of the largest exporters of liquefied natural gas (LNG) in the United States. The company owns and operates several natural gas pipelines and storage facilities, making it a leading player in the industry.

Cheniere has also secured long-term contracts with international customers, providing revenue stability. Cheniere financials are strong. The company earns $1.43 billion in net income (profit) each year or $31.24 on an earnings-per-share basis.

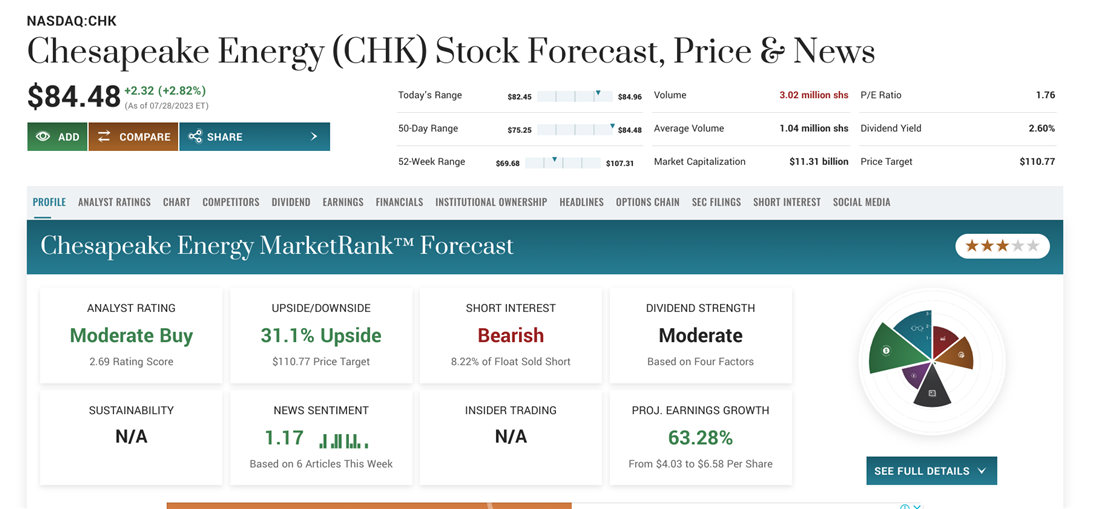

2. Chesapeake Energy Corporation

2. Chesapeake Energy Corporation

Chesapeake Energy Corporation NASDAQ: CHK is one of the leading public natural gas companies in the U.S. and is well known for its efficient drilling operations.

The company has recently emerged from bankruptcy and plans to focus on natural gas production in the coming years. With the increasing demand for natural gas, Chesapeake Energy looks poised to grow and provide strong returns. It has a market capitalization of $11.31 billion and generates $11.74 billion in revenue annually and $4.94 billion in net income (profit) each year, or $47.99 on an earnings-per-share basis. It pays an annual dividend of $2.20 per share and has a dividend yield of 2.64%. This payout ratio is healthy and sustainable, below 75%.

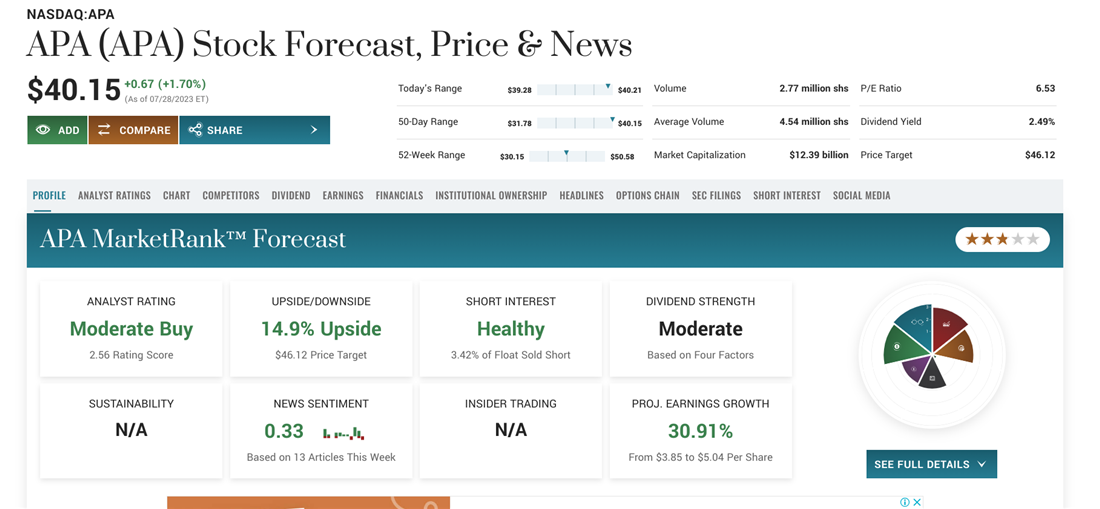

3. APA Corporation

3. APA Corporation

APA Corporation NASDAQ: APA is an exploration and production company that operates natural gas reserves in the United States, Egypt and the North Sea. The company has consistently grown in natural gas production in recent years and has a robust pipeline network for transportation. It has a market capitalization of $12.39 billion and generates $12.13 billion in revenue annually. The company earns $3.67 billion in net income (profit) annually, or $6.15 on an earnings-per-share basis.

APA pays an annual dividend of $1 per share and currently has a dividend yield of 2.50%. The APA dividend has increased for two consecutive years, and the dividend payout ratio is 16.26%.

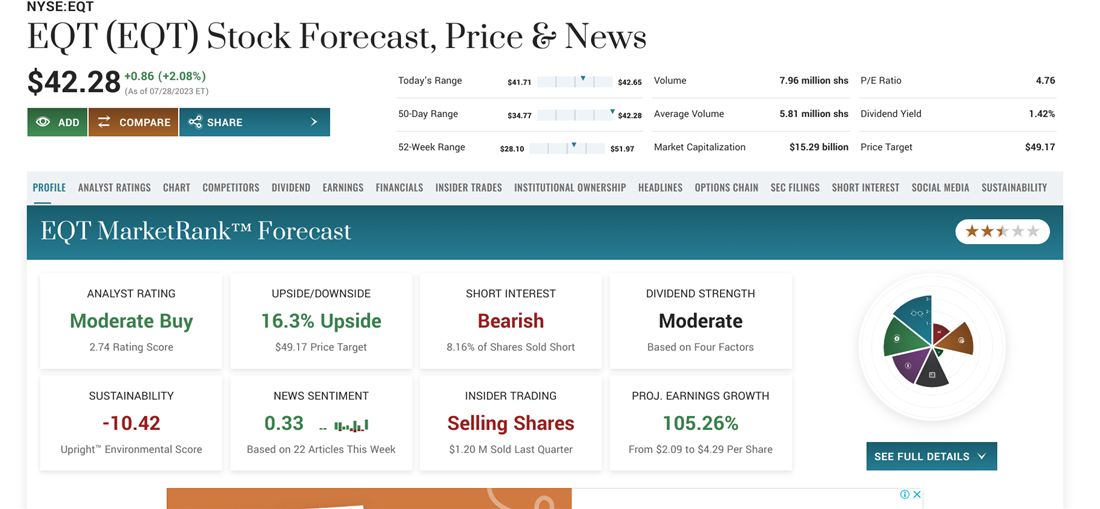

4. EQT Corporation

4. EQT Corporation

EQT Corporation NYSE: EQT is known for its vast operations in the Appalachian Basin, which spans several states on the east coast of the U.S. It has an extensive portfolio of natural gas assets, including production, gathering and transmission facilities. EQT has been expanding its operations and recently acquired several natural gas properties in the region, making it a strong contender for investment. It's also experienced significant growth recently, with revenue and net income increasing yearly for several years. EQT's profit margin has remained strong, averaging 27% over the past three years.

5. Williams Companies Inc.

5. Williams Companies Inc.

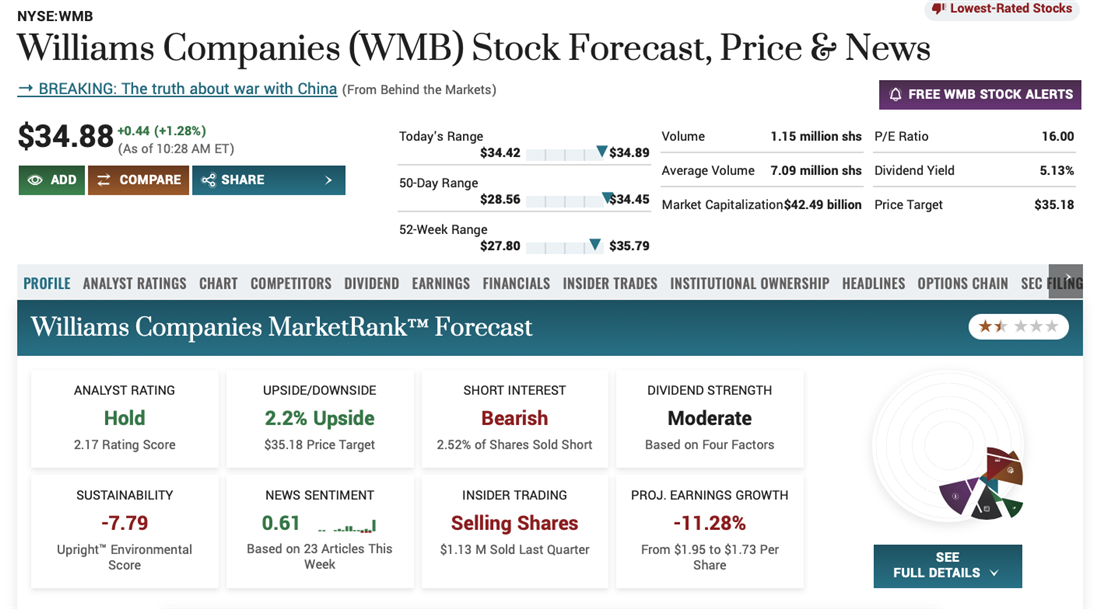

Williams Companies Inc. NYSE: WMB is a leading natural gas infrastructure company that operates a vast network of pipelines and processing plants across North America. The company generates income from processing fees for natural gas, making it less exposed to commodity price fluctuations. Williams Companies pays an annual dividend of $1.79 per share and currently has a dividend yield of 5.25%. The WMB dividend yield exceeds 75% of all dividend-paying stocks, making it a leading dividend payer.

6. Range Resources Corporation

6. Range Resources Corporation

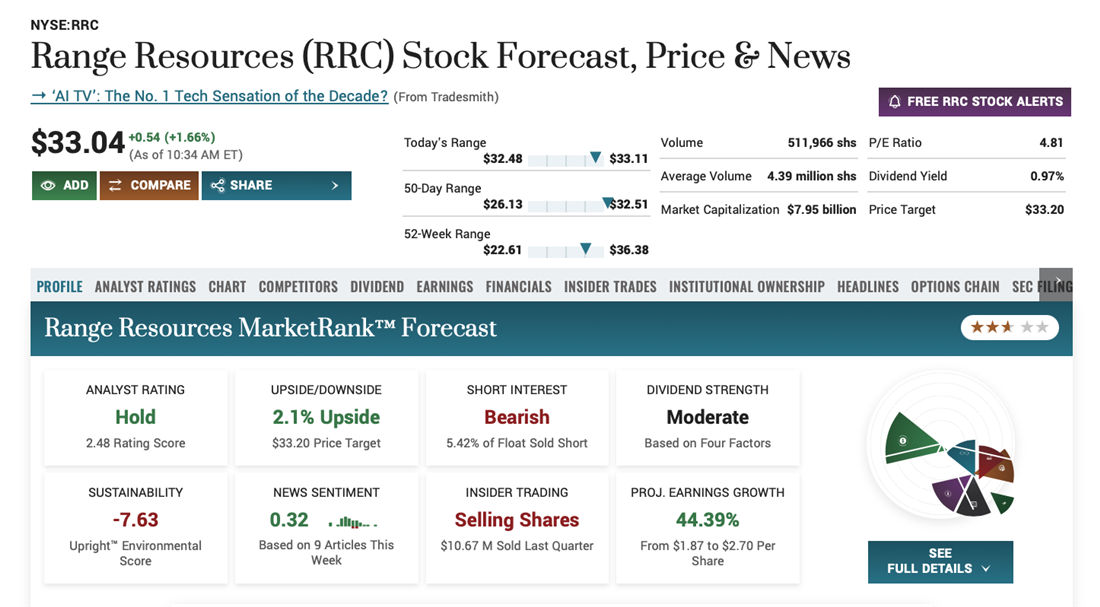

Range Resources Corporation NYSE: RRC is a leading independent natural gas producer operating primarily in the U.S. Appalachian and Midcontinent regions. The company has a long track record of consistent production growth and has a strong focus on cost control, making it a good investment option if you're seeking stable returns. Range Resources has a market capitalization of $7.55 billion and generates $4.15 billion in revenue annually. The company earns $1.18 billion in net income (profit) annually or $6.87 on an earnings-per-share basis.

7. Devon Energy Corporation

7. Devon Energy Corporation

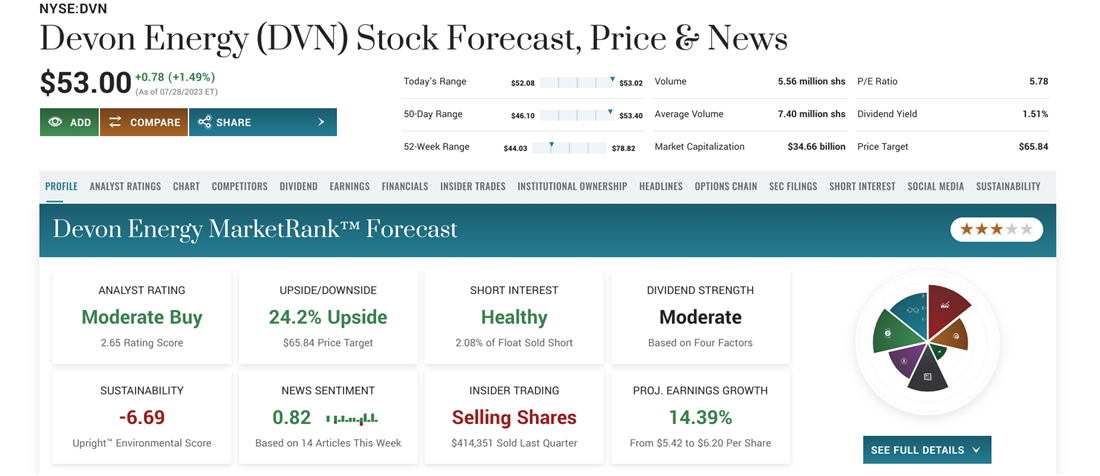

Having merged with WPX in 2021, Devon Energy Corporation NYSE: DVN is one of North America's largest independent energy companies, operating primarily in the Midwest. With a diverse portfolio of natural gas assets, including drilling rigs and production facilities, Devon Energy financials have consistently delivered strong performance and returns. It has pledged to reduce its greenhouse gas impact to net zero by 2050 through energy efficiency and leakage, a reduction in flaring and the electrification of its operations.

8. Coterra Energy

8. Coterra Energy

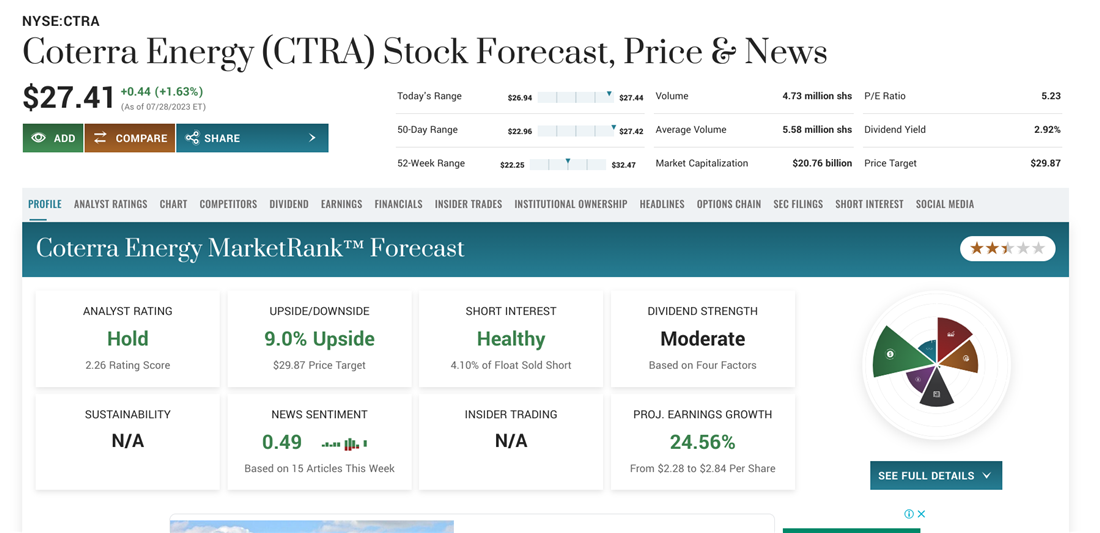

Cabot Oil & Gas Corp. and Cimarex Energy completed their $17 billion merger in 2021, forming Coterra Energy NYSE: CTRA, with a strong presence in the Marcellus Shale region, one of the largest natural gas fields in the U.S. The company has made significant investments in technology and operational efficiencies, with higher production volumes and lower operating costs. Coterra has a market capitalization of $20.76 billion and generates $9.05 billion in revenue annually. The company strives to achieve high returns by investing in various natural gas, natural gas liquids and crude oil investments.

9. Southwestern Energy Company

9. Southwestern Energy Company

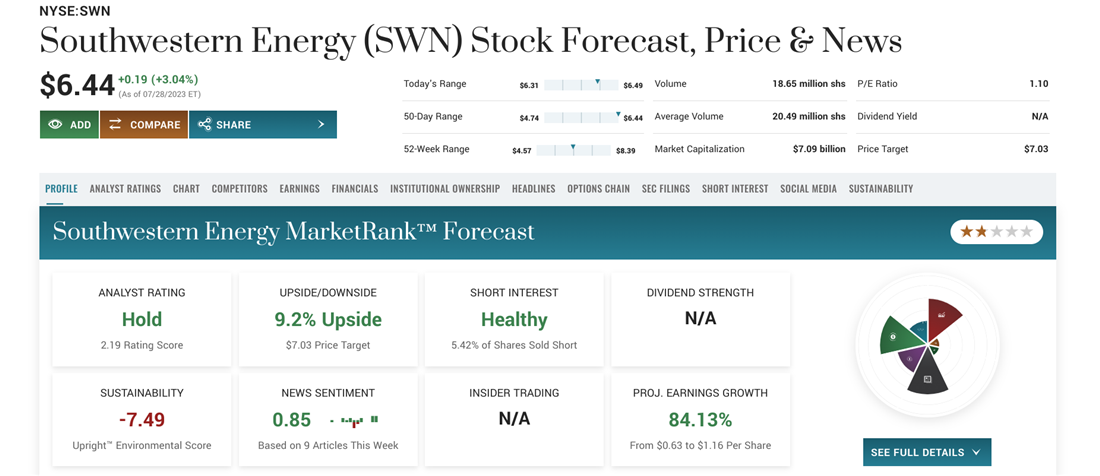

Southwestern Energy Company NYSE: SWN is an independent energy company that operates in the Appalachian Basin, Fayetteville Shale and Marcellus Shale regions. It's shown consistent growth in natural gas production. It has made major strides in reducing costs of exploration and production. Southwestern Energy financials have also invested in new technologies to improve efficiency rates further. It has a market capitalization of $7.09 billion and generates $15.00 billion in revenue each year.

10. Antero Resources Corporation

10. Antero Resources Corporation

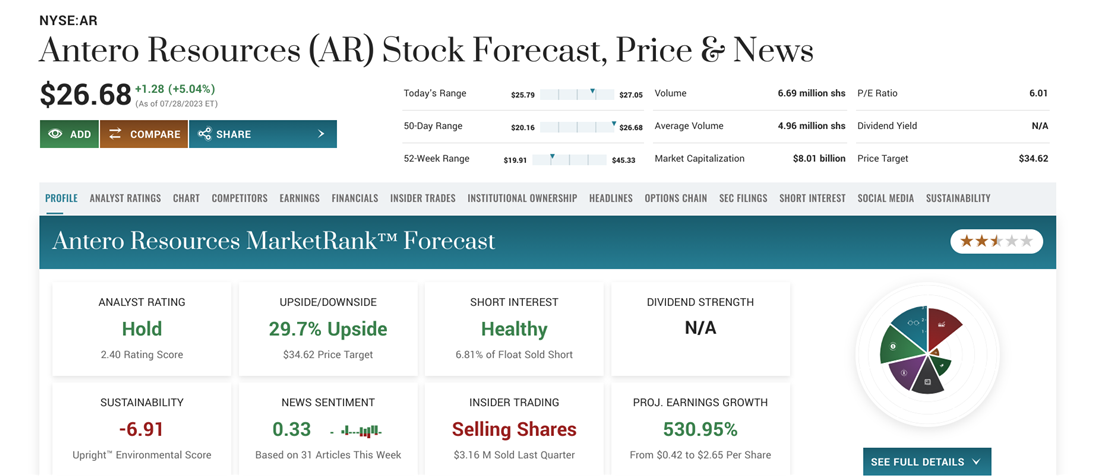

Antero Resources Corporation NYSE: AR is a leading independent natural gas and oil company that operates primarily in the Appalachian Basin. It has a diversified portfolio of natural gas assets, including significant acreage in the Upper Devonian shale formations. Antero Resources boasts a strong track record of production growth and cost control, making it a prime option for stable returns. Antero has a market capitalization of $8.01 billion and generates $7.14 billion in revenue annually. It's also been investing in innovative technologies to enhance its drilling operations and reduce environmental impact, positioning it as a responsible leader in the industry.

A Natural Choice

A Natural Choice

The natural gas sector is a dynamic and ever-evolving industry that's only poised to grow due to increasing global demand. The best natural gas stock offers many potential investment opportunities. Natural gas companies can be an intelligent way to diversify your portfolio. If you're wondering, "How do I invest in natural gas?" the 10 energy companies discussed here have long track records of solid performance, making them top options if you're looking for stable returns among a natural gas stocks list.

FAQs

Now that you know more about the bright future for natural gas investments, do you still have questions about the best natural gas stocks? We have some answers below.

Which is the most profitable natural gas company?

The most profitable natural gas company will have a strong portfolio of natural gas assets and operations and a history of producing stable returns. Look for companies on our natural gas stocks list investing in new technologies and practices to reduce their environmental footprints and remain competitive. Some of the leading natural gas companies include EQT, Southwestern Energy and Antero Resources. The best gas companies to invest in have strong track records of producing returns and are some of the most attractive options in the sector.

Is it a good time to invest in natural gas stocks?

The natural gas sector has risen in recent years and should continue growing. Many experts believe that now is a good time to invest in natural gas stocks due to their potential for long-term growth. But to invest in natural gas stocks can be risky, so pay attention to how natural gas prices may fluctuate over time and to macroeconomic factors that could affect the industry.

What is the best natural gas company?

When choosing the best natural gas company, there are various factors to consider. Look at the company's track record of performance, financial stability and soundness, and projected future growth. Research natural gas companies' environmental and social responsibility practices. Some top-performing natural gas companies are Williams Companies, Devon Energy and Antero Resources. The best natural gas companies stock include those that have strong track records of producing returns and are appealing options in the sector.

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.