With the sun shining and the evenings as long as they’re going to be for another year, there are few industries more suited towards the summer months than social media. People are out and about, meeting up, and keen to post about it.

Inflation worries have receded compared to where they were back in March and April, and we’re seeing a solid bid return to growth and tech stocks as a result. Here are some of the better-looking social media names to consider adding to your portfolio for Q3. Investors will still need to exercise caution in terms of entry points and risk management but on the whole, there’s

not much to dislike about them.

Snap has been making an attractive habit of posting impressive growth numbers for itself on a very consistent basis. Their most recent earnings report, for the first quarter, had revenue up more than 65% on the year and well ahead of the consensus. Management’s guidance for the current quarter was also higher than what analysts were expecting as Snap’s momentum continuously leaves them flatfooted.

To be fair, the company is still looking for consistently black EPS numbers, with GAAP EPS for Q1 coming in at -$0.19. But this is par for the course with high flying growth companies, and it hasn’t stopped investors piling in. While shares felt a pinch in the first half of 2021 as Wall Street started favoring value names, they’re picking up some steam as we cross the halfway mark. They put in a double bottom in the middle of May and are up 30% since, and are barely a 10% move away from hitting fresh all time highs. Shares were up more than 1% in Thursday’s pre-market session and look like they want to see $70 before the weekend.

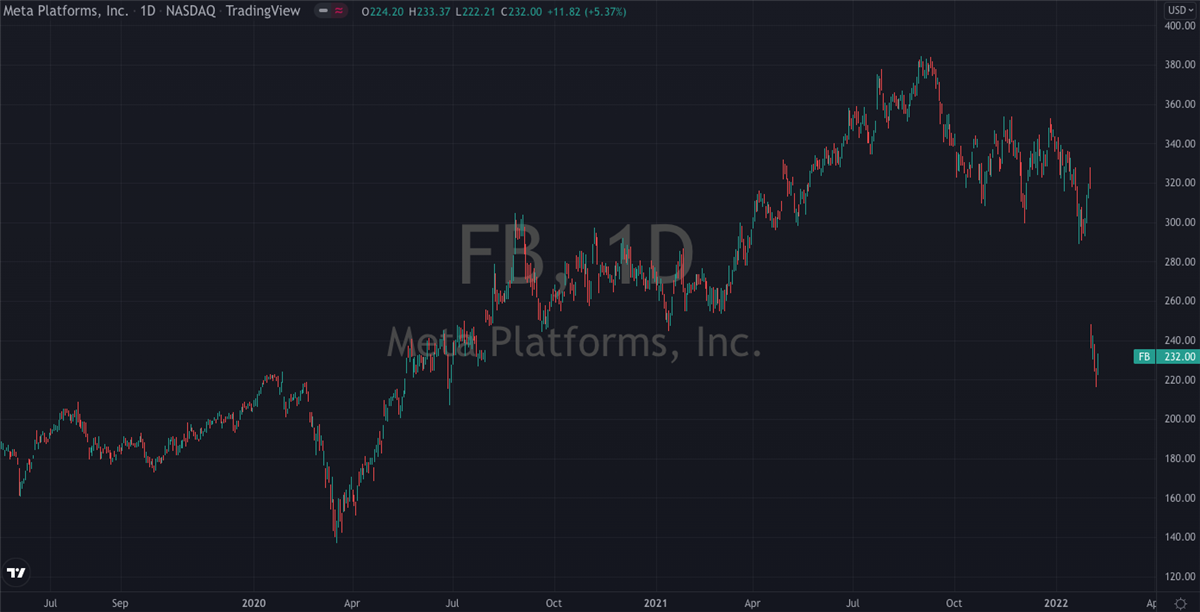

If Snap is coming close to printing fresh highs, Facebook is already there. Shares of the social media giant are up more than 30% since March and are looking good to cross $400 for the first time this summer. As of the end of May Facebook is at the top of Goldman Sachs' Hedge Fund VIP List, which isn’t an easy feat.

But with close to half the world’s population using the platform on a regular basis, it shouldn’t be all that surprising. The company has a seismic war chest and is aiming to have more than $100 million in free cash flow by 2026. This could see their cash balance cross $300 billion, and analysts are starting to think about ways the company could put this to use. If Zuckerberg and co ever wanted to dish out a dividend, Facebook would become an overnight blue-chip. It’s price-to-earnings (P/E) ratio is only 29, which in the context of Silicon Valley is relatively low so investors have little to fear by way of a frothy valuation.

It took Twitter a while to find its feet but it looks like they’ve put the sluggish years of 2014-20 behind them for good. Shares are up 30% since the end of May and have eaten into most of the selloff that sent them down 20% at the start of that month.

That ugly drop came on the back of Q1 earnings that didn’t impress Wall Street enough, but it was a dip that many were grateful for. Cathie Woods made a point of adding to her existing Twitter position in her flagship ARK Innovation ETF (NYSEARCA:ARKK), with Whale Rock Capital Management’s $12 billion fund opening a new position in Twitter shares around the same time.

The company is

comfortably growing revenue by double-digit percentage points quarter on quarter and this pattern doesn’t look like it’ll stop anytime soon. Their earnings reports can look a little less than optimal sometimes when compared to the likes of Facebook or Google (

NASDAQ: GOOGL), but any dips in the stock, as a result, are quickly eaten up as we’ve seen.

Before you consider Snap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snap wasn't on the list.

While Snap currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.