Active value managers and value as a portfolio factor have underperformed the indexes since the global financial crisis. This lead to mass redemptions from top value managers like Greenlight and Pershing Square, and the proclamation of value’s death from financial pundits.

Investment strategies go through their periods of outperformance and underperformance, and today’s market environment definitely favors growth-focused firms. Low-interest rates reward companies who take risks, not necessarily those who are great at managing it.

But markets are mean-reverting, and tomorrow’s market environment is likely to be different. Today we’re going over three value stocks that seem poised for outperformance given a shift in market dynamics.

Westell Technologies: Graham Cigar Butt

This $20M microcap stock has taken quite a beating over the last few years. Let’s not mince our words: operations at Westell have been steadily declining. They’ve replaced their CEO multiple times, and gross margins are thinning out. This definitely isn’t a value stock that modern-day Warren Buffett would be interested in.

Despite that, the stock is trading for less than its liquidation value when viewed from several angles.

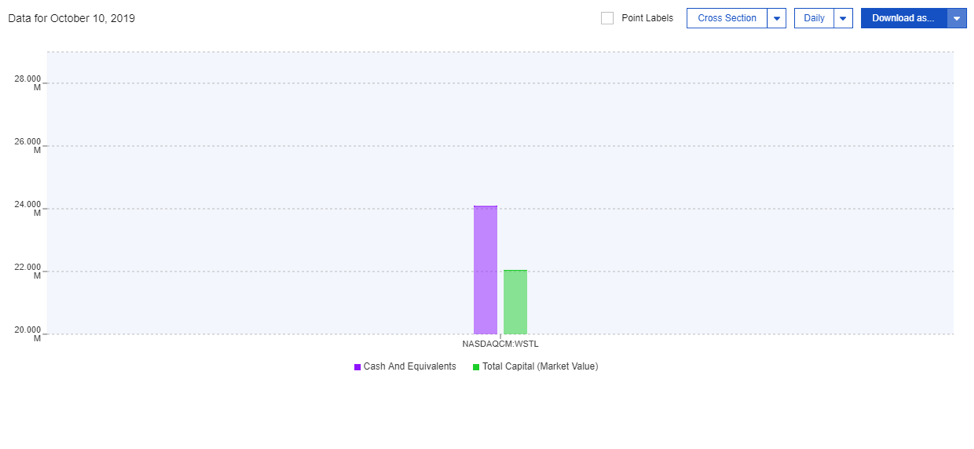

Westell’s current cash balance outweighs its market capitalization, a metric that makes deep value investors’ mouths water.

Of course, this could mean that Westell is burning cash and the market is simply discounting future cash burn. However, Westell’s cash balance has remained pretty steady over time.

The company is currently trading at Graham Net-Net status, with its net current asset value exceeding its market cap by a healthy margin. Currently trading at 0.66 of NCAV, this might have ended up in Ben Graham’s portfolio if he were investing today

MSG Networks: Quality and Value

MSG Networks (MSGN) is an operator of cable TV channels MSG Network and MSG+. The channels primarily serve the New York metropolitan area and aires games for the New York Rangers, Islanders, Knicks, and other regional sports teams.

Sure, the cable business is a melting ice cube. But, MSG has had contracts with these sports franchises for decades and can find their way in the streaming revolution.

This is one of those situations where an industry is so downtrodden that you find ridiculous value within it.

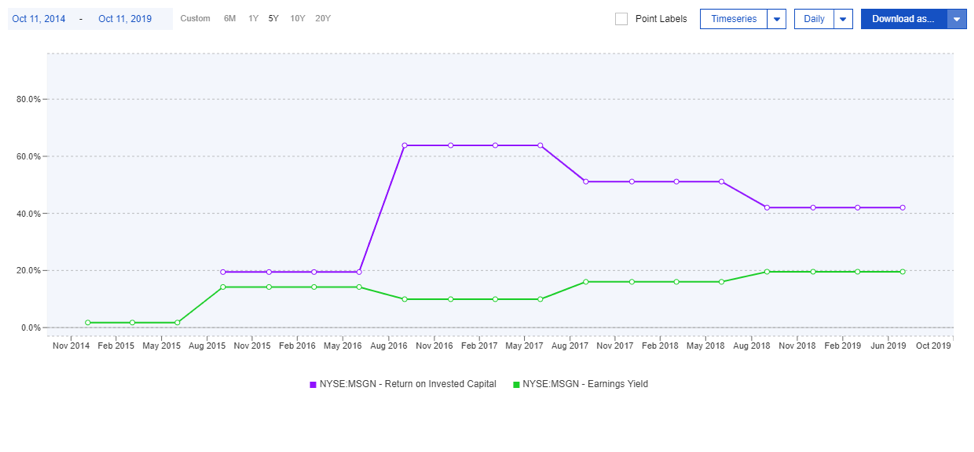

This is a company that would make Joel Greenblatt blush. MSG is currently trading at an earnings yield of 19.6%, with that number steadily rising over the last few years.

The company also utilizes its capital efficiently, reducing the likelihood of declining operations shedding away at any value within. The company currently has an annual return on invested capital of 42%!

Joel Greenblatt’s hedge fund Gotham Capital owns 138,961 shares of the company, according to a recent 13F filing.

Kontoor Brands (KTB)

KTB is more palatable to the average investor than WSTL and MSGN. It’s definitely more of a run-of-the-mill value stock, not threatened by severely declining operations or obsolescence like the above companies. Due to this, the company is a bit more expensive than WSTL and MSGN.

Kontoor is a producer of inexpensive jeans for the North American consumer. You’ve probably seen their products in stores, they own Wrangler and Lee. They were spun off from their parent company VJ Jeanswear in late 2018, and as such, have been given the spinoff treatment of a depressed share price following the spinoff. This is usually due to shareholders of the parent company selling their distributed shares.

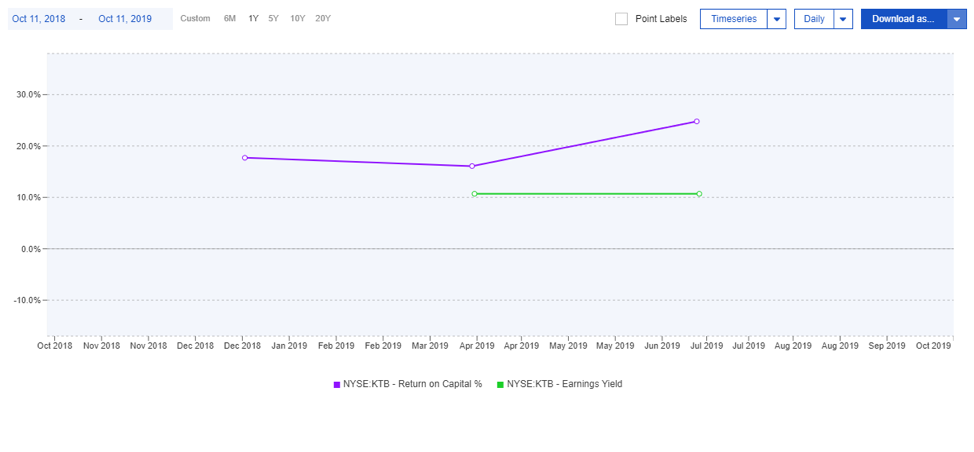

The company pays a 6.10% dividend while trading at a 10.7% earnings yield. The management team has been praised by several hedge fund managers, including value manager Curreen Capital in their recent letter to shareholders.

In addition to producing income and trading at a low valuation, the company also utilizes its capital efficiently, producing 24.8% returns on capital.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.