Few people ever stop to think about why there are so few car manufacturers and brands in the market, seldom do investors think about the thousands of car companies that never got off the ground or turned a profit, let alone stay in business. So it is quite interesting to notice the handful of names that dominate the global vehicle market and how - within that handful - there is one name that stands out in every nation where its cars are sold.

Toyota Motor NYSE: TM is a global household brand name, and anyone who has ever owned a Toyota places the car as a benchmark for future quality and reliability standards. However, there is a reason why Toyotas historically retain their value in the market and why the Toyota Corolla is the answer to the googling of "What is the best-selling car in the world." One of these reasons can be that the "Toyota Way" is dedicated to manufacturing cars meant to last for thirty years in a third-world country with just the usually required maintenance services. Another reason is the passionate - and effective - wave of innovation in their product offering which has shaken off market share from other hot names out in the market today.

The Largest Piece of a Growing Pie

Toyota brand vehicles represented 11.5% of the total global automotive market share in 2022, followed in second place by Volkswagen, taking up 6.7%, which is still quite a gap to be filled for second place. Global vehicle sales are an ever-expanding statistic, as the number of people that can afford a car in emerging economies grows by the minute, and car owners in mature economies showcase the statistic of trading vehicles every 2-3 years at a time.

The main concern for Toyota's management and its investors is how they will maintain this massive advantage in brand adoption and preference and how they will perform against other rising stars in the latest and most developed automotive technologies in the market today.

While the company expects to deliver 8.8 million vehicles in 2023 and deliver revenue growth of up to 16%, it is of utmost importance to investors and competitors alike to answer the million-watt question, how many of these vehicles will be electric?

Tesla vs Toyota

Superstition could say that Ford Motor NYSE: F versus Ferrari NYSE: RACE had its day in the racing ages of the early automotive industry, and now the rivalry is being replaced by the T versus T (instead of F versus F) of the "efficiency" and "energy transition" age.

Tesla NASDAQ: TSLA has been making headlines across many industries for the past five years, perhaps even more. From engineering industries providing their heartfelt critiques to environmental protection enthusiasts showing all their love, Tesla electric vehicles have made a splash in their own way. However, one segment of the universe that cannot go unmentioned is finance; ever since the Model S and Model 3 Tesla models became more mainstream, the finance community felt like a green light was flashing all over stock trading screens to pour billions upon billions of dollars into the car maker's stock.

Out of these 8.8 million vehicles expected to be delivered in 2023 by Toyota, approximately 2.7 million are targeted to be hybrid vehicles, with 86 thousand of them being a purely electric composition. This guidance compares to Tesla's 1.8 million delivery expectation by 2023. Toyota has already lapped Tesla deliveries for hybrid vehicles in the first quarter of 2023, where the Japanese counterpart sold 684 thousand units versus Tesla's 422.8 thousand.

Unfortunately, some investors and YouTube influencers seemed to forget for a minute that Tesla is a car manufacturer and should be valued and traded as such. Most participants attempting to value or invest in Tesla treat the firm like a software or hyper-growth tech company. If more than 80% of revenues come from selling cars (not software), then it is a car company and not the alternative.

Hype and exciting stories aside, why - and how - could Toyota show the potential to be a better investment in the automotive space? Tesla trades at a price-to-earnings ratio of 48.7x, while Toyota trades at a 10x multiple. Given the massive growth in the underlying earnings, some say this ratio is justified. However, comparing the price-to-sales ratio of an average car company brings investors to a 0.8-1.3x range; Tesla has remained above 5.0x for quite some time. Again, these are multiples worthy of a hyper-growth technology company where margins surpass the 30% levels, capital expenditures are minimal, or revenue is on a recurring service basis and not dependent on individual sales.

This is not to say that Tesla stock is overpriced and should, by all means, come down if eccentric CEO Elon Musk can deliver on these aggressive assumptions; who knows what may happen to the stock. However, this point is intended for those investors who prefer to place their capital into logical and time-tested value investment strategies, one that Toyota seems to be placing on the table.

A Value Play at Hand

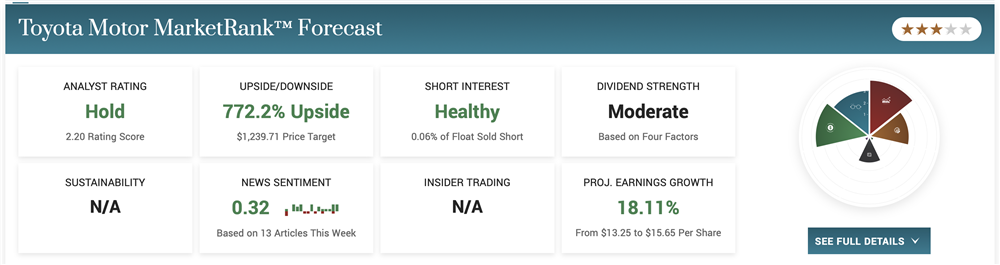

Following a 26% upside based on analyst consensus price targets, Toyota stock seems to be trading on the cheap end of the spectrum. Showcasing a 9.3x to 10x price-to-earnings ratio and a 10.5x price-to-free cash flow ratio, this company seems to carry at least 25% room for multiple expansion, perhaps the angle analysts have taken.

With the current supply of new vehicles as tight as ever, management has increased their inventory of finished products from 4.6% of assets to 5.6%, translating to a monetary increase of USD 7 million. Such an increase in inventory can be a sign that management is expecting to fulfill increased demand for the quarter or full year, which aligns with their 16% revenue increase guidance.

Technically speaking, Toyota stock is trading within the "golden ratio" of Fibonacci retracements and a significant support level in the $135-$140 range.

Before you consider Ferrari, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ferrari wasn't on the list.

While Ferrari currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.