China-based commerce behemoth

Alibaba Group Holding Limited (NASDAQ: BABA) dominates commercial and retail e-commerce throughout Asia as its Core Commerce segment has consistently grown revenues over 50-percent annually for the past five years. The Core Commerce segment enables funding investments for future breakthroughs. Alibaba Cloud, while unprofitable, is still in its early stages growing revenues 76-percent YoY last quarter. The Digital Media (Tudou) and Innovation (AliOS) segments are developmental investments broadening the scope and diversity of the its user base engagement. Alibaba has taken a page from

Microsoft (NASDAQ: MSFT) with cloud computing, Amazon (NASDAQ: AMZN) with e-commerce and

Alphabet (NASDAQ: GOOG) with diversified investment projects to synergistically scale up the network effect of its dominant platforms and brands. Alibaba strives to be the one-stop-shop for investors seeking growth and innovation throughout Asia. However, shares of BABA are sensitive to any complications with U.S. and China trade talks. While the Phase One trade deal has quelled trade war concerns, the coronavirus and its ripple effects on the Chinese economy has moved to the forefront of investor concerns. The Company indicated that coronavirus would have material effects on the top line. Investors will want visibility on productivity and supply chain disruptions and its impact on growth in the upcoming earnings release.

Earnings Catalyst

Alibaba reports earnings pre-market on Thursday, Feb. 13, 2020, followed by the 7:30am EST conference call. Consensus analyst estimates are for $2.25 EPS on revenues of $22.75 billion representing growth of 24-percent and 31-percent, respectively. The 2002 Severe Acute Respiratory Syndrome (SARS) epidemic shaved 2-percent off China’s GDP from 11.2-percent to 9.8-percent during the 6-month period of the outbreak culminating in 774 deaths from 8,100 cases. Epidemics tend to peak around 90-days after the first case. The SARS outbreak timeline template would hypothetically place June 2020 as the expected end point. It’s a given that Alibaba will be impacted by coronavirus as they already stated that some online orders will have ship dates delayed as far as Feb. 21, 2020, contingent on the suppliers. Investors will want more visibility as a one-off event and progress updates on attempts to enlarge its foothold in Europe. BABA is sensitive to currency fluctuations (Chinese Yuan/RMB) and any disruptions to Chinese economy can impact share prices as sentiment bias can shift basis from micro to macro and systemic rapidly. This is evidenced by recent price history as shares surged to all-time highs of 231.14 on Jan. 13, 2020 before sharply selling off to 199.50 on coronavirus fears and spiking back as high as 226.55 before settling in the 216s inside of two-weeks.

Rifle Chart Technical Analysis Trajectories: Longer-Term

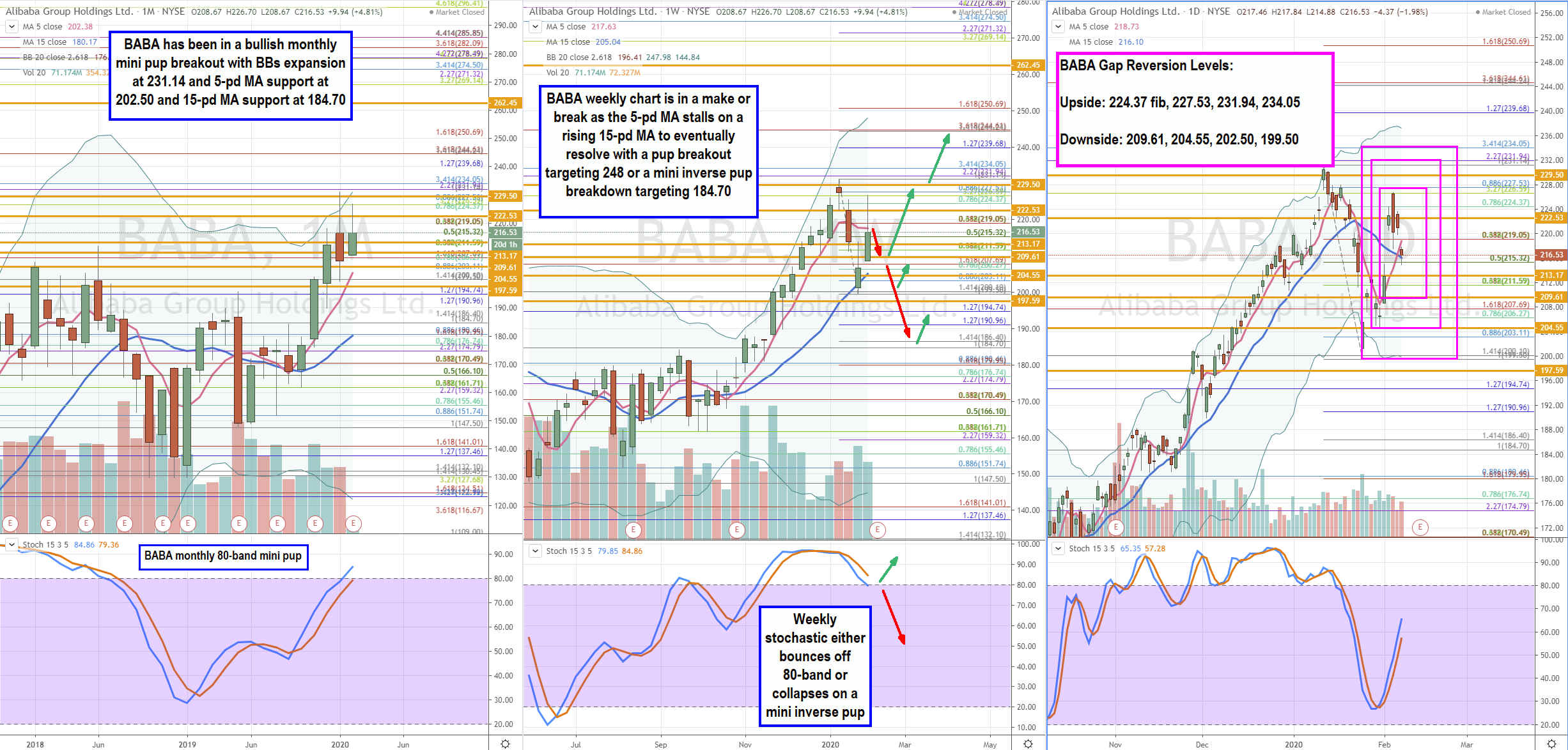

Utilizing the rifle charts, BABA has been in a bullish monthly mini pup with upper Bollinger Bands (BBs) at the 231.15 supported by the monthly 5-period moving average (MA) at 202.50. The BBs appear to be in expansion mode as both envelopes are sloping outward. Bollinger bands expand by one of two methods: pullback, test and bounce off the 5-period MA (202.50) or spike hard through the upper BB and drag the upper BB higher. The weekly stochastic has crossed down causing the 15-period MA to test and snapback coil through the 5-period before closing just under 217.63. From here the stochastic will either cross back up off the 80-band triggering a pup breakout towards the 231.14 high with longer-term upside to the 244.61 Fibonacci (fib) level. If the stochastic forms a mini inverse pup down through the 80-band, then expect the 202.50 monthly 15-pd ma support, then coil back to the 5-pd MA before grinding lower towards that 184.70 range. These are wider time frame trajectories to reference throughout the year and more accommodative to swing traders and investors.

Sympathy Stocks:

As a top tier Chinese e-commerce stock, BABA tends to impact other Chinese internet stocks including Baidu (NSADAQ: BIDU) , JD.com (NASDAQ: JD) , SINA Corporation (NASDAQ: SINA) and the third-largest China e-commerce player Pinduoduo Inc. (NASDAQ: PDD). BIDU shares tend to have the most positive correlation with BABA and priced 40-percent cheaper, making it the go-to sympathy/laggard play.

Trading Game Plan: Short-Term

This information is accommodative to intraday and short-term traders. The Feb. 13, 2020 earning release and conference call will take place prior to the 8:00 am EST access times for most retail platforms. Active traders should focus on trading the gap patterns in the morning session for the best volatility. Reversion scalps off the key price inflections levels can be played for the second gap reaction then shift focus to the third reaction trend move. The gap price reversion levels for the upside gaps are: 227.53 fib/sticky 2.50s, 231.94 fib, 234.05 fib. Downside gap reversion price levels are: 209.61 sticky 5s, 204.55 sticky 5s, 202.50 monthly 15-pd MA, 199.80 fib. Expect wide spreads off the open and thinner liquidity with algo sweeps leapfrogging each other. Use smaller-scaled in sizes and scalp quickly before the trend move on third reaction emerges. If BABA is too volatile, consider trading BIDU shares for direct laggard sympathy action using BABA as the lead indicator.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.