Heavy machinery maker

Deere & Co. (NYSE: DE) recovered to all-time highs in 2019 riding the global economic recovery in real estate and construction spending. While Deere saw a 5% YoY improvement in topline sales and revenues in their Q4 2019 release, net income fell (8%) with its Agriculture and Turf segment hardest hit. While the Company guided down FY 2020 estimates on Nov. 27, 2019, the China Phase One trade deal was reached a month afterward lifting sentiment across the board driving markets to all-time highs into 2020.

The alleviation of China trade war tensions and tariff relief at the start of 2020 have been offset with the ripple effects stemming from the coronavirus epidemic. Over 25% of the publicly traded companies reporting Q4 2019 earnings results have indicated financial impacts from coronavirus disruptions. Industry leaders like Apple (NASDAQ: AAPL) , Walmart (NYSE: WMT), Royal Caribbean Cruises (NYSE: RCL) , Qualcomm (NASDAQ: QCOM) , Dell (NASDAQ: DELL) , Under Armor (NASDAQ: UAA) and Nvidia (NASDAQ: NVDA) have already warned and reduced estimates as a result of the havoc unleashed on global supply chains impacting productivity and demand.

Coronavirus Impacts

The SARS epidemic of 2003 had 8,000 cases resulting in 774 deaths during the six-month epidemic. As of Feb. 18, the coronavirus outbreak has resulted in over 73,000 cases and over 1,800 deaths. The Chinese provinces under lockdown are headquarters to 90% of all active Chinese businesses with over 49,000 businesses being subsidiaries of foreign companies including 19% headquartered in the United States. Dun and Bradstreet report that nearly five million companies could be negatively impacted worldwide from this epidemic. Bears argue the financial markets are being complacent to the lasting impact of coronavirus misguided by assuming this as a one-off event segmented to the first quarter of 2020. Heavy machinery behemoth Caterpillar (NYSE: CAT) recently announced the planned reopening of Chinese manufacturing facilities in February but capacity restraints from worker shortages may offset any lasting positive sentiment with over 150 million Chinese still under coronavirus lockdown.

Earnings Catalyst

Deere reports fiscal year Q1 2020 earnings pre-market Feb. 21, 2020. Consensus analyst estimates are for 1.29 EPS profit on revenues of $6.178 billion. Investors are bracing for revised FY 2021 guidance from coronavirus impact. The question is the magnitude of the guide down and the narrative of being a one-off event lasting for the first half of 2020, would ease concerns. Anything more drastic or extended could accelerate the bearish monthly stochastic mini inverse pup.

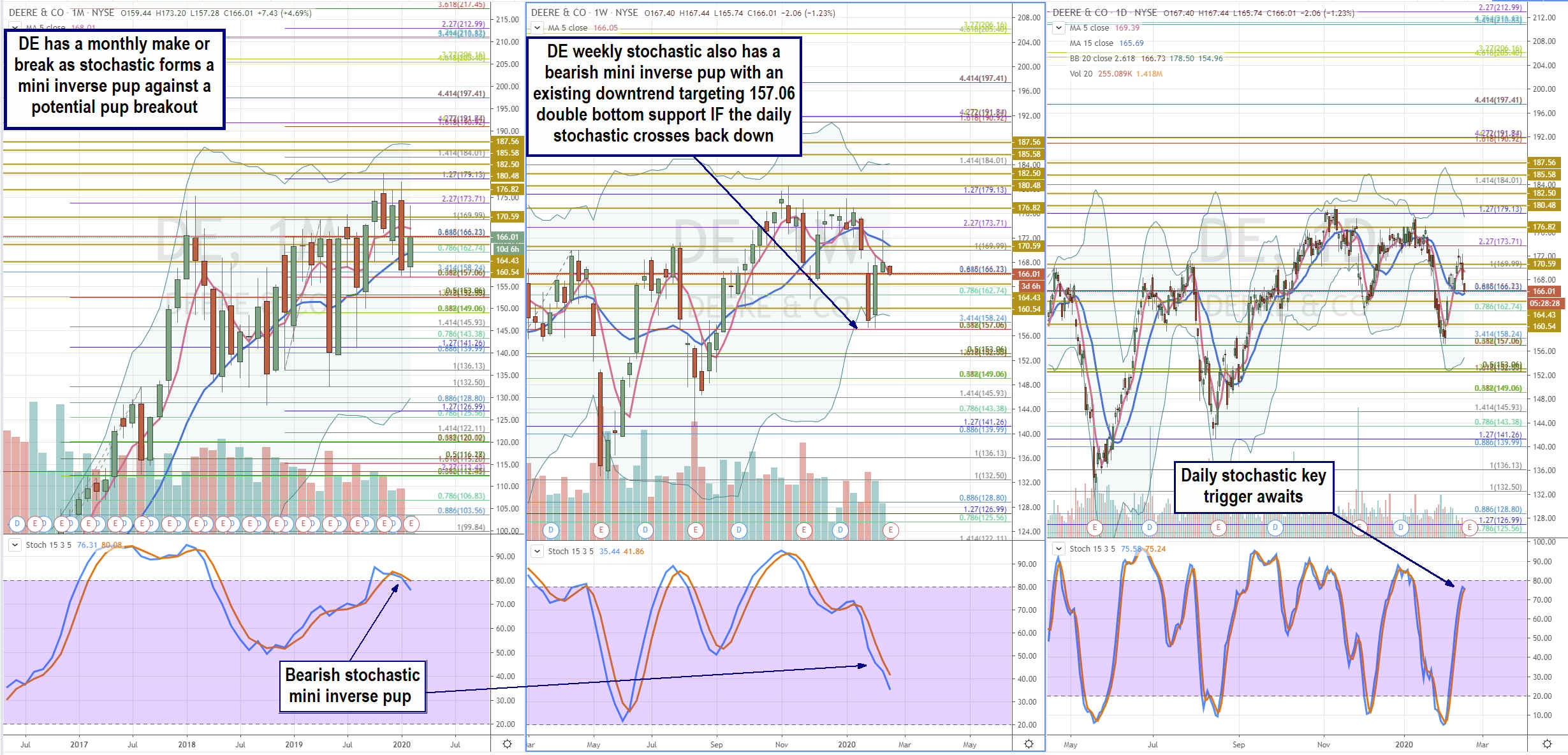

Rifle Chart Technical Analysis Trajectories: Longer-Term

We use the rifle charts on wider time frames to lay out the playing field suitable for swing traders and investors. The monthly chart has a make or breaks situation composed of a bearish stochastic mini inverse pup versus the potential for a moving average (MA) pup breakout. The bullish scenario would have the monthly stochastic cross back up through the 80-band triggering a pup breakout targeting the monthly upper Bollinger Bands (BBs) at 186.92. The bearish scenario would have the stochastic mini inverse pup perform a full oscillation down as the MAs crossover down forming a downtrend towards the monthly lower BBs at 129.79. The weekly stochastic has a mini inverse pup and downtrend targeting the 157.06 Fibonacci (fib) level support. With the presence of two simultaneous bearish stochastic mini inverse pups (monthly and weekly), they still remain dormant until the daily stochastic crosses back down. Currently, the daily stochastic has stalled just under the 80-band heading into the earnings release.

Sympathy Stocks:

DE shares a positive correlation with other machinery stocks starting with CAT, Cummins Inc. (NYSE: CMI) and Tracker Supply Co. (NASDAQ: TSCO) . As usual with sympathy trades, it’s prudent to firm confirm positive correlation based on the initial gap and then the follow-through. The larger the gap up or down, the more positive correlation can form.

Trading Game Plan for Earnings Gap:

This information is accommodative to intraday and short-term traders looking to play the earnings gap. DE reports earnings pre-market on Fri. Feb. 21, 2020. This puts the best tradeable action in the morning session off the opening bell. Spreads can start off wide on thin liquidity but eventually will get tighter since it’s a Friday. Traders can expect scalps ranging from 0.50 to 0.90 in the first 20-minutes and shrink afterward. Reversion scalps off the key price inflections levels can be played for the second gap reaction then shift focus to the third reaction trend move. The gap price reversion levels for the upside earnings gaps are: 170.60 sticky 5’s zone, 173.71 fib, 176.82 trend line, and 180.48 stinky 5s zone. Downside gap reversion price levels are: 162.74 fib, 160.54 sticky 5s zone, 157.06 fib/double bottom and 153 fibs. Traders can trade the in-between fibs and sticky 2.50s levels intraday as well.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.