Shares of the world’s largest gold miner

Newmont Goldcorp Corporation (NYSE: NEM) have rallied towards 52-week highs driven by surging prices of

gold (NYSE: GLD) accelerated by fears of the coronavirus epidemic. While Newmont also mines silver and copper, it’s synonymous with the gold mining industry as its largest producer. Precious metal gold is largely considered a safe haven investment to hedge against inflation, geopolitical and economic crisis and systemic risk. The steady decline of the world’s gold supply coupled with, fixed costs and falling fuel prices have helped bolster operating margins. As the top gold miner in the Dow Jones Sustainability index, Newmont qualifies as an environmental, social and governance (ESG) thematic investment.

Earnings Catalyst

Newmont reports Q4 2019 earnings premarket Feb. 20, 2020 followed by the 10:00 am EST conference call. Consensus analyst estimates are for 0.47 EPS profit on revenues of $3.023 billion. Tom Palmer took the helm as the new CEO in Q3 2019 to harvest accretive synergies from the Goldcorp acquisition. The company provided full-year guidance updates on Jan. 20, 2020 which included production guidance to 6.4 million ounces for 2020 and 6.2 million to 6.7 million ounces through 2024. Investors will watch for improvement in the all-in sustain costs (AISC) up from $978-per ounce from last quarter and visibility on improved efficiencies from the merger. Any divergence from January guidance will sway the price gap reaction. Since most of the operating mines are located in Australia and the U.S., investors don’t expect disruptions from the coronavirus, but confirmation helps. The narrative will impact the sentiment as gold prices rise with the presence of uncertainty and a global crisis.

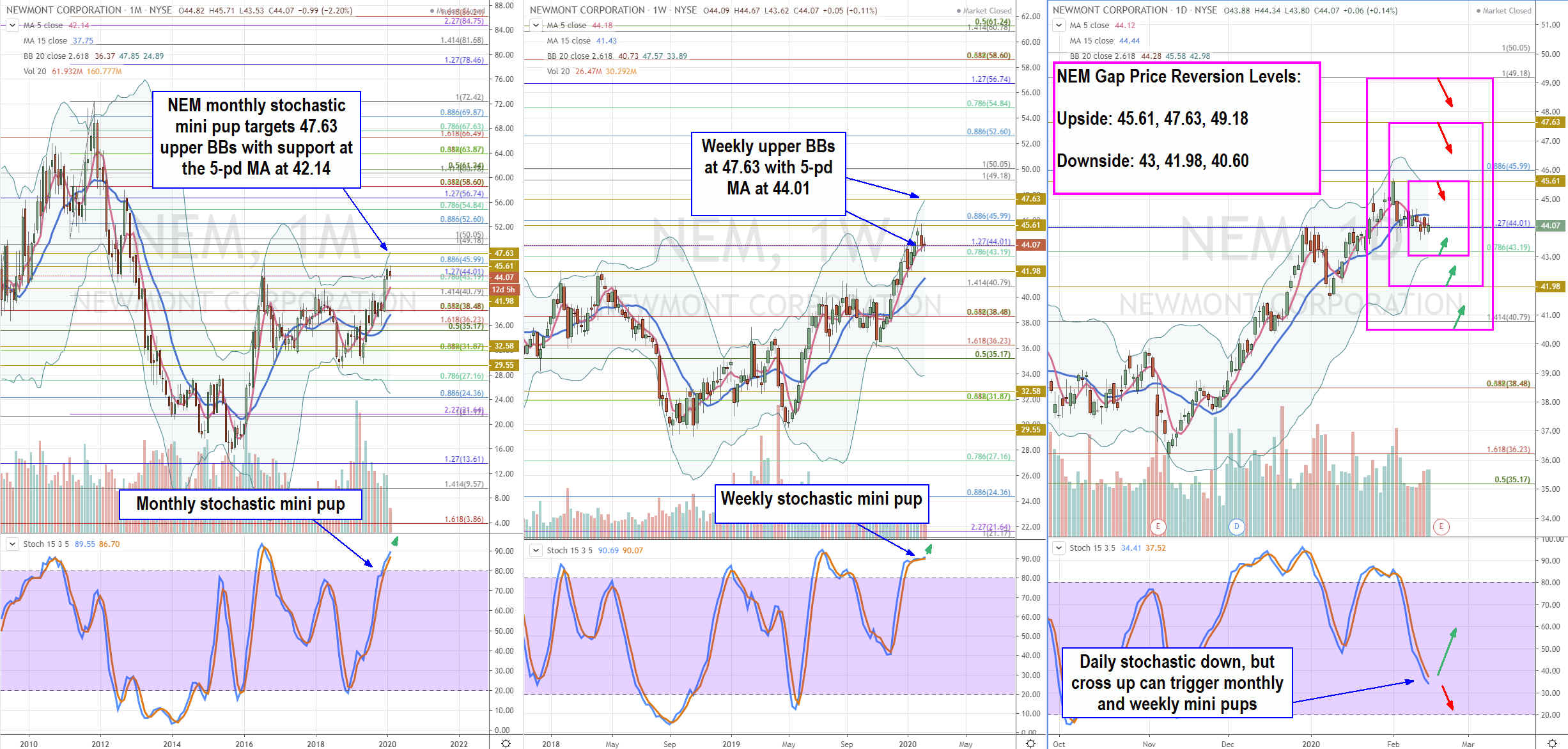

Rifle Chart Technical Analysis Trajectories: Longer-Term

We use the rifle charts on wider time frames to lay out the playing field suitable for swing traders and investors. The monthly chart for NEM has been in a bullish stochastic mini pup targeting upper Bollinger Bands (BBs) at 47.63 with the 5-period moving average (MA) support at 42.15 and 15-pd MA support at 37.75. The weekly stochastic has a high band mini pup with support at the 5-period MA at the 44.01 Fibonacci (fib) level with upper BBs at 47.63 area (same as the monthly upper BBs). The dual monthly and weekly stochastic mini pups are dormant until they trigger. The trigger is the daily stochastic cross back up. Currently, the daily stochastic is falling targeting lower BBs at 42.98 and the 43.19 fib. Expect coils off that level with potential for the daily stochastic cross up. Shares would need to push back up through the 44.01 fib to trigger the weekly/monthly dual mini pups.

Sympathy Stocks:

NEM is a top tier gold mining stock. The gold mining industry is littered with mining stocks of all levels that aren’t always correlated or legit. The most positive correlation with NEM is top peer Barrick Gold Corporation (NYSE: GOLD). The Direxion Daily Gold Miners Bear 3X Shares ETF (NYSEARCA: DUST) has a direct negative correlation (moves opposite) to NEM. This means it can be played long on NEM downtrends and short on NEM uptrends.

Trading Game Plan for Earnings Gap:

This information is accommodative to intraday and short-term traders looking to play the earnings gap. Since NEM reports pre-market followed by 10:00 am EST conference call, the morning session should see the most volatility. Reversion scalps off the key price inflections levels can be played for the second gap reaction then shift focus to the third reaction trend move. If NEM gaps down on earnings pay closer attention for a reversion coil into the conference call. The gap price reversion levels for the upside earnings gaps are: 45.61 daily upper BBS/sticky 5s, 47.63 weekly/monthly upper BBs/sticky 2.50s and 49.18 fib. Downside gap reversion price levels are: 43 fib, 41.98 monthly 5-pd MA, and 40.60 sticky 5s. For active scalpers, the in-between fibs and sticky 2.50s/5s ranges provide more intraday price inflection points to trade off. NEM is thick with plenty of liquidity so larger size shares can be used with scaling especially at the sticky 2.50s and 5s areas that overlap with fibs. Average scalp sizes of 0.05-0.20 can be expected with up to 0.20 wiggle room off the reversion levels. If NEM starts to trend on the third reaction, you can get more bang for the buck playing the negative correlation with DUST ETF at a quarter of the cost.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.