Graphics chips maker

Nvidia Corp. (NASDAQ: NVDA) dominates the graphics processing unit (GPU) market with its cutting-edge chipsets used to power gaming systems, cryptocurrency mining rigs, big data analytics, drones/autonomous vehicles and artificial intelligence (AI) applications. Shares soared from $40s in 2016 to peak out at 292.76 in October 2018 before collapsing from the ripple effects of the Bitcoin bubble and China trade tariffs. Shares have been steadily recovering since the 124.46 lows of December 2018. NVDA launched its GeForce NOW PC game streaming service to directly challenge

Google (NASDAQ: GOOG) (NASDAQ: GOOGL) Stadia service. GeForce NOW has compatibility advantages over Stadia by enabling gamers to play games they own rather than having to purchase Stadia-only versions. NVDA has an embedded customer base of customers to grow recurring revenues with the add-on service. Datacenter sales saw a surprise surge in Q4 2019 for

Intel (NASDAQ: INTC) and competing GPU maker

Advanced Micro Devices (NYSE: AMD) . Investors have high hopes for NVDA’s next-gen Big Red 200 chipsets to drive data center penetration with its 70-percent outperformance over current gen GPUs. RBC Capital Markets raised NVDA stock price target to $301 from $250 on Feb. 10, 2020.

Earnings Catalyst

NVDA reports Q4 2019 earnings post-market on Thursday, Feb. 13, 2020, followed by the 5:30pm EST conference call. Consensus analyst estimates are for $1.67 EPS on revenues of $2.978 billion. There is heavy optimism heading into the earnings release as investors have moved beyond just hoping to end the four-quarter revenue declines to an all-out blowout surprise on both top and bottom lines and guidance raise. Markets have (perhaps prematurely) looked past the coronavirus economic impacts despite reported supply chain disruptions from Chinese manufacturers. Foxconn factories in Zhengzhou and Shenzhen have only seen 10-percent of its workers return to the plant as of Feb. 10, 2020. Apple (NASDAQ: AAPL) shares initially plunged (2-percent) on the news since the bulk of iPhone 11 production occurs there. However, share recovered losses and closed green by the end of the day as the Nasdaq 100 and S&P 500 benchmark indices spiked to new all-time highs. Safety concerns from the spread of coronavirus have prompted NVDA along with Amazon (NASDAQ: AMZN) and Ericsson (NASDAQ: ERIC) to pull out of the Mobile World Congress 2020 event in Barcelona scheduled later this month. Whether NVDA shares have already priced in a strong beat to trigger a sell-the-news reaction or launch the next leg higher will be determined with this weekly candle close.

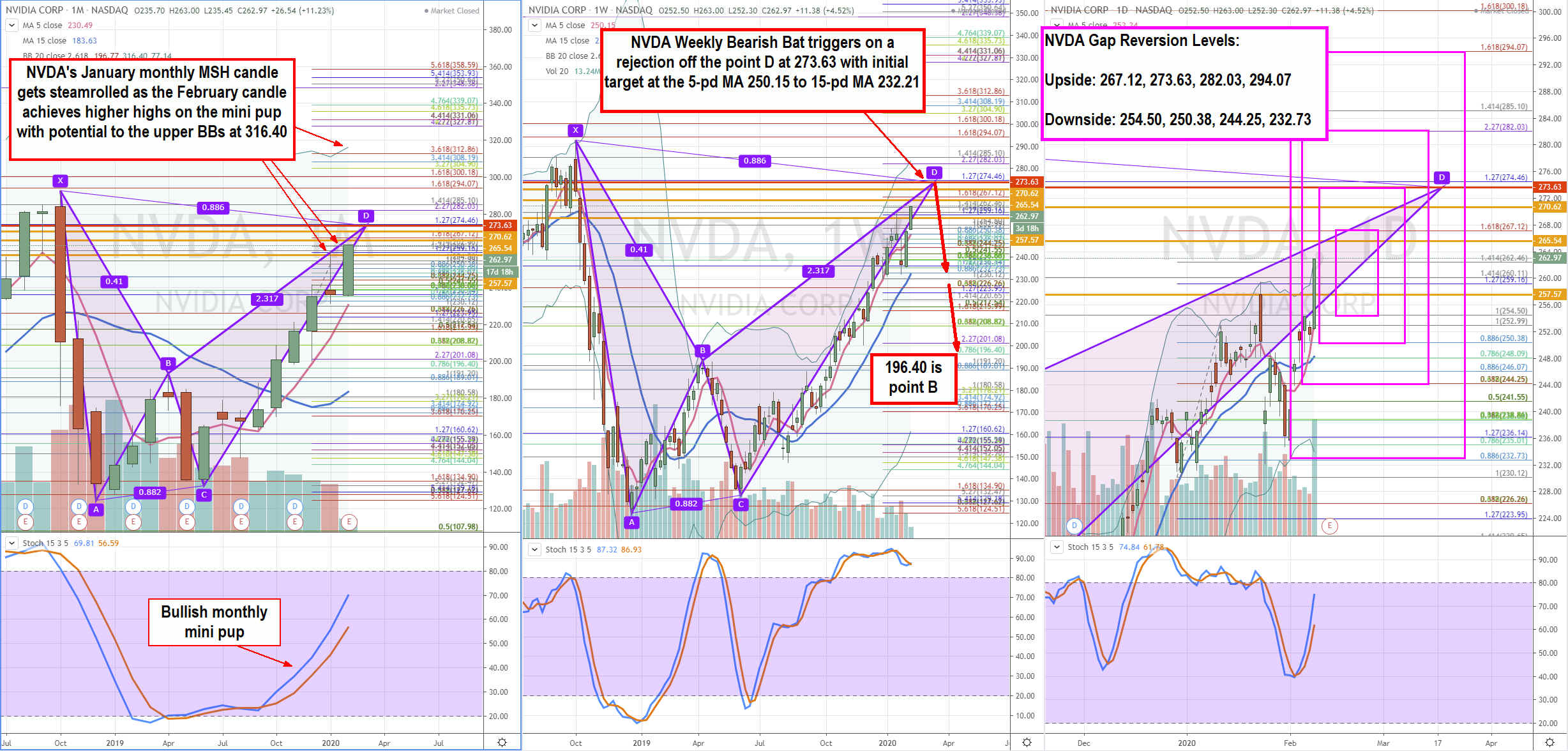

Rifle Chart Technical Analysis Trajectories: Longer-Term

Utilizing the rifle charts on wider time frames suitable for swing traders and investors. The January 2020 monthly candle closed with a shooting star and potential market structure high (MSH) at the 259.50 highs. However, the February candle already smashed through the highest high hitting 263, which continues the candlestick count going on six consecutive higher monthly highs. NVDA has a monthly bullish stochastic mini pup which targets the upper Bollinger Bands (BB) at the 312.86 Fibonacci (fib) level as long as the 5-period moving average (MA) support continues to deflect pullbacks, currently at 230.48. While the monthly looks bullish, there is a potentially rare bearish harmonic pattern setting up that could trap, and rug pull the bulls.

Potential Weekly Bearish Bat Pattern

The weekly NVDA candlestick chart has the potential to form a bearish five-point harmonic pattern known as a bearish bat. The first four points X, A, B, and C meet the Fibonacci leg ratios leaving point D as the trigger on the 0.886 XD trajectory at 273.63. In a nutshell, this means point D is a key resistance and price reversal trigger for potential shorts with point B at 196.40. Since this is a weekly chart, the price ranges are much wider as well as the length of time for targets to hit, unless an unexpected reaction to a catalyst presents itself (IE: Earnings shortfall).

Sympathy Stocks:

AMD is the go-to sympathy stock to play with (or in place of) NVDA, especially during earnings. As pointed out in the Trading Blueprint for AMD Earnings article, AMD tends to move primarily with NVDA, since they are the second dominant player in the GPU segment. However, AMD can also move with DRAM supplier Micron Technologies (NYSE: MU) which impacts storage device makers Western Digital (NYSE: WDC) and Seagate Technologies (NYSE: STX) . AMD can be swapped out for NVDA trades especially since shares trade at 1/5th the price and come with more liquidity.

Trading Game Plan: Short-Term

This information is accommodative to intraday and short-term traders. NVDA can be expected to trade with wide spreads and thin liquidity following the initial post-market reaction to the release. Pay close attention to the reaction off the 273.63 bearish point D trigger price level on the initial reaction spikes. Seasoned traders may even consider placing scaled limit short sells for the initial spikes. This is only for the most experienced and nimble traders.

Most intraday traders should focus on keeping trades segmented to the morning session for the best liquidity. Reversion scalps off the key price inflections levels can be played for the second gap reaction then shift focus to the third reaction trend move. The gap price reversion levels for the upside gaps are: 267.12 fib, 273.63-Bearish Bat point D, 282.03 weekly upper BBs/fib, and 294.07 fib. Downside gap reversion price levels are: 254.50 fib/sticky 5s zone, 250.38 weekly 5-pd MA/fib/sticky 5s zone, 244.25 super fib and 232.73 weekly 15-pd MA/fib. If NVDA is too volatile, then switch to AMD using NVDA as a lead indicator to trade a laggard move on AMD.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.