Website development platform

Wix.com Ltd. NASDAQ: WIX enables users to design and launch a personalized and professional looking website in under 10-minutes. E-commerce, CRM, marketing and API tools are at the ready with seamless out-of-box plug-and-play integration with contemporary cutting-edge AI-enabled design tools. While there are tons of website construction add-on services offered by competitors including e-commerce platform

Shopify Inc. (NASDAQ: SHOP) and website hosting providers

Verisign NASDAQ: VRSN and

GoDaddy NASDAQ: GDDY. However, Wix has managed to consistently merge innovation with simplicity with the agility of a nimble fintech. Topline revenue growth has averaged 26-percent YoY driven by consistent 15-percent YoY registered user and subscription growth for the past five years. The company guided down Q4 2019 estimates on Nov. 14, 2019, setting the bar lower heading into earnings release. Shares have since recovered from lows of 116.36 on Dec. 23, 2019, to within five percent of all-time highs.

Earnings Catalyst

Wix reports Q4 2019 earnings premarket Feb. 20, 2020 followed by the 8:30 am EST conference call. Consensus analyst estimates are for 0.31 EPS profit on revenues of $205.51 million. The rally in shares indicates optimism on exceeding the lowered revisions and upside improvement for FY 2020 guidance. The upside is priced into the shares, so management really needs to shape the narrative of Q4 2019 being a one-off with exceptionally bullish prospects moving forward to build positive sentiment for shares to exceed new highs. With growing geographic penetration evidenced by the Q3 2019 slideshow, North America has dropped to 55-percent of revenues as Europe representing 25-percent, Asia at 13-percent and Latin America at 7-percent. With 13-percent of total revenues coming from Asia, investors will want updates on any financial impacts from the coronavirus.

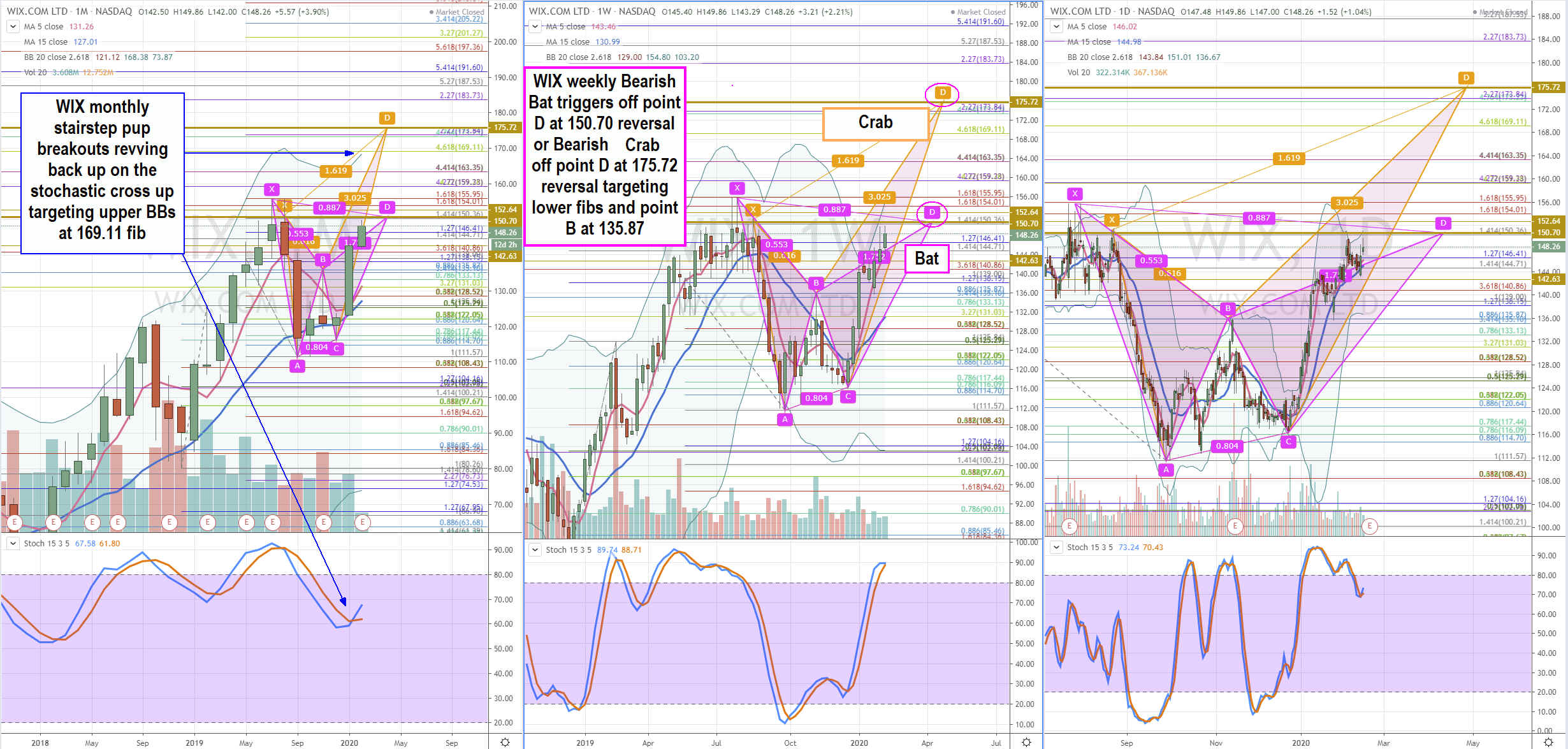

Rifle Chart Technical Analysis Trajectories: Longer-Term

We use the rifle charts on wider time frames to lay out the playing field suitable for swing traders and investors. The monthly chart for WIX has been in a bullish stair-step pup targeting upper Bollinger Bands (BBs) at 168.38 with the 5-period moving average (MA) support at 131.13 Fibonacci (fib) level and 15-pd MA support at 127.01. The monthly stochastic is revving up again on the crossover up. The weekly stochastic has made a full oscillation to the 90-band and stalling for either a mini pup thrust above the 5-period MA at 143.46 for another leg-up or a peak and pullback to the 80-band if the 5-period MA breaks setting up a sell-off to the 15-period MA at 131.03 fib. The daily stochastic is crossing back up again for a potential pup breakout to the upper BBs at 151.01 as the BBs are compressing for a larger trend move. The daily 5 and 15-period MAs are right at 146.02 and 144.98 respectively. The daily stochastic cross up has the potential to trigger a perfect storm breakout first then potential trigger of two potential bearish harmonic patterns, bat or crab.

Bearish Bat or Bearish Crab Pattern?

There are two bearish five-point harmonic patterns that can trigger at the respective point D reversal price levels, 150.70 and 175.72. The bearish bat pattern projects a peak near the 1.27 fib extension point D at 150.70 for a reversal sell-off towards the point B at the 135.87 fib level. The bearish crab calls for a much larger upside spike towards the 1.618 fib extension point D at 175.72 for a reversal towards the same point B 135.87 fib level. Harmonic patterns are not an exact science so the point D price levels should be given up to two-points of wiggle room. The reversals can be measured with intraday indicators and lower fib levels can be targeted for intraday and swing trades.

Sympathy Stocks:

WIX is a turn-key website creation, hosting and management platform. There are many competitors offering some or all of WIX-like services on their own platforms. This makes sympathy trade on positive correlation tricky depending on the magnitude of WIX strength or weakness. The stronger WIX gaps and trends the further down the totem pole the correlation will flow. The order of positive correlation is SHOP, VRSN, and GDDY. Always compare the intraday charts to confirm correlation before considering a sympathy trade.

Trading Game Plan for Earnings Gap:

This information is accommodative to intraday and short-term traders looking to play the earnings gap. Since WIX reports pre-market followed by an 8:30am EST conference call, the morning session should see the most volatility. WIX is a very fast and volatile stock requiring exceptional trade management to keep stops or scale in without hesitation. The initial spreads can be as wide as two-points but eventually tightening as the day wears on. Scales can range from .25 to 1.25 intraday. The harmonic point Ds are solid areas to watch for reversions. Any large gap downs can be expected to bounce heading into the 10 am EST earnings call.

Reversion scalps off the key price inflections levels can be played for the second gap reaction then shift focus to the third reaction trend move. The gap price reversion levels for the upside earnings gaps are: 150.70 Bat point D, 154.80 weekly upper BBs, 155.95 fib, 163.35 fib, 169.11 monthly upper BBs/fib, and 174.72 Crab point D.

Downside gap reversion price levels are: 143.46 weekly 5-pd MA, 140.86 fib, 135.82 Bat/Crab point B/fib, 131.03 monthly 5-pd MA/weekly 15-pd MA/fib and 128.52 super fib. If WIX shares are too fast and volatile, then consider sympathy trades on GDDY only after confirming intraday positive correlation which starts with participating in the price gap with WIX.

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.