Consumer products maker

Tupperware Brands NYSE: TUP stock was a

pandemic winner in 2020, but shares have recently taken a beating in 2021. As

COVID-19 vaccinations accelerate, the narrative is changing as money flows back into the

value names and industries most hurt by the pandemic in anticipation of a return to normal and

pent-up demand spending. The Company owns many brands that extend into cosmetics, bath and skincare products, nutrition, fragrance, and even jewelry. Tupperware was not only a pandemic winner but a turnaround situation that emerged as a stronger Company as evidenced by the recent earnings results. The stay-at-home restrictions bolster in-home dining which was a boon to its food storage and cookware business. Unfortunately, the estimate miss punished shares despite beating topline estimates due to a staggering 89.1% operating tax rate for Q4. Technically the Company is a

value play that also happened to benefit from the effects of the pandemic. The market will realize this after the initial sell-off reaction as the Company’s other consumer product lines should help offset reversions in its kitchenware and storage business. The sell-off has presented a chance for prudent investors to consider taking exposure at opportunistic pullback levels.

Q4 FY 2020 Earnings Release

On Oct. 10, 2021, Tupperware Brands released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported an adjusted diluted earnings-per-share (EPS) profit of $0.17 excluding non-recurring items versus consensus analyst estimates for a $0.71, which may not be comparable but shows a (-$0.54) miss. Keep in mind, this was an improvement over the (-$0.63) in the prior year period Q4 2019. Revenues grew by 17.4% year-over-year (YOY) to $489.6 million handily beating analyst estimates for $449 million. It’s worth noting that the EPS included a whopping 89.1% operating tax rate and full-year operating tax rate of 46.9%. The Company achieved $72 million in turnaround cost savings in Q4 and $192 million for full-year 2020. Full-year 2020 free cash flow was $197.6 million, up $137.2 million from 2019. Tupperware retired 4.75% of 2021 Senior Notes due in June 2021.

Conference Call Takeaways

Tupperware Brands CEO, Miguel Fernandez, set the tone on the turnaround, “We initiated a new growth strategy to unlock the power and consumer acceptance of our brand. And we started executing on our new defined purpose to nurture a better future every day, putting our environmentally friendly, reusable message front and center… With sales growth of 20% in the last two quarters, we believe we’ve changed the negative trends of prior years.” CEO Fernandez acknowledged how the stay-at-home trend led to more consumers cooking at home and used Tupperware products to, “prepare food, minimize food wastes and decrease their use of products made with single use materials.” The Company seeks to parlay the success of 2020 to, “accelerate widespread adoption in 2021.” In Q4, U.S and Canada sales grew 83% YoY due to service improvements dropping the backlog, which accounted for 47%, by $21 million. Much of this can be credited to the digital transformation as the sales force utilized digital demonstration tools for more efficient productive selling situations and are currently testing the new digital online party tools. The Company also appointed a new President for the China and Vietnam geographies, Ken Yang, formerly of Pepsi NYSE: PEP , JD.com NYSE: JD and Walmart NYSE: WMT. The Company continues its digital transformation and will embrace more data analytics and digital tools to create seamless sales experiences.

Turnaround Tax Rate Strategy

Tupperware Brands CFO, Sandra Harris, explained the “abnormally high tax rate” of 72.9% for Q4, “As we noted during our Q3 conference call, we expected our fourth quarter tax rate would be unusually high due to the timing of certain non-operating events associated with the sale of non-core assets and early retirement of debt.” The turnaround plan is executing a five-year tax strategy that will result in lower overall tax rate expected to be in the mid-30% range versus 47% for 2020 and 88% for 2019. By 2022, the Company expects to achieve an effective tax rate of 28%. If Q4 2020 applied the 28% tax rate, the EPS would have been $0.68 higher at $1.14 versus $0.14 adjusted EPS. The markets may have been overzealous in the sell-off without considering the upcoming improvement in the tax rate as the core business continues to improve. Prudent investors seeking exposure can watch for opportunistic pullback levels.

TUP Opportunistic Pullback Levels

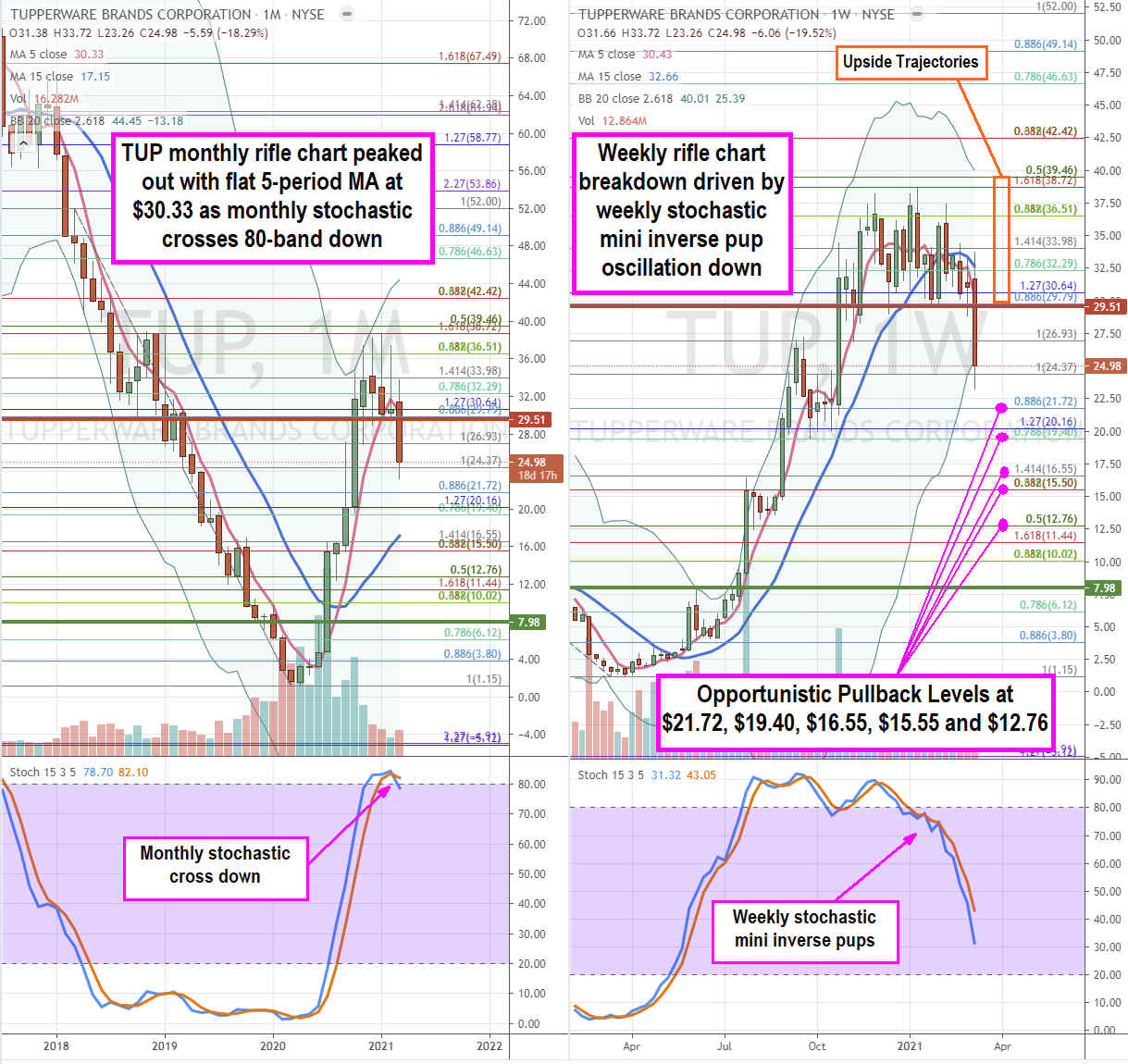

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for TUP stock. The monthly rifle chart peaked at the $38.72 Fibonacci (fib) level. The uptrend stalled as shares fell under the 5-period moving average (MA) at $30.33. The 15-period MA is at $17.15. The monthly stochastic has crossed back down through the 80-band. The monthly market structure low (MSL) buy triggered at $7.86. The monthly market structure high (MSH) sell triggered under $29.51. The weekly rifle chart broke down hard overshooting the weekly lower Bollinger Bands (BBs) at $25.39. The weekly stochastic formed a number of stairstep mini inverse pups as it continues its oscillation towards the 20-band. Prudent investors can monitor for opportunistic pullback levels at the $21.72 fib, $19.40 fib, $16.55 fib, $15.50 fib, and $12.76 fib. The upside trajectories range from the $29.79 fib up towards the $39.46 fib area.

Before you consider Tupperware Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tupperware Brands wasn't on the list.

While Tupperware Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.