A 5% jump on Monday was enough to make shares of social media giant

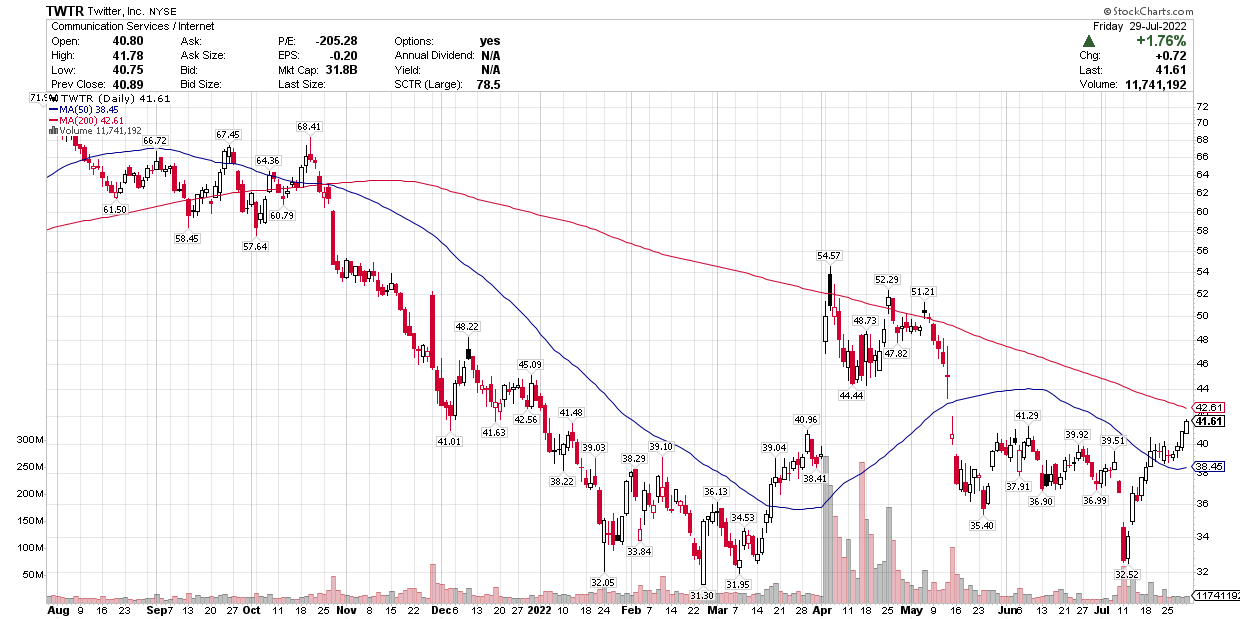

Twitter (NYSE: TWTR) among the best performing in the S&P 500 for the day. The final traded price of $48.25 meant shares closed at their highest level since 2015 and they appear to have broken out from a dangerous forming triple top.

Since IPO’ing in 2013, Twitter shares have given investors plenty of ups and downs and for much of 2016 and 2017 looked to be down for the count. At times, their earnings have left Wall Street speechless and precipitated double-digit percentage falls. But since reversing March’s wicked drop, shares have managed to resume the upward trend they were forming prior to the coronavirus pandemic and look set to have a killer Q4.

Fresh Upgrade

Deutsche Bank helped Twitter shares start the week off strong yesterday when they came out with an upgrade. They moved the stock from Hold to Buy while also pumping their price target up to $56. Even with Monday’s strong performance, this suggests additional upside of at least 16%.

Analyst Lloyd Walmsley is particularly bullish on Twitter’s ability to “drive monetization over the next few years" as their monetizable daily active user (mDAU) numbers continue to grow. Walmsley sees Twitter as well-positioned to "benefit from a big event landscape in 2021," and is "starting to hear more positive feedback in the ad channel." Even as their shares hit a multi-year high, he’s boosting the bulls case by advising investors still on the sidelines to get involved before a “stronger ad recovery takes hold” next year.

For context, July’s Q2 numbers showed a modest recovery in ad numbers as ad revenue came in 22% lower year on year. Topline and bottomline numbers were both lighter than expected as a result and down on the year too, but Wall Street was happy to focus on the positives. Twitter’s mDAU numbers were well above the consensus and up a full 34% year on year. This is the major tailwind that’s been driving shares since.

At the time, Citi were cautiously bullish and expected “modest strength” in shares as the recovery continued through the rest of the year. Since then, there have been several more sell-side names who’ve thrown their lot in behind the $38 billion San Francisco headquartered company.

Impressive Momentum

The last few weeks have been particularly good for this which bodes well for the company’s momentum into the final quarter of 2020. In the final week of September Pivotal Research upgraded Twitter stock from a Hold to a Buy rating. Analyst Michael Levine was impressed with the company’s user growth and how it has "been strong during the pandemic and the current news cycle". He also noted that continued growth in their mDAUs is a pleasant tailwind that should be sticking around for a while yet.

That same week Mizhou also raised their price target, with analyst James Lee noting the changing nature of how users are interacting with Twitter. In a note to clients he wrote about how it’s "started to become an 'always on' platform in terms of engagement" versus only primarily used during sports or live events.

In recent months, shares of Twitter has easily outperformed those of the company it’s probably most often compared to, Facebook (NASDAQ: FB). While this may not hold true if we stretch the timeline back before COVID, new investors will be focused on current momentum and that’s exactly what Twitter has right now. They’re due to release their Q3 numbers later this month and it will be interesting to see how the various tailwinds and headwinds are holding up. Wall Street will be watching closely but going off recent momentum, there’s every reason to think the tailwinds will continue to drive shares higher into 2021.

Before you consider Twitter, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twitter wasn't on the list.

While Twitter currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.