A Bubble Has Burst For These Two Retailers

The TJX Companies (NYSE:TJX) and Overstock.com (NASDAQ:OSTK) are two different but related stories representing trends present in the market today. On the one hand, we have a company in good health, weathering the pandemic, and poised to rebound strongly with the economic reopening. On the other a company at the forefront of eCommerce and growing like nobody’s business. In both cases, the Q4 results were not enough to keep the market interested and now shares are down because of it. In both cases, the market got ahead of itself, maybe way ahead of itself, and priced in some events that have yet to pass. What this means for us today is a deep discount in two names our team wants to own.

The TJX Companies Can’t Get Past COVID

The TJX Companies, Inc was very nimble in its response to the pandemic at once curbing exposure to illness within the operation and cutting back heavily on spending, including the dividend. In the wake of the shut-downs business was OK, better than expected, and set the company up well for a reopening bounce. That bounce began to materialize in the 3rd quarter of 2020 but fizzled out in the 4th. Kind of. While revenue deceleration accelerated to -10% YOY the company’s revenue grew on a sequential basis and the forecast is positive if still impacted by COVID.

The problem for TJX investors is that revenue missed the consensus by nearly 500 basis points and that pain was felt on the bottom line too. The mitigating factor for us is that open-only store comps fell only -3.0% versus the -6.0% expected by the analysts. It may not seem like much but 300 basis points is a significant impact on comp sales providing more of the stores are able to open and it looks like that is happening right now. Looking forward, The TJX Companies is expected to see a robust uptick in earnings to the tune of 10,000 basis points or about 1000%.

That’s great news for shareholders because it means the TJX Companies can not only sustain the recently reinstated dividend but will be able to grow it again next year. Technically speaking, discounting the lack of distribution in the Q1 to Q3 2020 period, The TJX Companies has been increasing the payment annually for over 20 years and should have no trouble doing it again next year. The reinstated payment is 13% greater than the previous and the expected CAGR is in the range of 15% to 20%.

Overstock, When Great News Isn’t Good Enough

Overstock.com had a great 2020 and that did not stop in the fourth quarter. Far from it. Overstock.com’s Q4 revenue shrank a bit from the Q3 period but growth remained strong at 84.4% YOY. Not only was growth strong, but it beat the consensus by 200 basis points but there is a problem. The company says tailwinds supported by the pandemic will likely weaken as vaccine distribution increases and that is not what the market wanted to hear. While the results are better than expected, the guidance is not and the forward outlook is what drives price action.

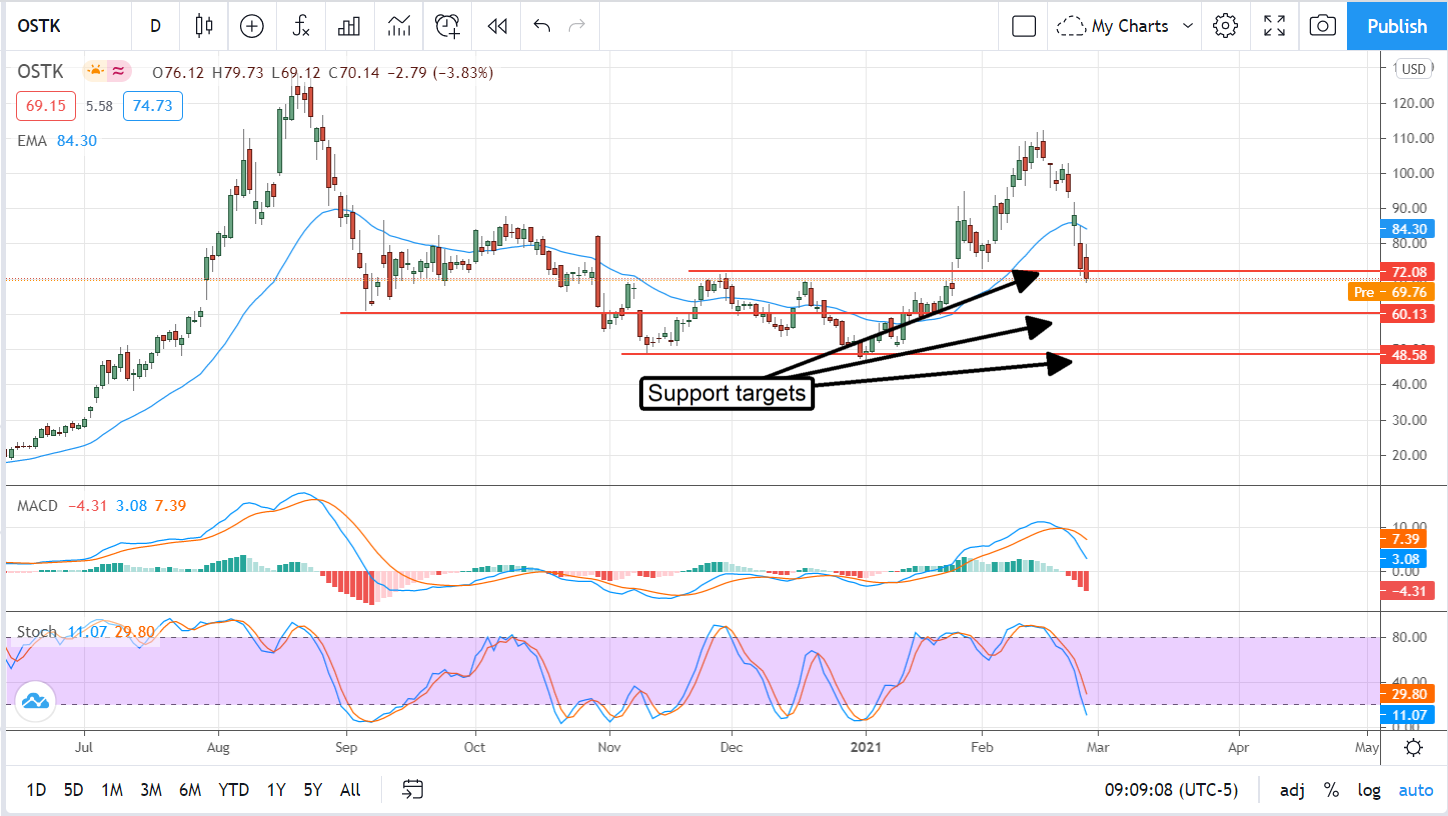

What this means for investors is a chance to buy this highly desirable stock at a much cheaper valuation. The stock is already down more than 35% and heading lower if the shorts have anything to do with it. Short interest is running near 15% and may continue to weigh on prices in the near-term. Longer-term, we expect this company to outperform is newly lowered bar and begin a rebound if one does not start sooner. On a technical basis, the stock is approaching what should be considered a strong support level within a long-term up trend. Although there is sign of support at the $72 level in premarket action this stock could fall as far as $48.58 before really hitting bottom.

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.