Global meat and poultry products producer Tyson Foods NYSE: TSN stock has been in a nine week losing streak falling (-24%) for the year. The Company has faced all kinds of problems this year putting pressure on its shares which are trading at 7.5X forward earnings with a 2.79% annual dividend yield. Labor and supply chain constraints have been a recurring problem since the pandemic, but high inflation and currency pressures are becoming major headwinds. The nation’s largest meat and poultry producer operates many popular brands like Jimmy Dean, Tyson, Hillshire Farm, Ball Park, Wright, Aidells, iBP, and State Fair. While consumers pullback on discretionary spending, they are still spending on consumer staples. However, tough macroeconomic conditions and food inflation are pushing consumers to opt for cheaper private label and generic brands versus well-known national brands. The strong U.S. dollar is having a negative effect on international sales as margins shrink. It is worth noting that the headwinds are generally affecting all food producers including Pilgrim’s Pride NYSE: PPC, Hormel Foods NYSE: HRL , and Beyond Meat NASDAQ: BYND. Tyson has been able to mitigate some of the tailwinds by raising prices and implementing cost savings measures which are expected to generate $400 million in cost savings in 2022 and $1 billion in savings by fiscal 2024.

Earnings Were Not Bad

On Aug. 8, 2022, Tyson Foods reported its fiscal Q3 2022 earnings for the quarter ended in June 2022. The Company reported earnings-per-share (EPS) profits of $1.94 vs. $1.97 missing consensus analyst estimates by (-$0.03). Revenues grew 8.2% year-over-year (YoY) to $13.49 billion versus $13.25 billion analyst estimates. Earnings were not bad as 2021 was an outlier year making for tough comps in 2022. GAAP operating income fell (-3%) from prior year to $1.03 billion. However, adjusted operating income fell (-27%) from prior year at $998 million. The Company ended the quarter with $3.3 billion in liquidity. Unfortunately, the market was disappointed plunging TSN shares by (-8%) the following day and sliding lower ever since.

Here’s What the Charts Say

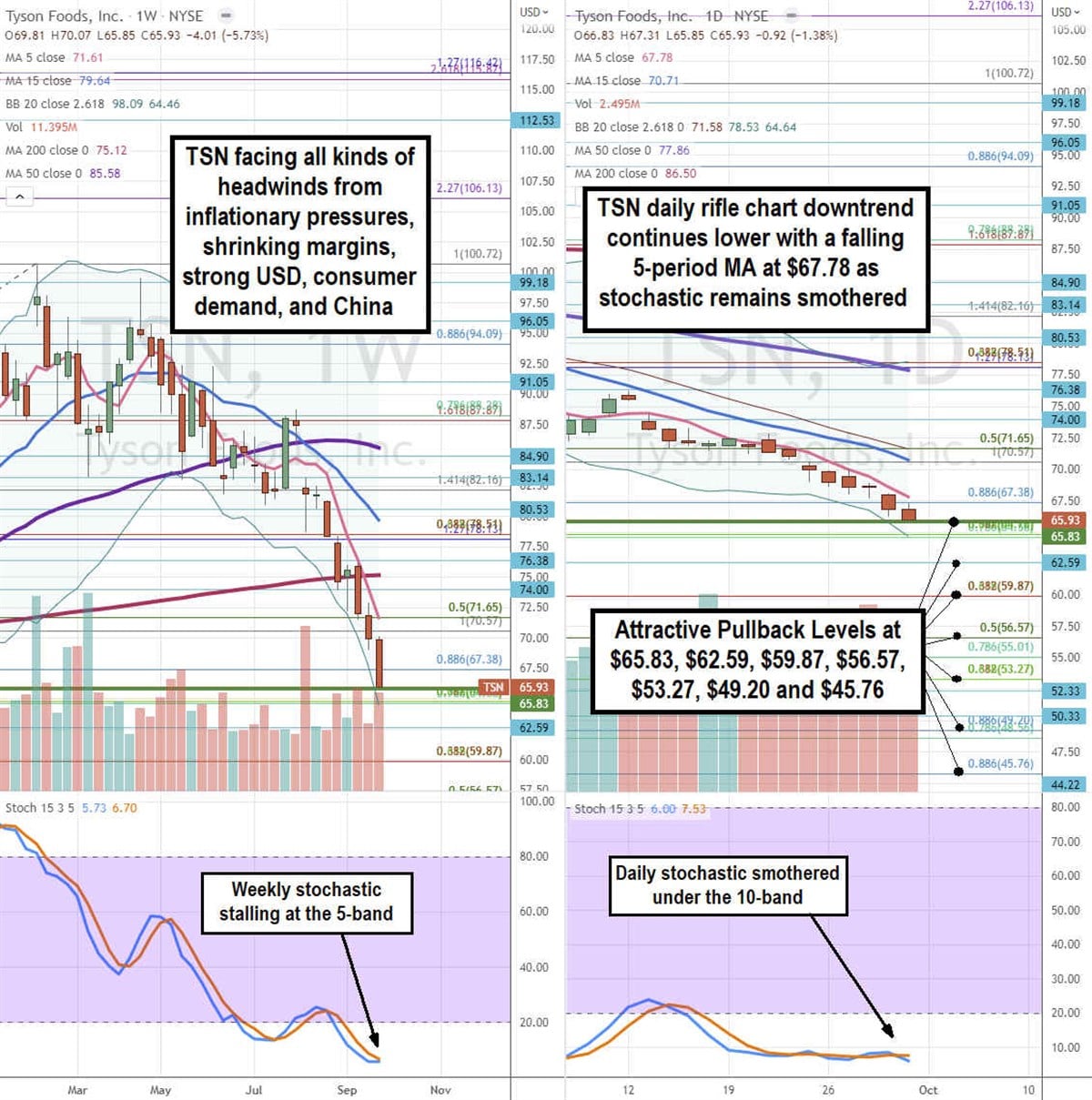

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for TSN stock. The weekly rifle chart commenced its collapse after rejecting the $88.28 Fibonacci (fib) level. This formed a bearish weekly inverse pup as selling accelerated to test the weekly market structure low (MSL) buy trigger at $65.83. The weekly downtrend is led by the 5-period moving average (MA) resistance at $71.61 followed by the 15-period MA at $79.64 and the weekly 200-period MA resistance at $75.12. The weekly stochastic fell back down under the 20-band as it stalls at the 10-band for a possible cross back up or a mini inverse pup lower. The weekly lower Bollinger Bands (BBs) sit at $64.46. The daily chart has been slowly downtrending led by the 5-period MA at $67.78 followed by the 15-period MA at $70.71. The daily 50-period MA is falling at $77.86. The daily stochastic has been smothered under the 20-band for over three weeks. The daily lower BBs sit on the $64.58 fib level. Attractive pullback levels come up at the $65.83 weekly MSL trigger, $62.59 fib, $59.87 fib, $56.57 fib, $53.27 fib, $49.20 fib, and the $45.76 fib level.

CEO Paints a Pretty Picture

Tyson CEO Donnie King commented, “We delivered solid results during the third quarter, focusing on operational excellence and aggressive cost management. The turnaround of our chicken business continues, and we continue to be the market share leader in many of our retail business lines, which include our Tyson, Jimmy Dean, Hillshire Farm and Ball Park iconic brands. We maintained double-digit sales and earnings growth year to date as well as progressing toward our goal of delivering more than $1 billion in recurring productivity savings by the end of fiscal 2024." China has been restricting imports from select U.S. poultry locations due to concerns over bird flu.

Currency Impacts Trigger Downgrade

The US dollar has been rising even higher since the earnings release triggering many concerns about the impact on demand. These were the main issues that triggered downgrade on TSN stock to a HOLD from a BUY rating at Argus on Sept. 13, 2022. They noted a strong dollar and rising hog prices will “likely” cause pork volumes to drop.

Before you consider Tyson Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyson Foods wasn't on the list.

While Tyson Foods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.