UiPath Inc NYSE: PATH is a leader in robotic process automation (RPA) and business process automation (BPA) solutions. Their platform enables companies to use artificial intelligence (AI) powered software robots (bots) to automate repetitive and rule-based tasks that humans typically perform. This streamlines processes and workloads and improves efficiencies while enabling humans to focus on more complex tasks at hand.

Capitalizing on 2 Secular Tailwinds

UiPath capitalizes on 2 secular tailwinds, automation and AI. This business services sector company

It is a clear benefactor in the AI trend like C3.ai Inc. NYSE: AI. The company released a strong fourth-quarter 2023 earnings report, handily beating top and bottom line estimates only to have shares sell-off on mixed guidance. The reaction is similar to prior quarters, where shares sold off on lowered immediate guidance coupled with raised annual guidance.

Strong Q4 2023 Earnings

UiPath released its fiscal fourth-quarter 2024 EPS of 22 cents, beating consensus analyst estimates by 6 cents. Revenues surged 31.3% YoY to $405.25 million. Annual recurring revenue (ARR) rose 22% YoY to $1.464 billion. The company achieved its first quarterly GAAP profit since going public. Cash flow from operations and non-GAAP adjusted free cash flow was $146 million.

Mixed Guidance

While the Q4 2024 results were a clear top and bottom line estimate beat, shares plummeted from their mixed guidance. PATH shares surged as high as $27.50 and as lower at $22.50 in the after-hours session upon its earnings release.

Its Q1 2024 estimates caused concern as revenues are expected between $330 million to $335 million, missing $346.84 million consensus estimates. ARR is expected to come in between $1.508 billion to $1.513 billion.

Its fiscal full-year 2025 forecasts delivered upside guidance with revenues expected between $1.555 billion to $1.560 billion, beating $1.53 billion consensus analyst estimates. ARR is expected to be in the range of $1.725 billion to $1.730 billion.

CEO Insights

UiPath CEO Rob Enslin emphasized the strong close to the fiscal year, which exceeded top and bottom-line internal guidance. Quarterly revenue hit a record $406 million, up 31% YoY. Cost management and disciplined capital deployment enabled the company to record its first GAAP profitable quarter since it became a public company. Enslin reported that a joint study between UiPath and Bain revealed that 70% of executives asserted that AI-driven automation is critical to meeting their company's strategy objective. This falls right into UiPath's wheelhouse.

Enslin commented, “Our business automation platform is the foundation to deliver value across every organization. We make AI actionable, unlocking the promise of this next evolution in technology. And I believe that the combination of AI and automation is the strategic change enabler for our customers.”

Land and Expand

Its partnership with SAP generates pipelines across geographies. One of its new clients is Switzerland's largest retail and wholesale company. The clients switched over after frustration with its old RPA provider, which was lacking in application performance monitoring solutions. They are in the process of launching document understanding to automate invoice processing with the goal of expanding company-wide.

Journey with RPA

Enslin noted how one of their top 25 customers started its RPA journey in 2018 and has since adopted their full platform, which includes document understanding, test suite and process mining. As automation spreads across its many business lines, the client has over 15,000 robots automating thousands of processes. The client has grown into a seven-figure customer with a Q4 2024 deal, which enables them to deploy communications mining in the HR department, commercial bank and corporate investment bank.

Analyst Upgrades

Needham reiterated their Buy rating on PATH, raising its price target to $30 from $25. Analyst Scott Berg noted that Q4 2024 results were strong, driven by accelerating deal flow and strong platform sales. He commented that UiPath's partnerships with SAP SE NYSE: SAP, Alphabet Inc. NASDAQ: GOOGL, Microsoft Co. NASDAQ: MSFT and Deloitte continue to drive deal flow improvements. JP Morgan raised its rating to Overweight from Neutral raising its price target to $28, up from $22. Mizuho reiterated its Neutral rating raising its price target to $25, up from $22.

UiPath analyst ratings and price targets are at MarketBeat. UiPath peers and competitor stocks can be found with the MarketBeat stock screener.

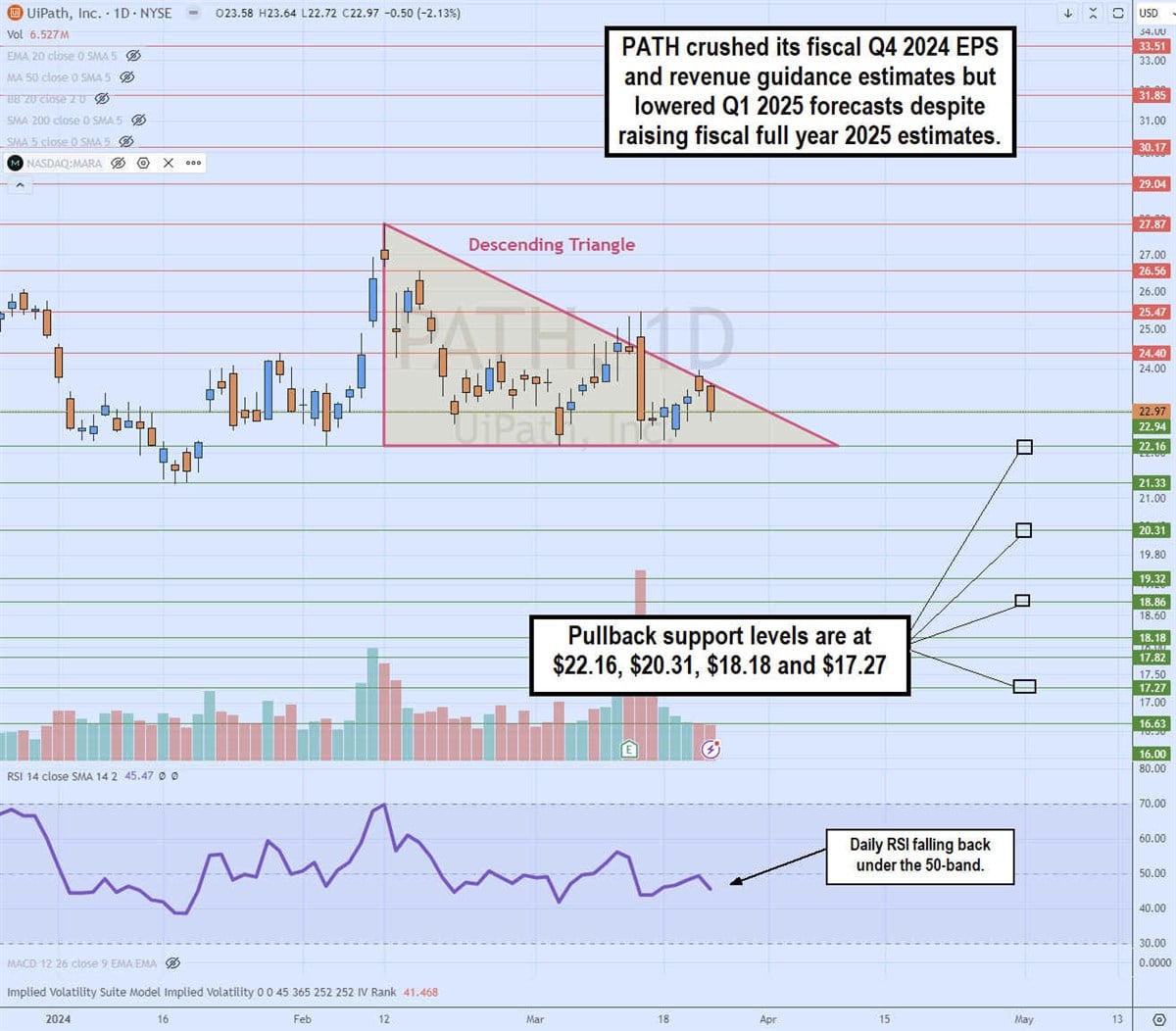

Daily Descending Triangle Pattern

The daily candlestick chart on PATH illustrates a descending triangle pattern. The upper descending trendline formed at the $27.87 swing high on March 12, 2024. It capped bounce attempts on the descending trendline but held the swing lows at the flat-bottom lower trendline at $22.16. The daily relative strength index (RSI) is losing steam, falling under the 50-band.

Historically, when PATH lowered its short-term guidance and raised full-year guidance, shares would initially sell off and then recover afterward. Pullback support levels are at $22.16, $20.31, $18.18 and $17.27.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.