Enterprise cloud workflow software provider Upland Software NASDAQ: UPLD stock has been decimated in recent weeks. The cloud software maker blamed COVID-19 effects on the lackluster performance and lowered Q4 2021 guidance. Weak Q3 2021 results was lowered variable text and email messaging volumes. However, since the accounts have not churned, it means the volumes could bounce back swiftly at any time. The Company’s vast cloud software library acts as a strong base for over 1,700 enterprise customers. The Company is targeting 15% annual growth moving forward as it puts the pandemic behind it. The depressing share plunge may be providing an opportunistic pullback for prudent investors willing to ride out the downturn.

Fiscal Q3 2021 Earnings Release

On Nov. 3, 2021, Upland released its fiscal third-quarter 2021 results for the quarter ended September 2021. The Company reported earnings-per-share (EPS) profits of $0.57 versus $0.47 consensus analyst estimates, a $0.10 beat. Revenues grew 2.5% year-over-year (YoY) to $76.05 million, missing analyst estimates for $77.71 million. Adjusted EBITDA was $25 million or 33% of total revenues. Subscription revenue grew 2% to $72.3 million. GAAP net loss was (-$0.36) per-share. The Company ended the quarter with $179.6 million in cash. Upland CEO Jack McDonald commented, “In Q3 we posted strong Adjusted EBITDA and remained on track to achieve our free cash flow generation targets for the year. We did not see in Q3 the uptick in new logo bookings and renewals we had expected. We remain determined to improve our sales performance and note that our focus throughout this year on securing multi-year customer renewals and expansions means a higher percentage of our revenue is now contracted through 2022, which supports improved net dollar retention rates next year,” he added. “Finally, we remain active in the market for additional acquisition opportunities.”

Lowered Q4 2021 Guidance

Upland lowered its Q4 2021 revenues to come in between $73.2 million to $77.2 million versus $80 million consensus analyst estimates. Adjusted EBITDA is estimated between $23.4 million and $25.4 million for a 32% margin midpoint.

Conference Call Takeaways

CEO McDonald set the tone, “We are lowering our Q4 guidance revenue guidance by $3.9 million to reflect our reduced outlook on messaging volumes and also to reflect the fact that we didn't see the uptick in new logo bookings and net dollar retention rate that we had expected in the third quarter. The COVID impacts on the business of the last 18 months are now fully reflected in our Q4 outlook for $75 million quarterly revenue run rate and we will grow from that run rate as we move into and through 2022 because we see signs of real improvement in net dollar retention rate as we move through next year. Finally, our M&A outlook remains unchanged, and we are targeting $40 million to $50 million of acquired revenues between now and the end of 2022.” He elaborated on the broader points moving forward, “Again, as I noted earlier, the impacts of the last 18 months are now fully reflected in this Q4 outlook for $75 million quarterly revenue run rate. And we're going to grow from that run rate, because as I say, we see real structural signs of improvement in net dollar retention rate as we move through 2022. And of course, on top of that between now and the end of next year we're targeting to add another $40 million to $50 million in acquired revenues. Look we saw two-plus years ago the opportunity to build out a real go-to-market and product organization. Rod joined us 18 months ago. And even in the face of the complexities of the lockdown, he was able to hire our new go-to-market team by the end of 2020 and to complete key additions to the product team by the middle of this year of 2021. We are still in the early stages of executing this mission, but I remain as excited about the opportunity today, as I was two years ago. As we move through this and look out over the next five years, we continue to be excited about our business and the opportunity for growth and value creation. We have a powerful cloud software library, a proven operating platform, a strong base of over 1700 enterprise customers and an equity compounder financial model. Over the next five-year period, this is a business that can reasonably target total revenue growth of 15% per year from the current run rate, organic plus acquisitions. And importantly, do it on a self-funded, sustainable basis and generate positive free cash flow as we go.”

Google Cloud Partnership

CEO Seibal elaborated on the partnership with Google Cloud, “The two companies will tightly integrate C3 AI and Google Cloud technologies and go-to-market initiatives with the effect of accelerating enterprise AI adoption. The comprehensive alliance includes coordinated software development roadmaps, tight product integration as well as joint selling, joint marketing, and joint customer success programs at global scale. C3 AI and Google Cloud will regularly synchronize our software engineering roadmaps and activities to ensure that the Google Cloud, Google Cloud applications and the C3 AI Suite and AI enterprise applications are fully optimized and tightly integrated. The companies will engage in significant ongoing marketing development activities and will coordinate sales and service activities

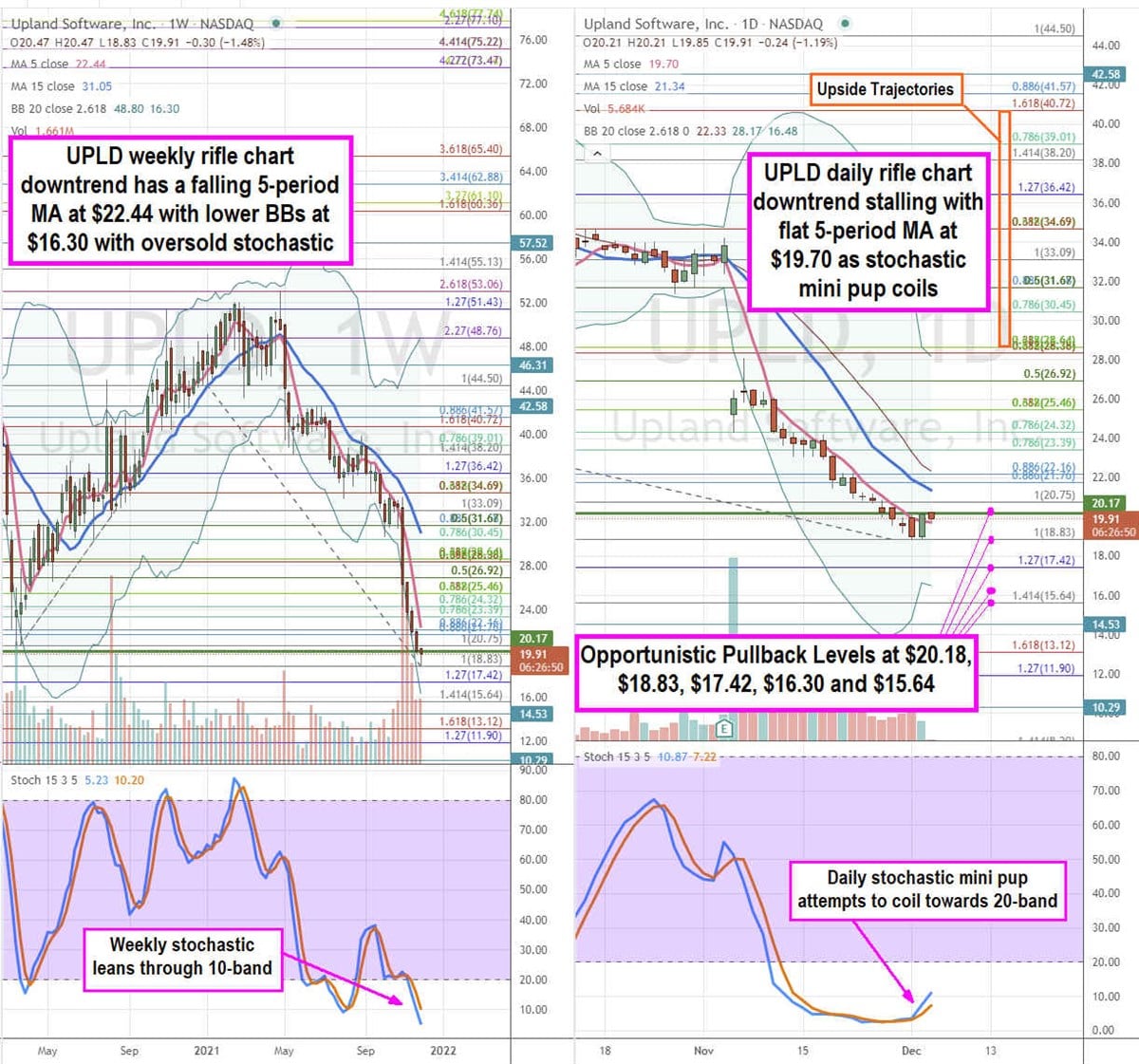

UPLD Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for UPLD stock. The weekly rifle chart triggered a pup breakdown on the $34.69 Fibonacci (fib) level break. The sell-off has been dramatic as the weekly stochastic leans down through the oversold 10-band with a falling weekly 5-period moving average (MA) at $22.44 followed by the 15-period MA at $31.05. The daily rifle chart has been in a downtrend but is starting to flatten out as evidenced by the flat 5-period MA at $19.70 and stochastic mini pup through the 10-band. The daily 15-period MA sits at $21.34. The daily market structure low (MSL) buy triggers above $20.17. Prudent investors can monitor for opportunistic pullback levels at the $20.18 fib, $18.83 fib, $17.42 fib, $16.30 weekly lower BBs, and the $15.64 fib. Upside trajectories range from the $28.64 fib up towards the $40.72 fib.

Before you consider Upland Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upland Software wasn't on the list.

While Upland Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.