Verra Mobility NASDAQ: VRRM is a smart mobility technology solutions company that operates three segments: Government Solutions, Commercial & Fleet Services, and Parking Solutions. Government Solutions services the dreaded photo enforcement cameras for running red lights, speeding, and school bus safety. Verra detects and processes traffic violations through its road safety camera programs with municipalities and school districts. This segment continues to prosper as more municipalities consider adding these photo enforcement cameras for public safety and revenues. Commercial & Fleet Services offer automated toll and violations management and title and registration solutions to rental car companies and fleet owners. It owns nearly a 90% market share of this segment. The Company renewed its tolls and violations contract with

Avis Budget Group NASDAQ: CAR competitor

Hertz Global NYSE: HTZ for five-years. Parking Solutions provide parking software and hardware solutions to parking operations and facilities including universities, municipalities,

healthcare facilities and transportation hubs in the U.S. and Canada. The Company has bounced back since the

pandemic lockdowns which shut down

traffic as commuters stayed home. The start of the school season also helped jump revenues as school bus camera violations commence again. Upon initial reading of its Q3 earnings release, it appears to have been a large beat, but upon closer examination, there was some financial engineering involved to make a weaker quarter appear stronger than the year-ago period.

Financial Engineering

Service revenues climbed to $180.6 million, up from $141.8 million in Q3 of 2021. However, products revenues fell to $17.04 million in Q3 2022 from $20.28 million in the prior year. The cost of service revenue, product sales, operating expenses, and general and administrative expenses all rose higher in the quarter for a total of $152.16 million versus $120.2 million a year ago. Interest expense nearly doubled to $20.26 million from $11.64 million in Q3 2021. This led to the net income of $24.58 million which was lower than the $27.3 million a year ago. However, EPS was $0.15 versus $0.14 due to the reduction in shares from 165.4 million to 158.2 million diluted weighted average shares outstanding. The Company authorized a $125 million stock buyback program over the next 12 months in May 2022. On May 12, 2022, Verra paid $50 million to a third-party financial institution for the initial delivery of 2,739,726 shares. The final settlement occurred on Aug. 3, 2022, with the delivery of 445,086 shares. The Company paid an additional $6.9 million to buy back 445,791 shares. On Aug. 19, 2022, Verra paid $68.1 million to receive and initial delivery of 3.3 million shares and the final settlement is expected to occur in Q4 2022. The Company paid $125 million for stock buybacks and $0.1 million for transaction costs up to Sept. 30, 2022.

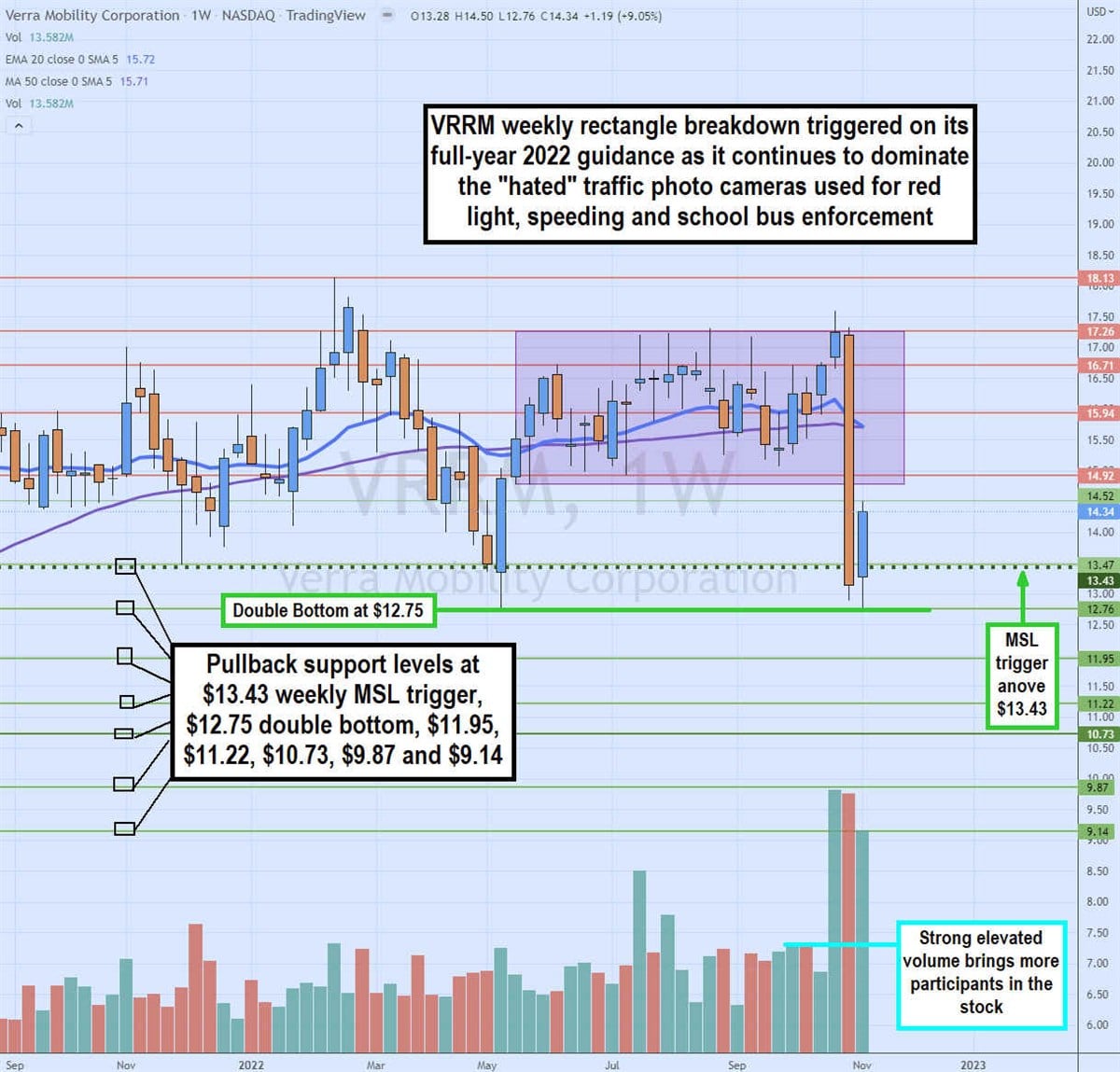

Rectangle Breakdown and Double Bottom in the Weekly Charts

The VRRM chart is about as simple as it gets due to the relatively small range indicating a lack of volatility. The weekly candlestick chart for VRRM illustrates the rectangle price range between $14.75 to the $17.60 for the past 10 months. Shares finally broke the range to the downside in reaction to its recent Q3 2022 earnings report falling to a low of $12.76 before bouncing to form a double bottom. The weekly 20-period exponential moving average (EMA) overlaps the weekly 50-period MA at $15.71 with no channel between them. Shares managed to rally off the double bottom on the breakout through the $13.43 weekly market structure low (MSL) trigger. It’s worth noting that daily trading volume has steadily been climbing from the beginning of 2022. VRRM averaged a few hundred thousand shares per day in early 2022 to a range of 1.5 million to 4 million shares a day by November 2022. The additional volume is a good indicator of growing liquidity and a potential indication of a capitulation on the double bottom formation after earnings. Pullback support areas sit at the $13.43 weekly MSL trigger, $12.75 double bottom, $11.95, $11.22, $10.74, $9.87, and $9.14.

Growth is Still There

Verra released its Q3 2022 earnings report on Nov. 2, 2022, for the quarter ending September 2022. The Company reported earnings-per-share (EPS) profit of $0.27 beating consensus analyst estimates for a profit of $0.14 by $0.13. Net income was $24.6 million versus $27.3 million in the year-ago period. Adjusted EBITDA was $90.9 million versus $82.1 million in the year ago period with EBITDA margin at 46% versus 51%, respectively. Revenues grew 21.9% YoY to $197.66 million versus $197.34 million consensus analyst estimates.

Macro Trends

Verra Mobility CEO David Roberts said, "We delivered an outstanding third quarter, highlighted by strong revenue and adjusted EBITDA growth and solid free cash flow generation. We are benefitting from several macro trends, including continued robust travel demand by consumers and businesses as well as strong and growing interest in automated enforcement for road safety and increased traffic flow. We are poised to close out 2022 on a high note and are excited to start 2023 with strong operating momentum across our three business units." The Company still plans to expand into Europe and expects to gain from the $2.7 billion Federal Infrastructure Investment and Jobs Act which directly allocates funds for school bus and traffic safety programs.

Before you consider Verra Mobility, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verra Mobility wasn't on the list.

While Verra Mobility currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.