VinFast Auto Today

VFS

VinFast Auto

$3.93 -0.02 (-0.51%) (As of 11/22/2024 ET)

- Price Target

- $9.00

VinFast Auto Ltd. NASDAQ: VFS is a Vietnamese manufacturer of electric vehicles (EVs), e-buses, and e-scooters. The start-up company is pursuing an aggressive EV expansion strategy growing in the United States, Europe and Southeast Asia. VinFast officially signed agreements with 12 new dealers in the United States in April 2024, bringing the total dealership count to 18 across seven states, in addition to the 15 operational stores and service centers in California. The company announced its ambitious forecast of hitting 30X to 40X increase in U.S. sales in 2024 over the $6.4 million in 2023. This implies sales of more than $180 million to $240 million in 2024, up from $6.4 million in 2023.

VinFast operates in the auto/tires/trucks sector, competing with EV makers like Tesla Inc. NASDAQ: TSLA, Lucid Group Inc. NASDAQ: LCID, and Rivian Automotive Inc. NASDAQ: RIVN.

Hype is No Stranger to VinFast

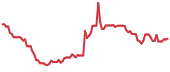

VinFast made headlines when its stock surged to a high of $93.00 on August 28, 2023, before selling off to a low of $2.26 on April 22, 2024. A brief meme stock rally recently spiked shares to a swing high of $6.42 before falling back down to a swing low of $3.72. VinFast went public through a reverse merger with a special purpose acquisition company (SPAC). Shares may have finally put in a bottom since they’ve doubled off the lows.

The VinFast Line-Up and Infrastructure

Its EV line-up consists of four SUVs, from the 5-passenger VF6, VF 7, and VF8 models to the 7-passenger VF9 all-wheel drive (AWD) starting at $69,800. Its vehicles come with a 10-year, 125,000-mile bumper-to-bumper warranty and 24/7 mobile service. Its batteries have a 10-year unlimited-mile warranty. Its connected vehicles have over-the-air (OTA) software updates, continually adding features to enhance performance and improve the ownership experience.

VinFast vehicles have access to 100,000 chargers across the United States and an all-in-one VinFast app that provides a comprehensive hub for all charging and maintenance needs. The app also enables in-app payments, trip-planning tools, and remote charging management. VinFast is already manufacturing and delivering vehicles in the United States. It needs to ramp up production to meet its lofty goals.

VFS Stock is Attempting to Break Out of a Descending Triangle Pattern

The daily candlestick chart on VFS illustrates a descending triangle breakout pattern. The descending trendline formed after peaking at $6.42, capping bounce attempts at low highs until reaching the flat-bottom lower trendline at $3.72. A breakout is attempting to form as shares rise to the upper trendline at $3.90. The daily relative strength index (RSI) is rising through the 50-band. Pullback support levels are at $3.72, $3.20, $2.85, and $2.26.

VinFast's Triple-Digit Revenue Growth in Q1 2024 But Larger Losses

VinFast reported a Q1 2024 GAAP EPS loss of 26 cents, missing consensus expectations by 2 cents. VinFast recorded a net loss of $618.3 million. Vehicle sales grew 324.4% YoY to $270.5 million. Revenues surged 269.7% to $302.65 million, which still missed consensus estimates by $119.77 million. EV deliveries rose 444% to 9,686. E-scooter deliveries fell 32% YoY to 6,632. As of March 31, 2024, VinFast had 119 global showrooms for its EVs and 235 showrooms and service workshops for e-scooters.

Lofty Full-Year Delivery Target of 100,000 VinFast Vehicles

Chairman Thuy Le stated that despite temporary market fluctuations in certain regions, the company is confident about the strength of the EV industry's medium and long-term prospects. The full-year delivery target for 2024 is set at 100,000 vehicles.

Le commented, "Supportive government policies, the anticipated transition of the EV market from early to mass adoption, and the projected growth in Ex-China markets fuel our confidence. During the first quarter, we strategically expanded our global business, successfully entering new markets and achieving yearly growth in vehicle deliveries."

VinFast Provides June 2024 Update and 30x to 40x U.S. Sales Goal

On June 14, 2024, VinFast released a statement, "We are expecting a 30x to 40x increase in sales in the U.S. market this year over $6.4 million in 2023 and believe that this growth trajectory can be sustained over the next five years. We also expect to reach a break-even point soon. This outlook reflects our current and preliminary view on the business and existing market conditions, which is subject to change."

The company also officially launched its brand in the Philippines in May 2024. It expects to open a series of showrooms and commence sales shortly afterward.

VinFast Auto analyst ratings and price targets are at MarketBeat.

Before you consider VinFast Auto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VinFast Auto wasn't on the list.

While VinFast Auto currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.