Spaceship tourism pioneer

Virgin Galactic Holdings, Inc. NYSE: SPCE stock squeezed to near all-time highs on the successful space flight with its charismatic billionaire chairman Richard Branson. This paves the way for

consumer passenger space tourism. Virgin Galactic shares traded as a

meme stock but has lost momentum. There’s been much controversy as to whether the 53 miles above earth flight was truly considered space as the Karman Line line is technically 62 miles above the planet, which is considered space by an international aeronautics body. However, NASA and the U.S. consider anyone who has flown above 50 miles earth as an astronaut. Virgin’s key competitor Blue Origin, owned by

Amazon.com NASDAQ: AMZN co-founder

Jeff Bezos, has launched its New Shepard through the Karman line and considers it the first true civilian journey into space in 17 years. Virgin Galactic has sold 600 tickets between $200,000 and $250,000 for its flights. It plans to conduct 400 space flights a year and eventually lower prices to around $40,000 per seat. This is a narrative play on space tourism for high-risk tolerant investors seeking opportunistic pullbacks to gain exposure on what could be the birth of a new industry.

Risks of Malfunctions

Investor was holding their breath on the first civilian flight. It was only in December of 2020, when a test flight malfunctioned causing shares to collapse. It’s a template of how a single malfunction or accident can torpedo share prices. As it turned out, the malfunction was a connection-related error once the launch plane reached 44,000 feet and purposely shut off the rocket motor. The pilots were able to safely fly back to Spaceport America and “landed gracefully”. The Company narrated it as a successful test of the on-board fail-safe mechanism that kicks in when the computers sense any disruptions with the rocket motors.

Virgin Galactic Statements

One more flight (4th test flight) is scheduled before moving into commercial service. Branson’s flight was the 3rd test flight. During the May 10, 2021, Q1 2021 earnings conference call, Virgin CEO Mike Colglazier summed it up, “As we progress towards commercialization, we plan to create a comprehensive multi day consumer journey on the shoulders of our 90 minutes spaceflight experience. Our goal is to ensure that the memory of the spaceflight lasts the lifetime. We believe our experience and approach will be distinct in the marketplace. We're also developing our customer brand architecture and marketing strategy. We intend to leverage the unique strengths of the Virgin brand to create a bespoke experience.” In the same conference call, CFO Doug Ahrens revealed sales plans, “We currently expect to have a sales funnel open for a limited period of time and plan to add a finite number of incremental members to our private astronaut community. With this approach, we'll look to build an appropriate backlog relative to the pace of our overall fleet expansion. Our goal is to address some of the consumer demand for our service while maintaining appealing price point for the experience and an appropriate time horizon for flight for our private astronauts. We have not yet released updated pricing for our private astronaut market.” He elaborated, “We have however, established current pricing for microgravity research and private astronaut training markets. As we've previously discussed, we have a flight planned in partnership with the Italian Air Force that will demonstrate our capabilities for these markets. We expect this flight to generate $2 million of revenue, or the equivalent of $500,000 per seat. On a per seat equivalent we're now entering into agreement at $600,000 per seat. We think these are excellent results for our introduction to the market. We're quite excited about this market and the pricing dynamics we're seeing for this portion of our business.”

SPCE Opportunistic Pullback Levels

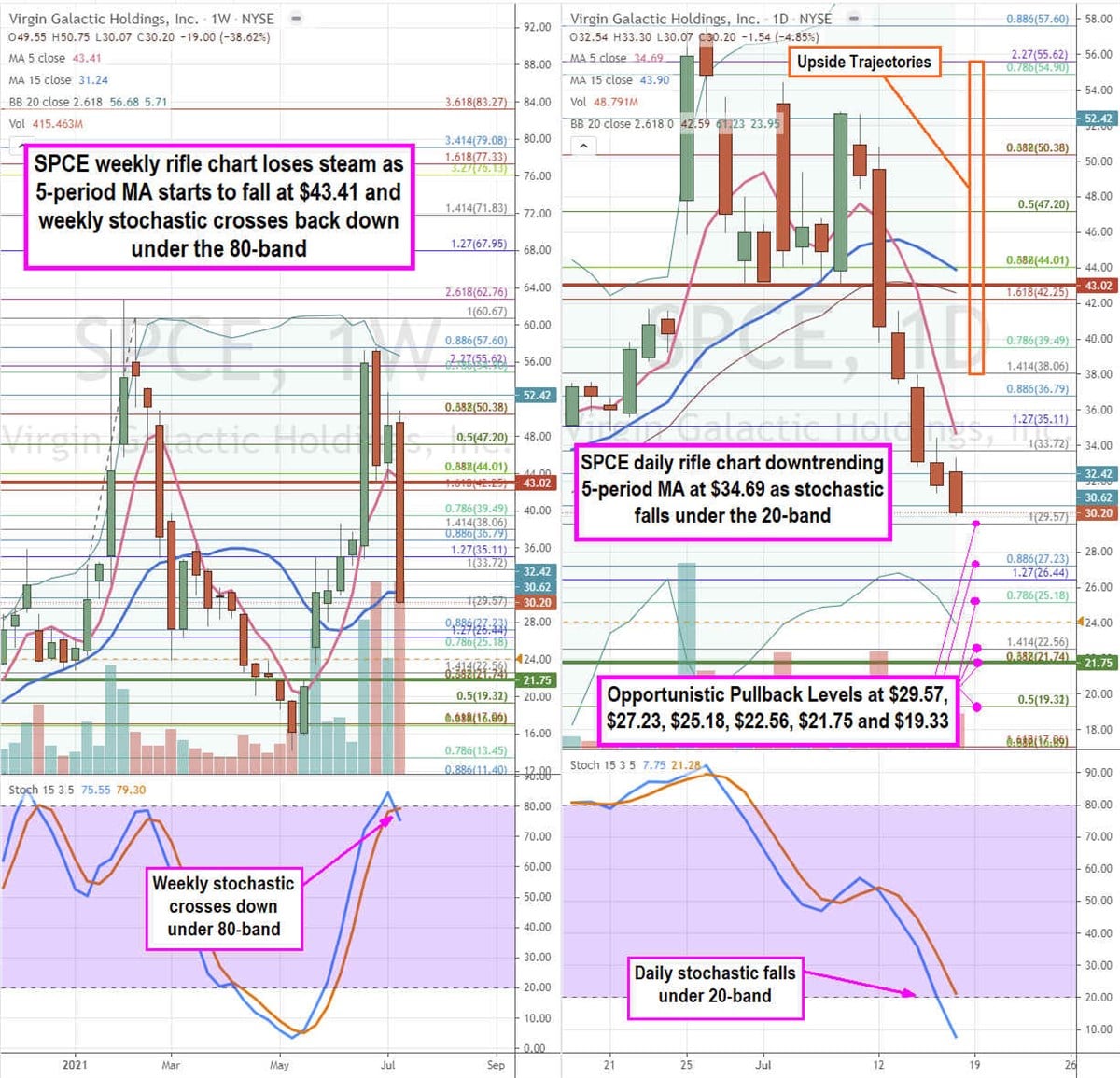

Using the rifle charts on the weekly and daily time frames enables a precision view of the playing field for SPCE shares. Shares have been extremely volatile, so caution is warranted for anyone trading this stock. The weekly rifle chart is losing steam as the 5-period moving average (MA) starts to slope down at $43.41 and 15-period MA stalls at $31.24. The most recent spike peaked at the $57.60 Fibonacci (fib) level. The weekly market structure high (MSH) sell triggered when shares fell under $43.02. The weekly rifle chart triggered a market structure low (MSL) buy above $21.75. The daily rifle chart is downtrending with a falling 5-period MA resistance at $34.69 with 15-period MA lagging at $43.90. The daily lower Bollinger Bands (BBs) are at $23.99 which is the potential downside. Risk-tolerant investors can monitor opportunistic pullback levels at the $29.57 fib, $27.23 fib, $325.18 fib, $22.56 fib, $21.75 fib, and the $19.32 fib level. The upside trajectories range from the $38.06 fib up towards the $55.62 fib.

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.