Equity Markets Reverse On Spiking Volatility

Russian aggression in Ukraine remains unchecked and is driving volatility in global markets. The latest news has Putin manipulating ceasefire agreements in his efforts to push deeper into the embattled territory. The latest targets include population centers and civic infrastructure and are intended to drive Ukrainians from their homes. The news has the VIX INDEXCBOE: VIX up more than 5% in early trading at the start of the week and the trend is up. Our take on the fear gauge is that it is on the rise along with the chances of an all-out World War Three scenario. The only hope for Ukraine is assistance from western nations which ultimately means a proxy war between us and them. In that scenario, China may move on Taiwan and block shipping lanes in the South China Sea, it’s as easy as that, and Ukraine is paying the price now no matter what happens.

Volatility At New Highs As Russia Moves On Kyiv

The fear index spiked more than 5% in early trading and is now well above what we view as a key resistance point. The 32.00 level has been the top for the VIX for almost a year and it looks like this test of resistance broke through and is now heading higher. The weekly chart of VIX shows has indicators that are not only bullish but set up to run and have plenty of room to do so. The premarket action is down from the high of the morning but trading near the extreme high of any previous test of resistance with no reason to believe geopolitical, economic, or market conditions will have good news for the next few weeks to several months at least. In our view, the VIX may move down to test support at the 32.00 level but we would expect to see it rebound and trend up to set another high near or above the 40.00 level.

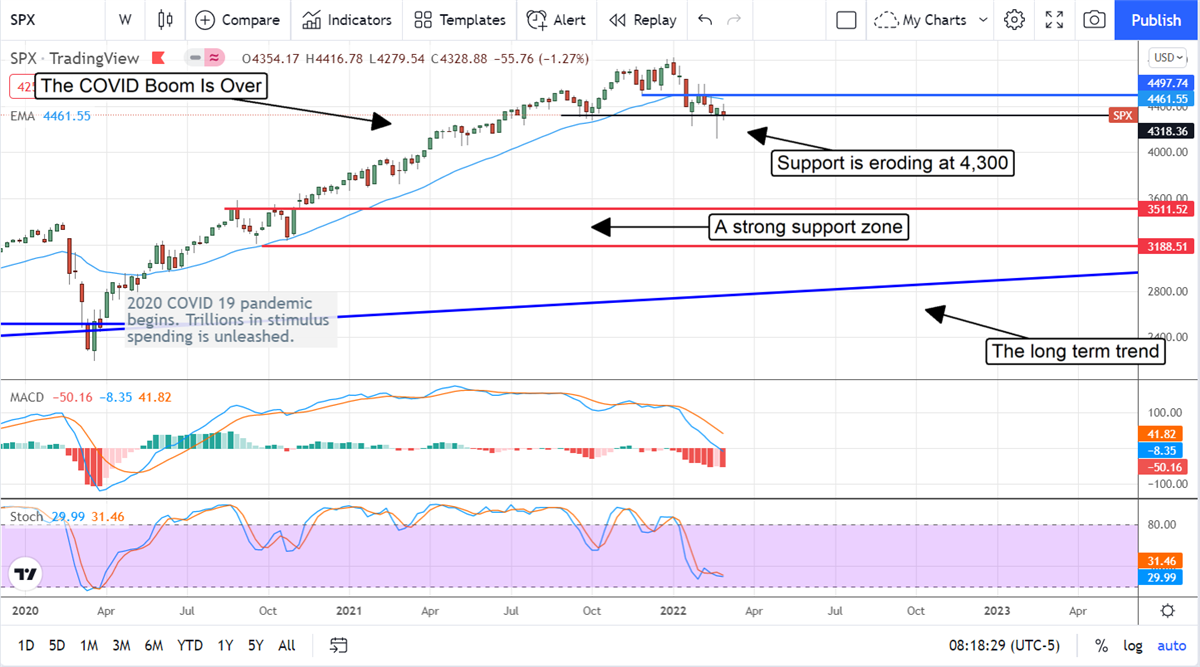

As always, a change in the VIX means a change in the underlying market and the SPX (NYSEARCA: SPY) appears to be in reversal as well. The index had been correcting but the growing uncertainty and economic risk have the bulls on the run. There is still plenty of interest around the 4,300 level but the market is at a turning point. If the bulls are unable to stage a significant rally at this point and get price action moving higher the S&P 500 will fall below the 4,300 level and then move to a much deeper low. By our estimates, this could be as deep as the 2,800 level or as much as 35% from current price action but we don’t think it will fall quite that far. We see the bottom, if the market falls that far, at or near 3,500. From that point, the market will be range-bound for the next several years.

Equity Bulls Are Drowning In Oil Price Spikes

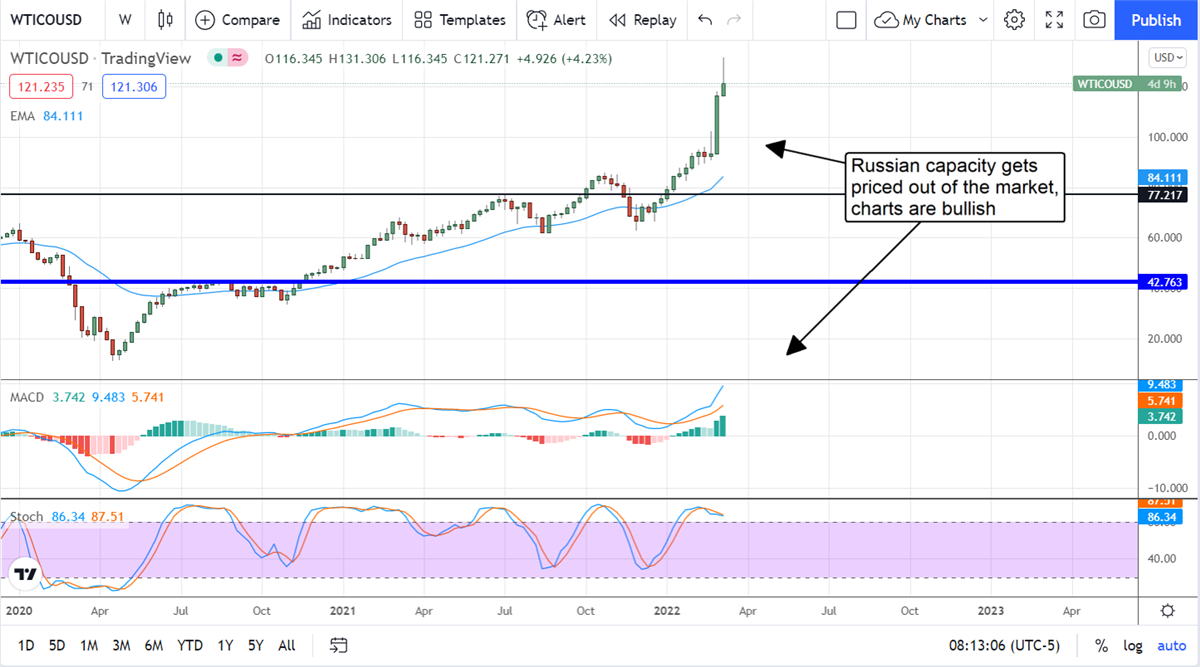

The price of

WTI NYSEARCA: USO rose more than 5% at the start of the week as Russian production and capacity get priced out of the market. The move has WTI above our initial $122 target and well on the way to the all-time highs set in our

best-case scenario (for oil, not for equities). The White House is talking with Venezuela to see if they can pump some more oil but that move is smoke and mirrors. The Venezuelan energy industry had deteriorated to the point of collapse well before the pandemic began and has only gotten worse since. The engineers and maintenance personnel who took of that equipment were driven out of the country long, long ago. In our view, oil prices will remain at these levels if not trending higher for the foreseeable future. OPEC’s not going to pump any more oil and we don’t seem to be eager to either.

Before you consider SPDR S&P 500 ETF Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPDR S&P 500 ETF Trust wasn't on the list.

While SPDR S&P 500 ETF Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.