Augmented reality smart glass maker Vuzix Corporation (NASDAQ: VUZI) stock has staged a rally off its lows of $3.88 but is starting to fall again. The Company had a challenging fiscal Q1 2022 as the macro problems from inflation, COVID-19 effects, supply chain and Russian conflict all indirectly led to the top-line shortfall. This was largely caused by timing issues with two key accounts for the quarter and an anomalous fiscal Q1 2021. Defense customers are driving higher demand and follow-on orders for display engines and head-worn waveguides. There were many developments on the OEM side that were not reflected in the quarter but should make an impact later in the year. Growth is still expected to exceed 2021 levels driven by robust demand in the internet of things (IoT) warehousing, logistics and steady expansion in healthcare including the rollout from on of its clients for their next-gen shoulder augmented reality surgical platform. Speculators looking for a potential double or triple bagger can watch for opportunistic pullbacks in shares of Vuzix.

Q1 Fiscal 2022 Earnings Release

On May 10, 2022, Vuzix reported its fiscal Q1 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) loss of (-$0.16) missing consensus analyst estimates of ($0.14) by (-$0.02). Revenues fell 34.2% year-over-year (YoY) to $2.5 million falling short of $3.4 million consensus analyst estimates. Vuzix CEO Paul Travers commented, "The first quarter was a challenging one for many of our customers, suppliers, and partners due to a combination of ongoing COVID disruptions and geopolitical tensions in Europe. These issues generally, and their impact on the timing of certain anticipated customer orders, resulted in first-quarter sales falling short of expectations. Despite delays that occurred in the first quarter, we continued to see underlying momentum within our key smart glasses accounts, especially within warehousing and logistics, and healthcare. On the OEM side of our business, we are seeing growing demand and follow-on orders from new and existing defense customers and consumer electronic OEMs for head-worn waveguides and displays engines, which should positively impact our second quarter of this year."

Conference Call Takeaways

CEO Travers admitted that the quarter was challenging stemming from macro conditions and geopolitical tensions in Europe. These undercurrents led to timing impacts for certain customer orders resulting in a top-line shortfall for fiscal Q1 2022. He believes that the AR industry is at its early beginnings. Key customer accounts reflect growth as the Company is focused on delivering value-added hardware solutions. Vuzix continues to invest in core technologies like waveguides, display engines, and bolstering manufacturing capacity. The first-quarter revenues fell by (-36%) YoY during the historically weakest quarter. The shortfall was due to an anomalous Q1 2021 which was a benefactor of timing delays of rollouts that front-loaded the quarter. Fiscal Q1 2022 would have met or exceeded consensus estimates if two key accounts weren’t pushed out. There was growing momentum on the OEM side of the business, which has yet to be reflected in the quarter. CEO Travers still expects 2022 core smart glass revenues to exceed 2021 revenues on the strength of logistics and warehousing and expansion in healthcare. All its major healthcare ISVs are expanding the availability of Vuzix-powered surgical solutions including the rollout of the next AR shoulder augmented reality surgical platform by Medacta in Europe and the U.S.

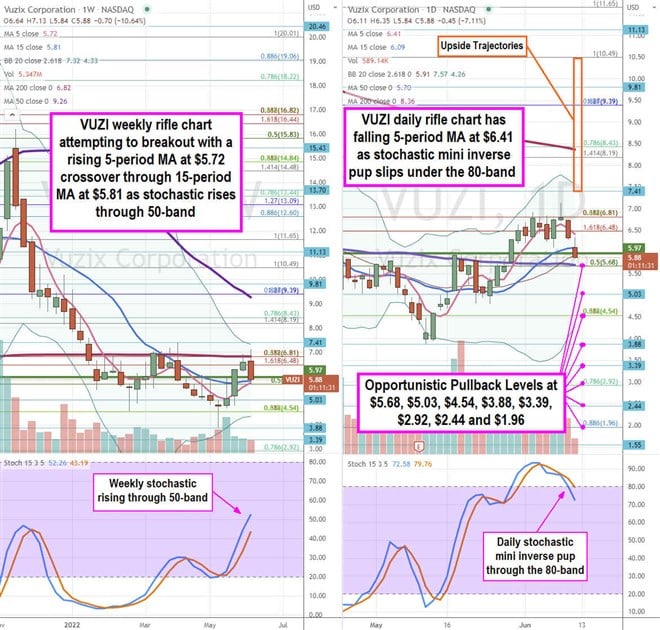

VUZI Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for VUZI stock. The weekly rifle chart is attempting to reverse the downtrend as the weekly 5-period moving average (MA) rises at $5.72 to attempt a crossover up through the 15-period MA at $5.81. Shares have stabilized near the $4.54 Fibonacci (fib) level. The weekly 200-period MA is flat at $6.82 and the 50-period MA at $9.26. The weekly market structure low (MSL) buy triggers a breakout above $5.97. The weekly stochastic is rising up through the 50-band. The weekly upper Bollinger Bands (BBs) sit at $7.32 and lower BBs sit at $4.33. The daily rifle chart uptrend is attempting a potential reversal as the daily 5-period MA falls at $6.41 towards the 15-period MA at $6.09. The daily 50-period MA support overlaps the $5.68 fib. The daily lower BBs sits at $4.26. The daily stochastic formed a bearish mini inverse pup as it fell back down through the 80-band. Speculators can watch for opportunistic pullback levels at the $5.68 fib, $5.03, $4.54 fib, $3.88, $3.39, $2.92 fib, $2.44, and the $1.96 fib level. Upside trajectories range from the $7.41 level up to the $10.49 fib level.

Before you consider Vuzix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vuzix wasn't on the list.

While Vuzix currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.