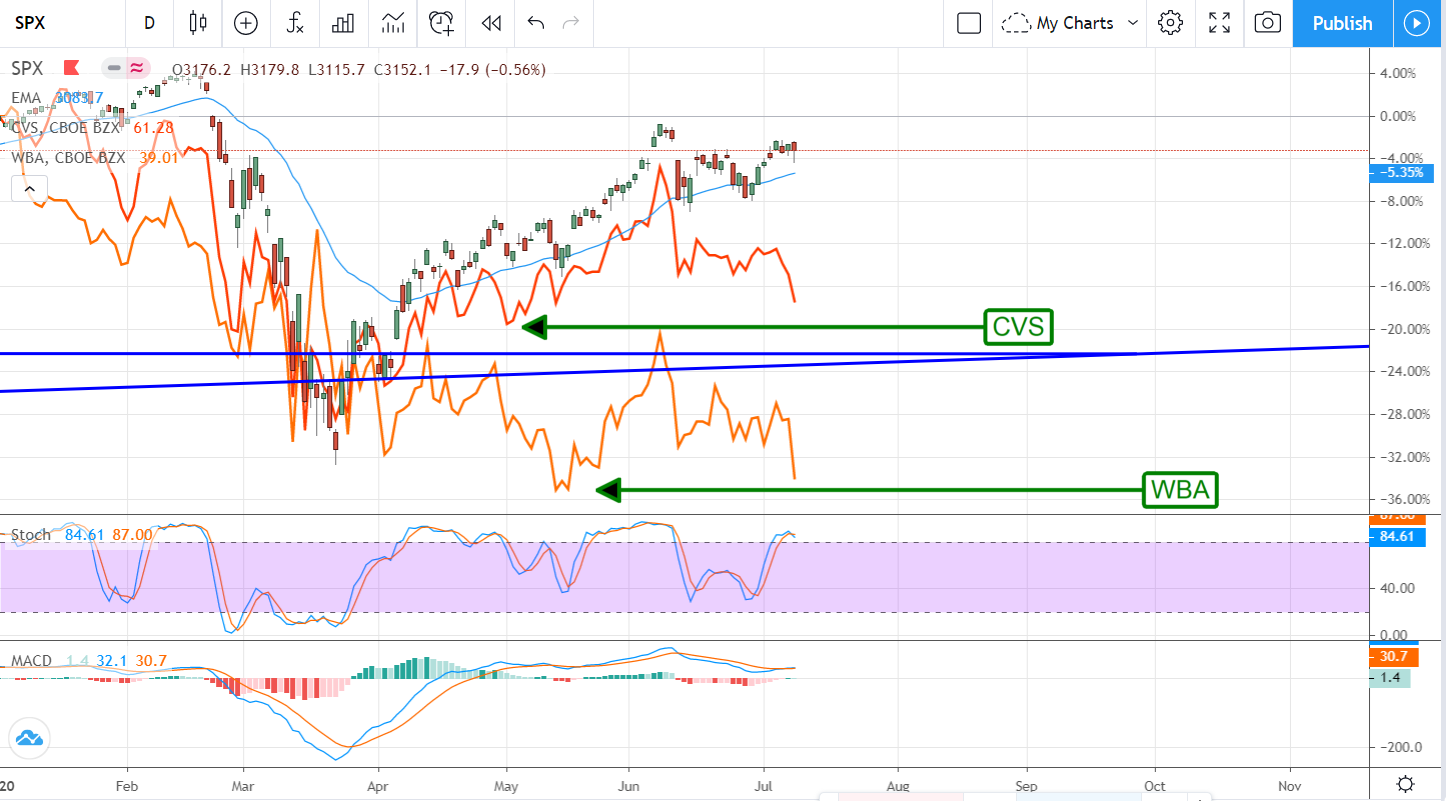

A Tale Of Two Drug-Stores

Neither CVS Health Corporation (NYSE: CVS) nor Walgreens Boots Alliance (NASDAQ: WBA) has staged much of a rebound in the post-pandemic world. This is surprising given their status as the largest retailers of staple, consumer-oriented, healthcare products in the post-pandemic world. At today’s prices, both present deep-values for dividend investors but only one stands out as a buy. At least, if you can only buy one, one of them is the clear winner for investment today.

The Dividends: Market-Beating Yield, And Growth Too!

- CVS is not a Dividend King or even a Dividend Aristocrat but it does have a solid history of past increases. In fact, until just a few years ago, the company had increased its payment for 20 years. The stock is yielding about 3.25% which is closing in on double the broad market average. In terms of safety, the payout ratio is a low 28% of earnings and backed up by a near-fortress balance sheet. Debt is low, cash is ample, and coverage is high. No sign of a suspension or cut in these cards.

- Walgreens is a Dividend Aristocrat verging on Kingship with 44 years of consecutive annual increases. The 5-year CAGR is a bit lower than that of CVS but offset by a higher expectation of increases and a much better yield. At today’s prices, 13-year lows, this stock is yielding closing to 4.75% with an equally strong balance sheet. The payout ratio is running in the mid-30% range with equally good coverage and debt ratios.

The Earnings Outlook:

- CVS is expected to post slightly positive revenue and earnings growth in 2020. This will be compounded by an acceleration of growth in 2021 that puts the two-year growth rate (from the pre-COVID through the post-COVID period) at roughly 6% earnings and 6.5% revenue. The analysts are generally bullish on the stock and have been inching their targets and ratings up over the past three months.

- Walgreens is expected to post steady low-single-digit revenue growth this year and next. The negative in the outlook is that this year’s -12% decline in EPS will not be offset by next year’s 17% rebound. The two-year outlook for growth has consensus for revenue at 4.75% and eps at -7.50%. What is perhaps the mitigating factor is that the two company’s fiscal’s years are not directly comparable. CVS reports 4th quarter earnings in December while Walgreens will do the same next month. In that light, the outlook for Walgreens is robust EPS growth in the range of 12% during the period starting now while CVS’ will be a bit more tepid in the 5% range.

The Valuations Are Compelling

At face value, both stocks are a deep discount to their average broad-market cousins. Trading in the 7X to 9X forward earnings range these stocks are roughly a third the value of the average S&P stock and at long-term lows compared to their historic averages. The difference is that CVS is trading in the 8-9 range while Walgreens is in the 7-8 range and trading at its long-term lows. CVS is sitting a bit off of its lows suggesting that it will either move down to match WBA or vice versa.

On a technical basis, I prefer Walgreens because it is sitting on potentially very strong support while CVS looks like it may retreat. Add to this the fact of Walgreens’ superior yield, equally strong balance sheet, positive outlook for growth in the current period, and lower valuation and it becomes the winner in my book. If you’re looking for a high-growth rebound play that is lagging the broad market this could be the ticket.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.