Walgreens Boots Alliance Today

WBA

Walgreens Boots Alliance

$10.86 +0.06 (+0.51%) As of 03:32 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $8.08

▼

$18.83 - Dividend Yield

- 9.21%

- Price Target

- $10.59

The charts, the sell-side activity, and the outlook for a rebound have Walgreens Boots Alliance NASDAQ: WBA stock tracking for a rebound that will likely begin this year. Trading at only 6x earnings, this high-yielding deep-value has headwinds to bear and hurdles to cross, but there is nowhere for its stock price to go but up.

Details from 2024 include slowing growth, warnings, and plans for store closures that impacted the near-term outlook but improved the long-term. Store closures and trimming other cumbersome assets is not a surprise; management bit the bullet when it decided, and it was the smart thing to do. The impact is that the consensus forecast is for earnings contraction to bottom this year, hold steady in 2026, and revert to growth soon after.

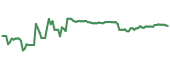

Volume Increase Shows Strong Buying of Walgreens Stock

The technical action is significant because of the chart patterns and, more importantly, the volume. The volume indicates market interest and strength and increased significantly in the summer of 2023 and again in the summer of 2024. The volume increase in the summer of 2024 aligns with a sharp gap lower caused by the bad news, signaling market capitulation by retail traders that was met by an inrush of sell-side capital.

Sell-siders, including insiders, institutions, and analysts, show solid support and provide a tailwind for prices and a catalyst for the market. Insiders own only a tiny fraction of the stock but haven’t sold a share since Q1 of 2024. The last activity is buying by two directors and the CFO, which is aligned with the institutional activity. The institutional activity is bullish, with the balance buying for four consecutive quarters in 2024. They collectively own nearly 70%, and broad-based ownership provides a solid foundation of support and a strong tailwind.

The catalyst is the analysts’ sentiment. The consensus reported by MarketBeat fell to Reduce in late 2024, but the bias is to the upside. There is potential for an upgrade cycle to begin later in 2025. The sentiment bias is to the upside because only four ratings are at Sell, about 26% of the 15 tracked, while 60% are Hold and 13% are Buys. Likewise, the range of price targets suggests this stock is trading near its floor with the potential for a 35% gain at the consensus.

Walgreens Will Make Big Changes in 2025

Walgreens is on track to make significant changes in 2025, and one possibility is to sell itself. The news from late 2024 includes rumors of a debt-financed offer that has yet to materialize. The opportunity for investors is the premium associated with the offer, whatever it may be, and its impact on the price action. However, there is a risk because industry insiders cast doubt and don’t see the deal closing. The question is what Walgreens does next, which is what a private equity firm will likely do: sell Boots and focus on the core U.S. retail and healthcare business. Boots revenue in Q4 was only 15% of the net revenue, not a huge loss, and a drag on net growth, so there is a benefit.

The dividend is unlikely to change. The company has already cut its distribution, aiding the downdraft in early 2024, and can sustain itself at the current level with or without Boots in the mix. With Boots in the portfolio, the payout ratio runs roughly 65% of the 2025 and 2024 earnings outlook. That will change with Boots out of the portfolio, but the balance sheet will be injected with capital to offset the increase until earnings growth resumes.

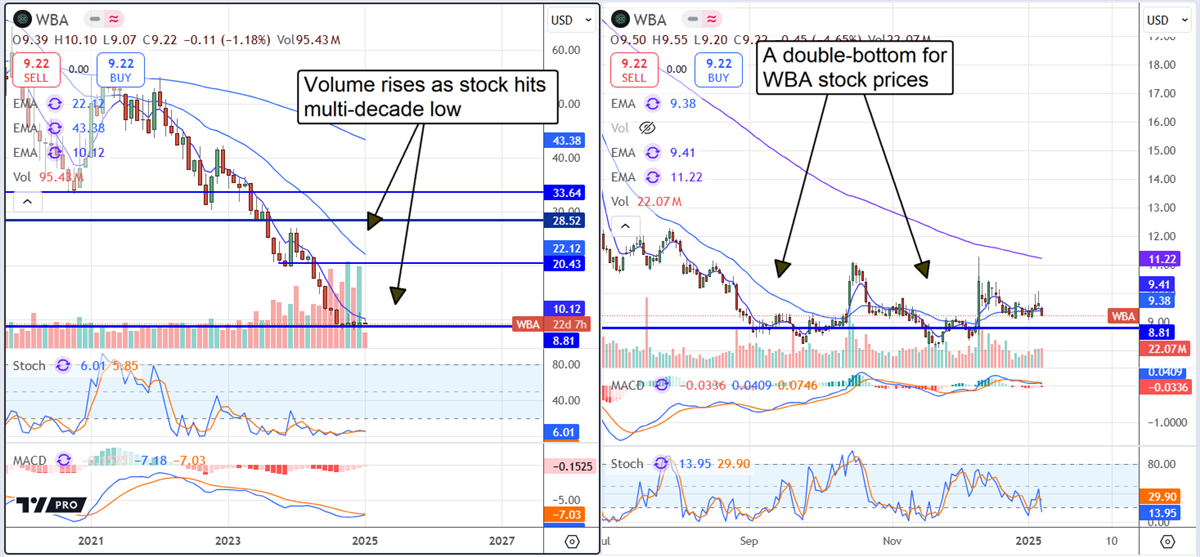

A Double-Bottom for Walgreens Boots Alliance

The Walgreens chart shows a bottom formed in 2024, beginning with the June capitulation. That was followed by two tests of support, which confirmed the same level, and a subsequent rise to a higher support level later in the year. The action in 2025 aligns with support at the new, higher level and is set up to move higher.

Before you consider Walgreens Boots Alliance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walgreens Boots Alliance wasn't on the list.

While Walgreens Boots Alliance currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.